Is there a more controversial commercial real estate property type than office? People in the US are shopping online and driving the need for industrial space. They are going back to retail centers. People are moving around the country in a mass shuffle driving up demand for multi-family and single family residential. They are even traveling more again and increasing occupancy for hotels. Many government offices have opened but many companies have put their “return to the office” plans on hold. Some companies are moving forward with permanent work from home plans. It will be interesting to keep watching office properties in Denver Commercial Real Estate. Let’s take a look at supply, demand, new construction, and leasing.

Supply

Demand

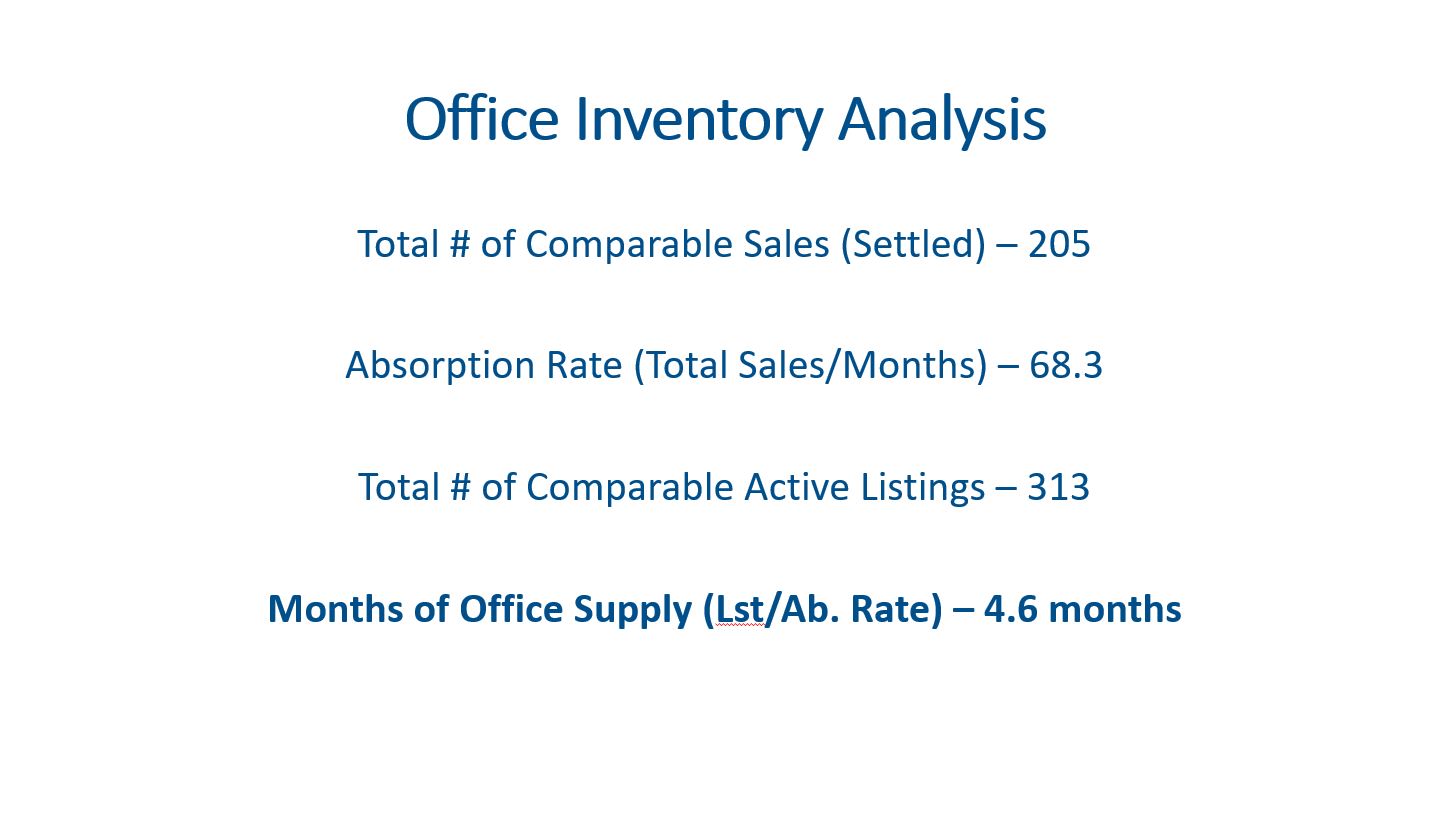

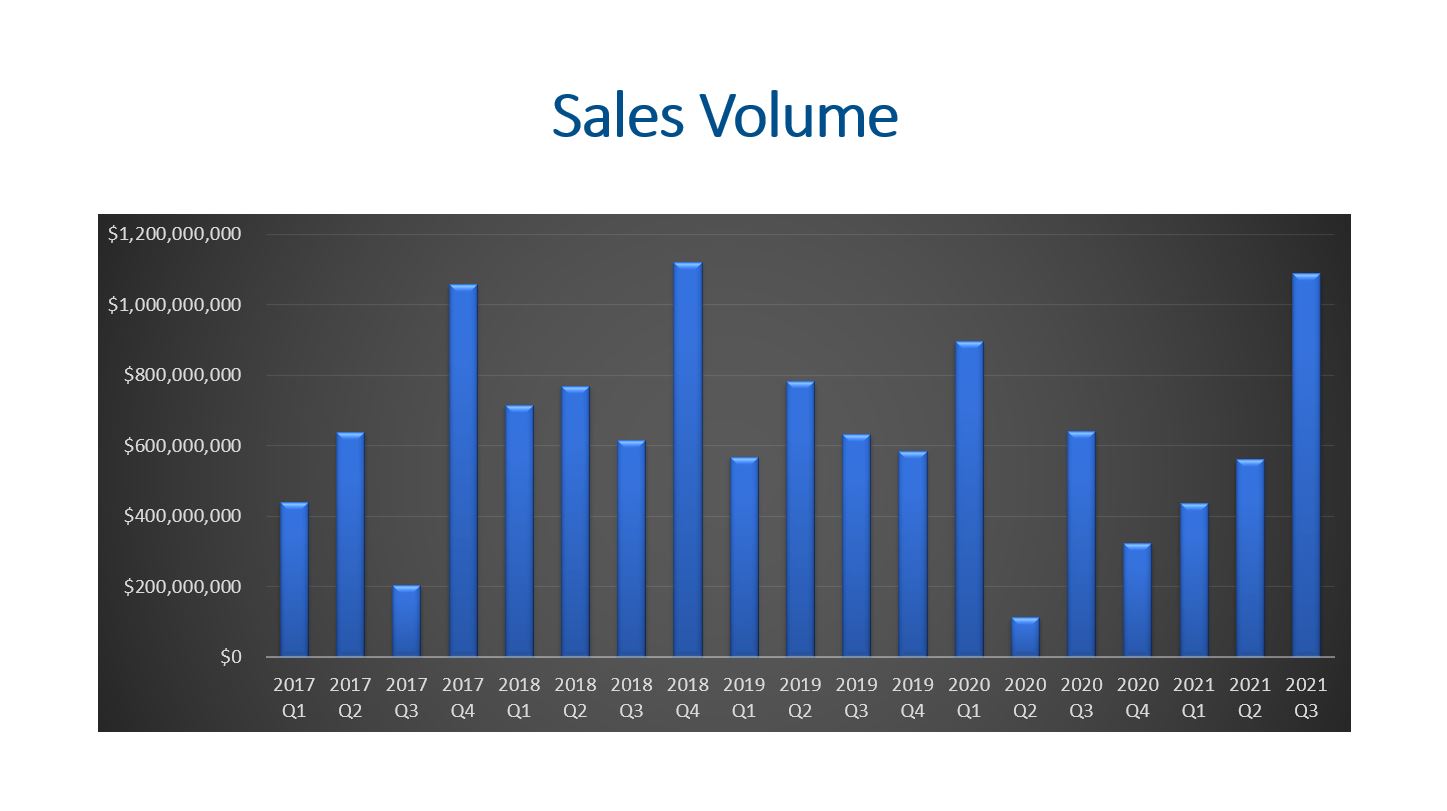

There were 205 office sales in Q3 compared to 172 office sales during Q2. The absorption rate is now 68.3 sales per month.

The negative net absorption for the previous six quarters has cost us nearly 5.8M SF of occupancy, and we finally had a positive absorption of 250k SF.

Surprisingly, cap rates have been pretty flat.

New Construction

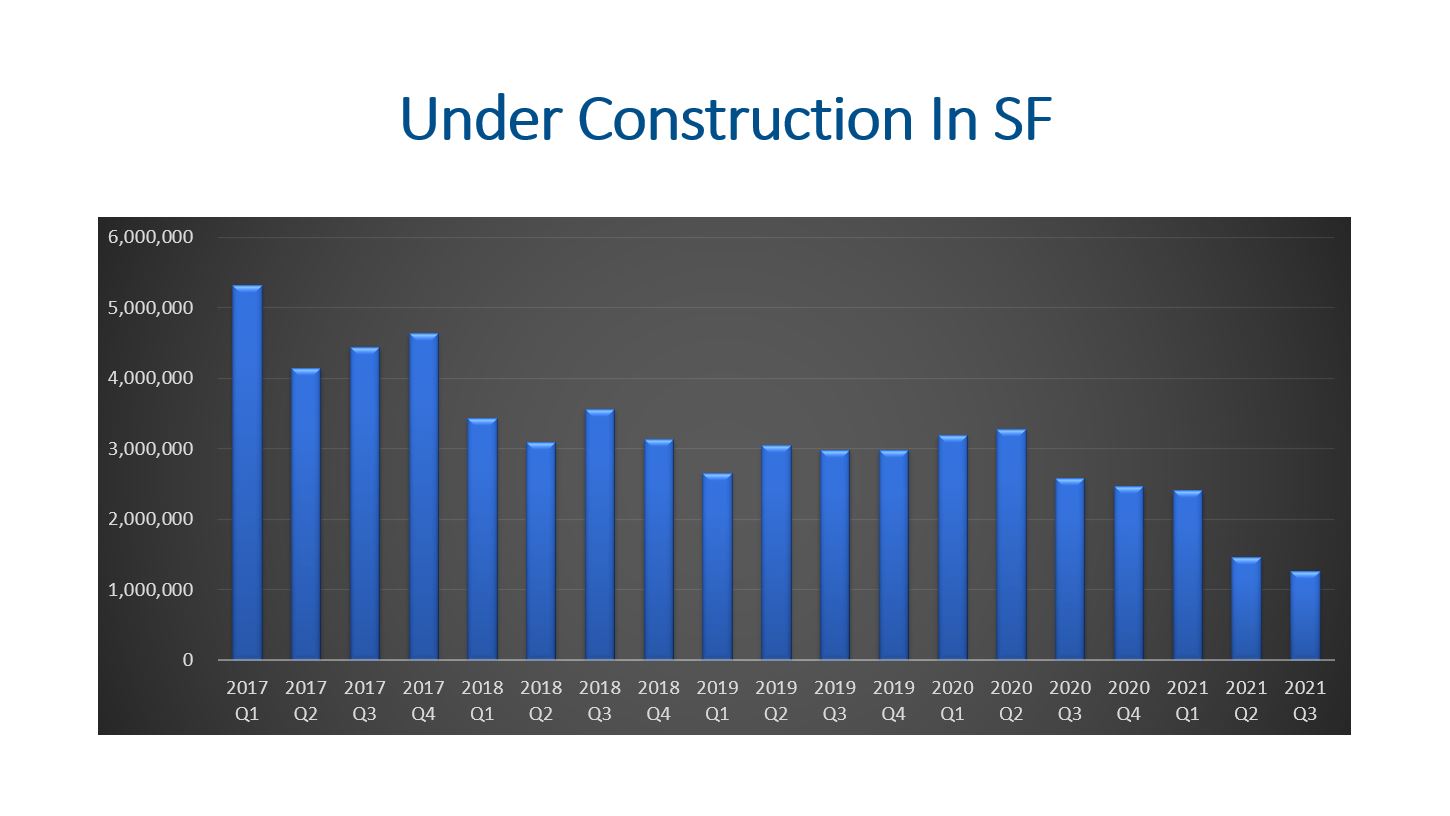

Developers started construction on 76k SF during Q3. In 2021, developers have started construction on only 529k SF. This is 28.7% of what was started during the same period in 2018.

Altogether, developers have nearly 1.3M SF under construction right now. We haven’t had this low amount of SF under construction since 2013, but it does make sense given the current climate.

The office space market size is around 181M SF in Denver, over 5,577 buildings, so the space market is set to expand 0.72% (7/10ths of 1%).

Leasing

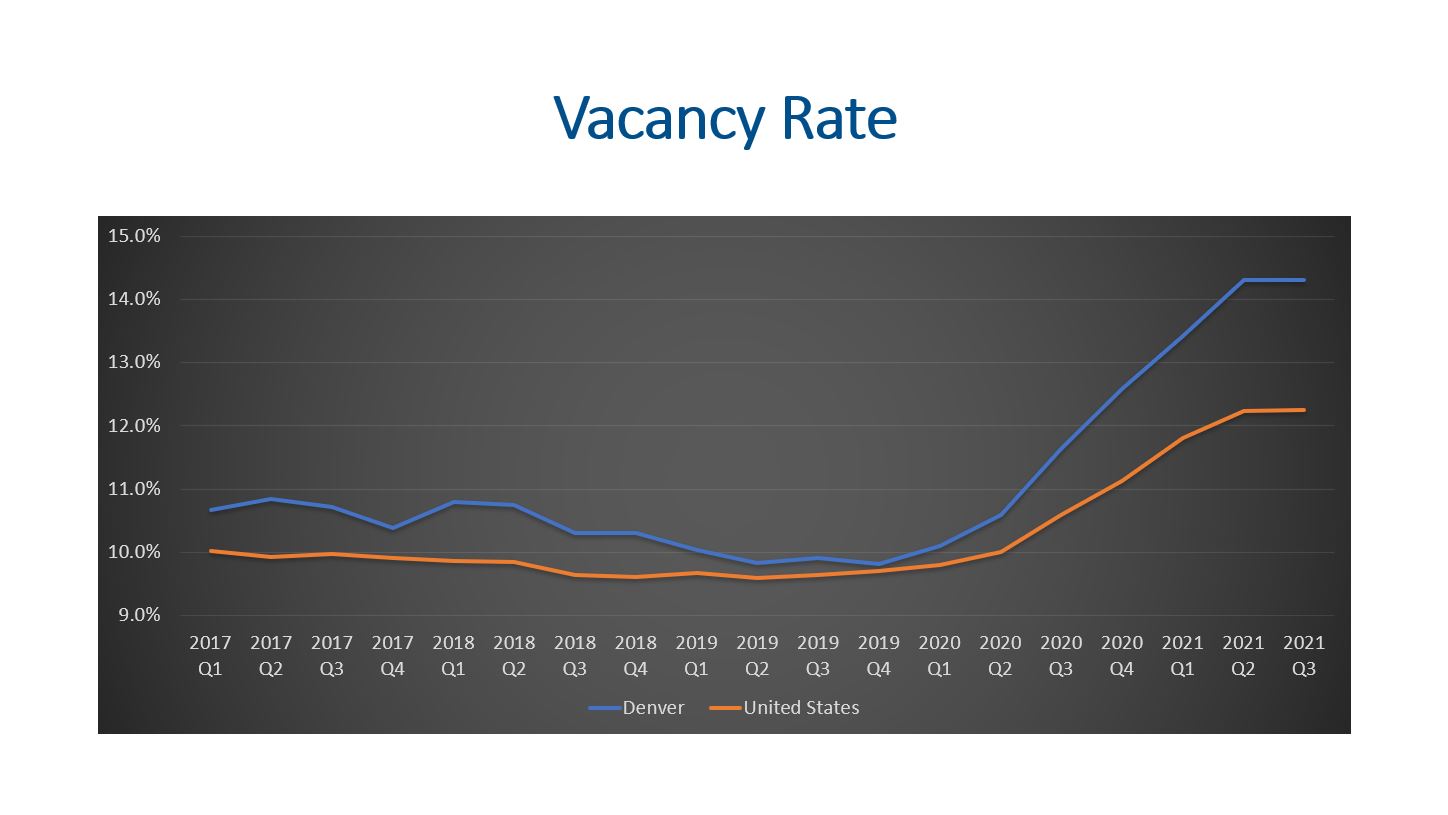

Given the rise in vacancy and availability, we are expecting to see more downward pressure on rents. The Q3 vacancy rate is 14.3% and the availability rate is 18.7%. Vacancy is space that is not occupied. The availability rate is based on the vacant and occupied space that is on the market.

The long-term average vacancy is 12.1%, so exceeding that by 2.2% does place this property type into hyper supply according to Dr. Mueller at DU.

Sometimes, we get lost in percentages… the current vacancy translates into 26.1M SF of vacancy and the current availability translates to 34.2M SF! Ouch!!! Based on these figures, we expect that it will be a while before developers start more new construction.

On average it is taking 13.7 months to find a new office tenant. This is up 3 months from a year ago.

Final Thoughts

All in all, supply, demand, new construction, and leasing are all showing us signs that deserve our attention. There has been an improvement in the absorption rate and the dollar volume of sales has recovered. The negative net absorption streak for the last 6 quarters has finally turned positive! Developers have been reluctant to start construction on their new projects. The leasing rate per SF declined some, and will need to decline more before office users start heading back to the office to fill up the 26.1M SF of vacant office space.

Here is a link to the presentation: