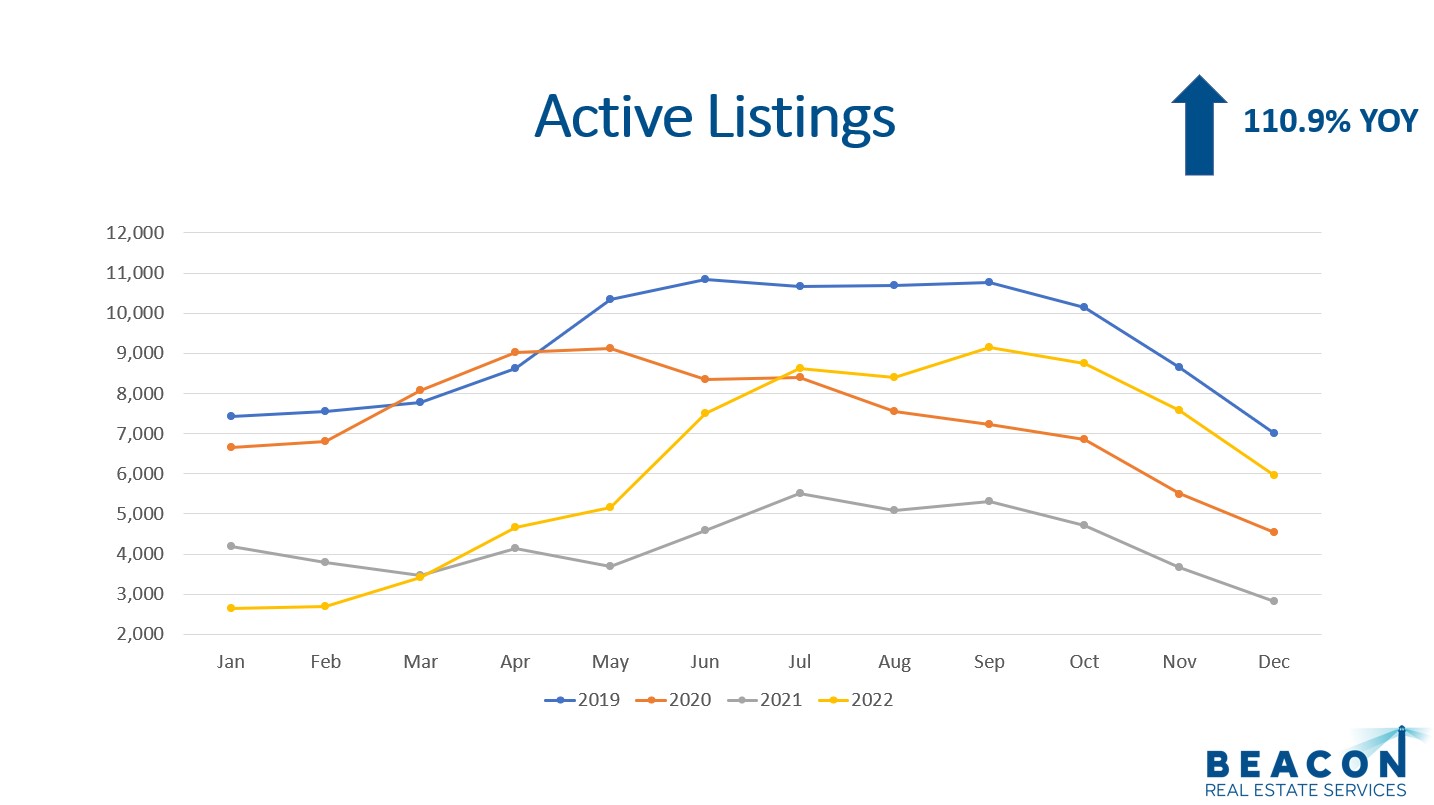

The Denver residential real estate market has closed out another interesting year! I feel like I have been saying that for several years now. Inventory is up 110.9% compared to December 2021. The 30-year mortgage rate retreated to 6.42%! This is welcome news since rates climbed over 7% in November. Let’s dive into the key market data for the Denver residential real estate market to see what is happening with supply, demand, sales prices, and months of Inventory for December 2022.

Supply

We saw a meager 2,114 new listings during December 2022. This is down (25.8%) from the 2,849 new listings in December 2021. It is worth mentioning that we saw 2,995 new listings during November 2022, so we saw a month over month decline of (29.4%). The Denver market does see a seasonal slowdown, but the residential market is slowing faster than in the past.

The total amount of active listings at the end of the month came in at 5,965. This is up 110.9% compared to December 2021! This does sound dramatic when looking year over year but the inventory is actually lower than the 10-year average from 2012 to 2021 of 6,807 listings.

Year to date, detached home construction starts, for the Dener Metropolitan Statistical Area (MSA), are down (19.4%) compared to the same period in 2021; however, housing starts are only down (7.6%) compared to 2020.

Year to date, detached home construction starts, for the Dener Metropolitan Statistical Area (MSA), are down (19.4%) compared to the same period in 2021; however, housing starts are only down (7.6%) compared to 2020.

All in all, the supply is up from is up from the spring of 2022, we are nowhere near the 24,288 listings in December 2010. Let’s look at demand.

Demand

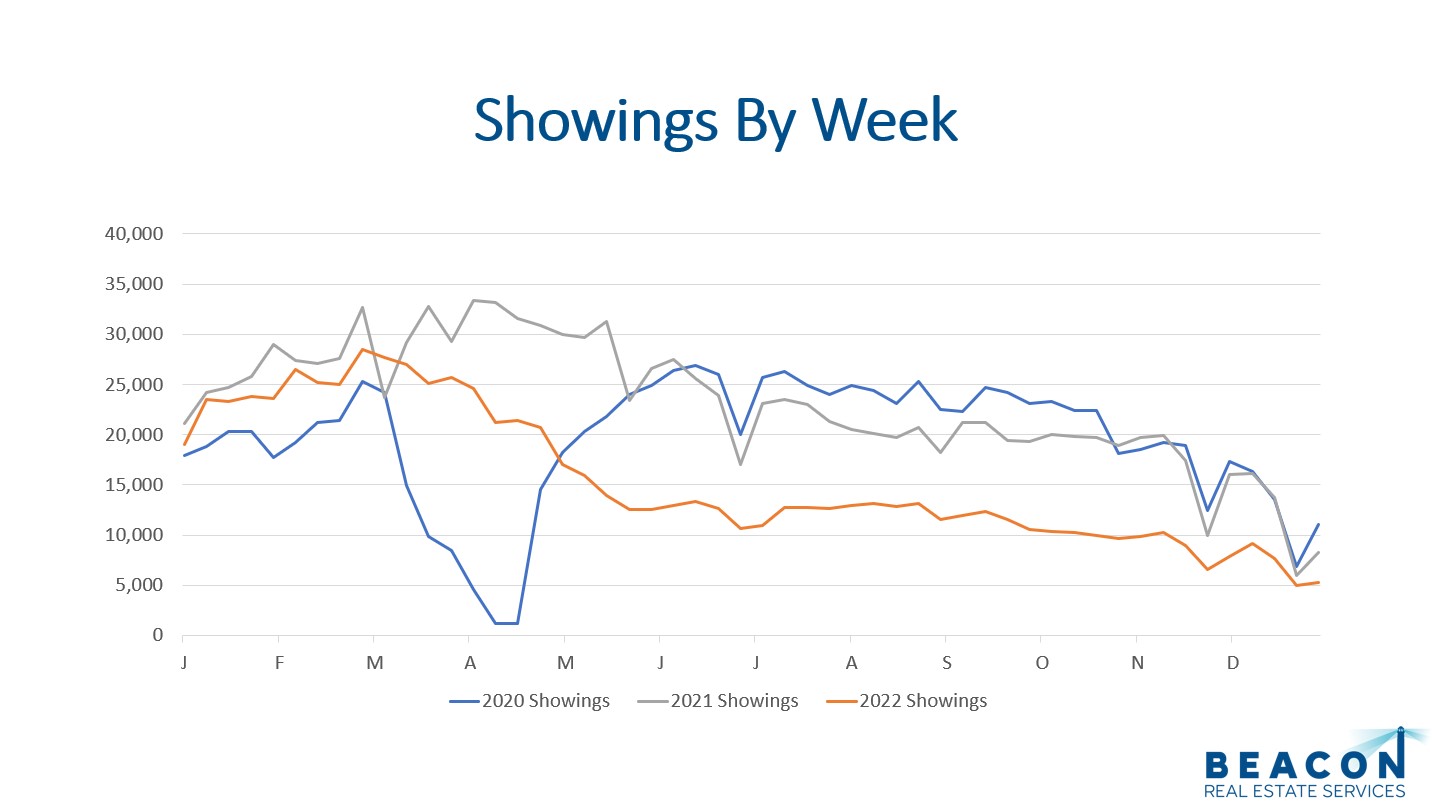

Showings are a great leading indicator for where the market is headed. The average total showings for 2019, 2020, and 2021 during December is 54,420. December 2022 had a gloomy 30,429 showings. This represents a (45.8%) decrease in showings compared to December 2021.

Denver had 2,296 properties go under contract in December 2022. This is a (26.1%) decrease compared to December 2021 and is a (10.4%) decrease compared to November 2022.

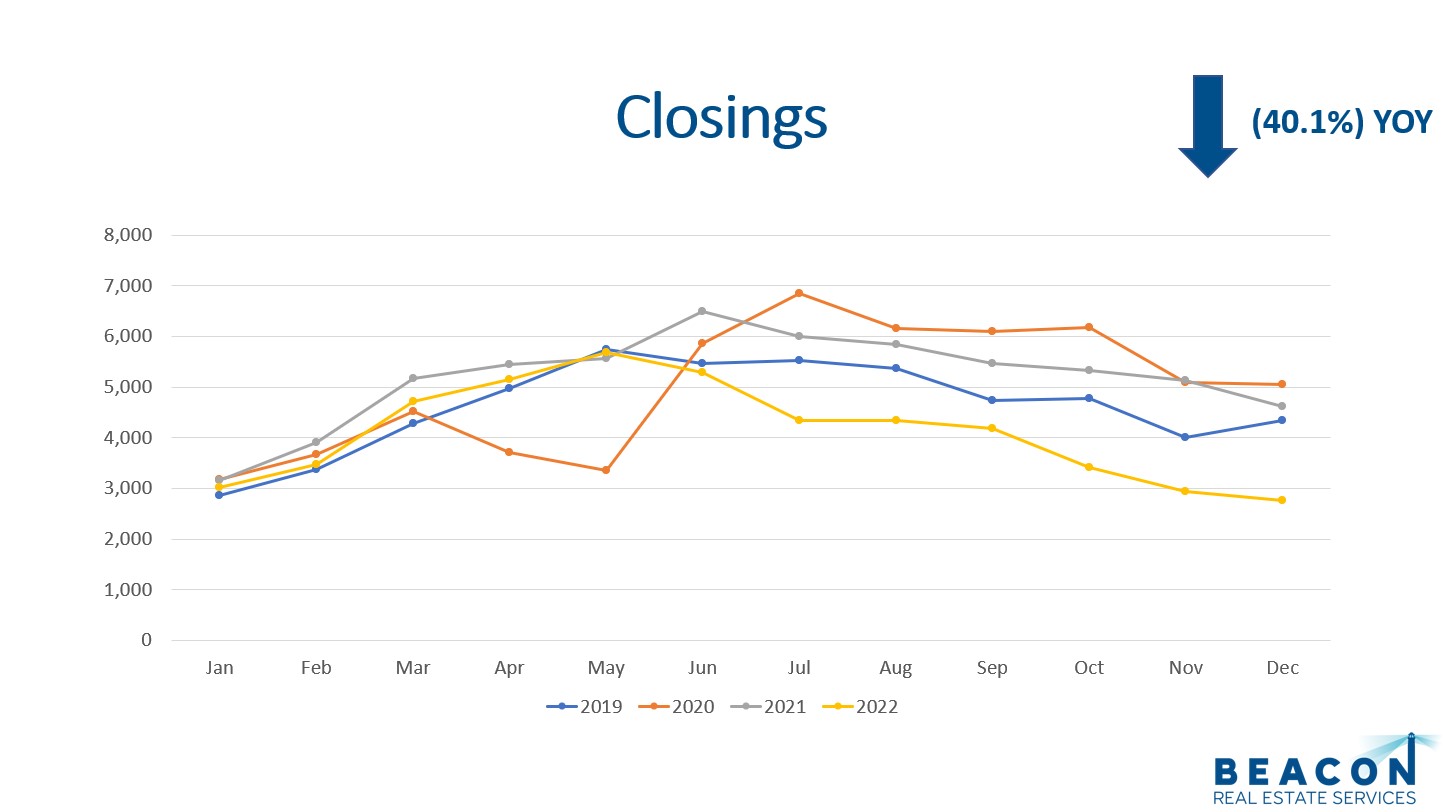

There were 2,766 closings in December 2022 compared to 2,940 in November 2022. This is a (5.9%) decrease month over month. A year ago, we had 4,619 closings in December. The residential market had 62,100 closings in 2021, which was a record high. In 2022 we had 49,322 closings, which was a (20.6%) decline. This was the lowest volume of closings in the last 10 years. Fannie Mae is forecasting a decline in volume of (22%) for 2023 and a 18.6% increase in 2024.

The median days on market for December 2022 was 31 days. This means half of the properties listed are sold in a month or less and half took longer. The average marketing time is now 44 days as more properties take longer to sell.

In summary, demand for housing is being suppressed by higher interest rates. We believe pent up demand for housing is being created right now. People still want to buy and sell but interest rates has made this more expensive. We believe interest rates will stay higher for some time before settling to 5-5.5%. As rates and prices come down, more buyers will jump in! Let’s look at sales prices.

Sales Prices

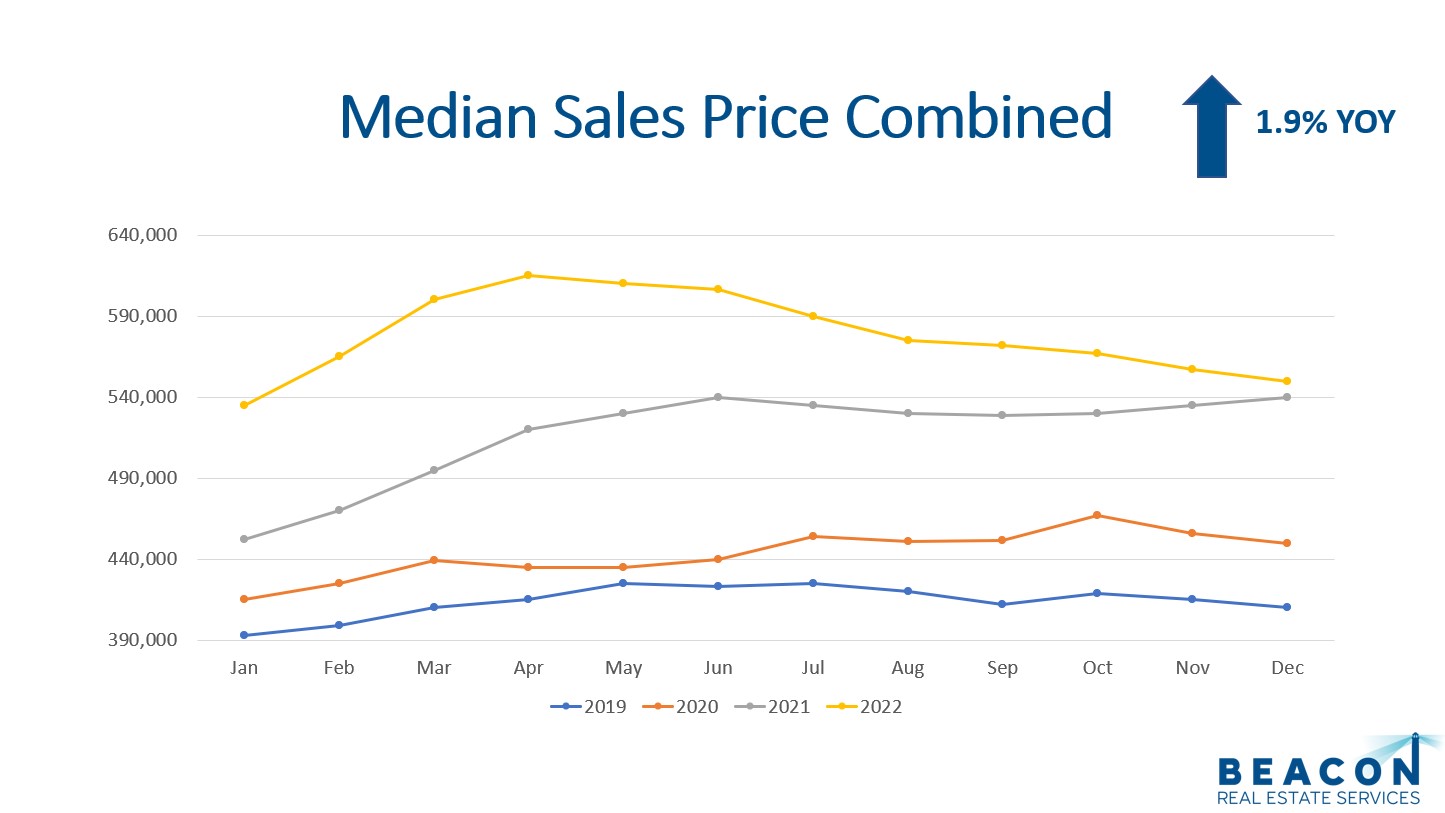

The median sales price for December was $550,000. This metric includes detached homes, condos, and town homes. This price is up 1.9% compared to December 2021 but is down (10.6%) from the peak in April 2022. It is important to note this is the milled sale during the month.

The median detached home sold for $600,000. This is down (2.4%) compared to November 2022 but is up 0.8% compared to December 2021.

We have dipped below the long-term average appreciation rate of 6%, and we expect some downward pressure on prices during 2023 until inflation is under control and interest rates start coming down.

In summary, sales price appreciation is below the long-term average, but we had such a run up in prices it is natural to have a slowing. Let’s look at months of inventory now.

Months of Inventory

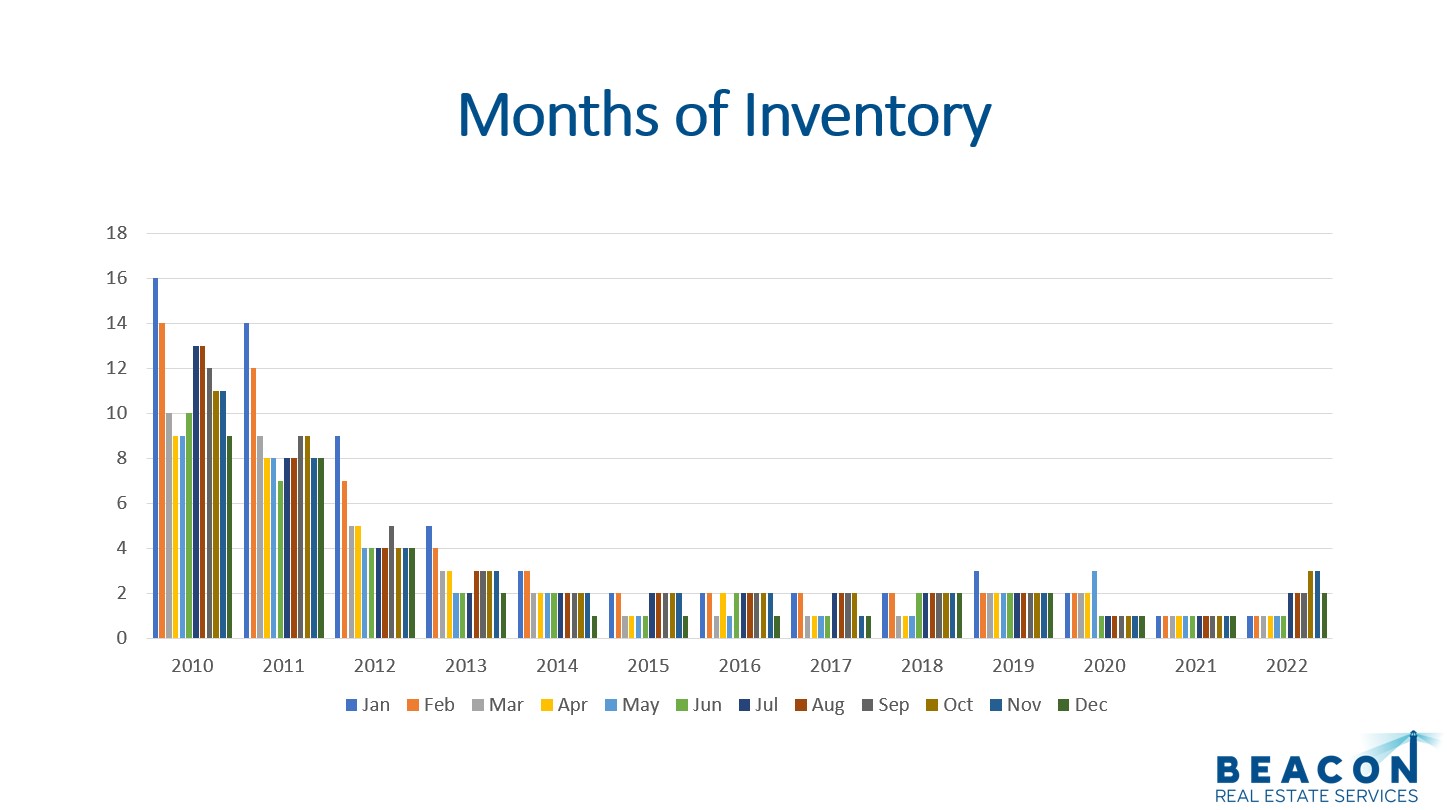

The months of inventory is a great indicator to watch for market trends. Typically, a seller’s market has 0-3 months of inventory. A balanced market has 4-6 months of inventory, and 7+ months of inventory is a buyer’s market. In a seller’s market prices go up. In a buyer’s market prices go down.

With 5,965 listings on the market and 2,766 closings, we have 2.2 months of inventory or 9.24 weeks of inventory. This is down from the 2.6 months of inventory in November as some sellers decided to not list.

All in all, months of inventory is still very low compared the financial crisis.

Final Thoughts

In summary, supply, demand, sales prices, and months of inventory are great key performance indicators to watch for market trends. Supply was trending higher but tapered off at the end of the year. Demand is being suppressed by inflation and higher interest rates but 49,322 properties still sold last year! The 30-year mortgage interest is off of a recent high but is still more than double the 3.1% rate from January 2022. Lastly, 2.2 months of inventory is still quite low.

Here is a link to the full presentation: