The Denver Commercial Real Estate market has been very interesting to watch as we embarked on 2022. The four major property types in this analysis are retail, multi-family, office, and industrial. It is interesting to study each property type while considering the market as a whole. Let’s dive into supply, demand, new construction, and vacancy rates.

Supply

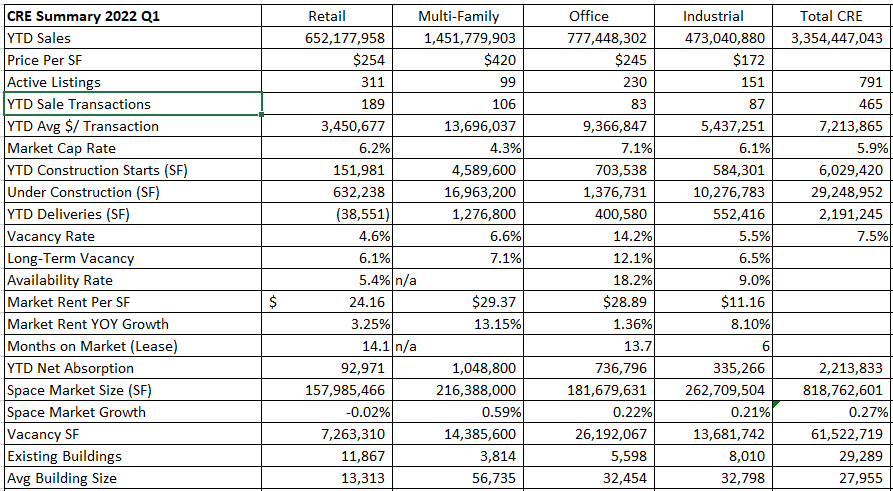

There are 791 active for sale listings across the four major property types. Retail properties range from a $150,000 restaurant to a $39M portfolio of five Walgreens locations. Multi-family properties range from $625,000 for 7-unit mobile home park to $26M for a six- property portfolio totaling 102-units. Office properties range from an $80,000 condo to $25.75M 124,644 sf building. Lastly, industrial properties range from a $525,000 industrial condo to a $21M for a manufacturing complex in Unincorporated Arapahoe County.

Demand

There were 465 closed sales in Q1 2022 with a total dollar volume of $3.354B. The average transaction was $7.2M.

One gauge for demand is net absorption. Absorption is a gauge of the space tenants need. Retail gained 92,971 sf of occupancy. Office gained 736,796 sf. Industrial gained 335,266 sf, and multi-family gained 1,048,800 sf. It is surprising to see industrial this low.

Capitalization rates are different for each of the property types. Multi-family is seen as less risky with a 4.3% cap rate. Office is seen as the riskiest with a 7.1% cap rate. It will be interesting to see what cap rates do as mortgage interest rates increase. Our thought is that they will increase.

New Construction

Developers started construction on more than 6M sf in Q1 2022. Retail saw just 151,981 sf get started. Office developers started 703,548 sf. Industrial developers started 584,301 sf, and multi-family developers started construction on 4,589,600 sf. This means 76% of the new construction in commercial real estate was multi-family (residential).

Developers completed nearly 2.2M sf in net deliveries during the first quarter of this year. Retail net deliveries were down (38,551 sf) due to a large demolition. Multi-family developers completed nearly 1.3M sf. Office developers delivered 400,580 sf, and Industrial developers delivered 552,416 sf. For reference industrial developers delivered 2.6M sf in Q4 2021, which was a new record. Therefore, we aren’t too surprised to see a smaller number in Q1.

Vacancy Rates

Vacancy rates for Denver Commercial Real Estate tell an interesting story as well. Specifically, we need to compare the current vacancy rate to the long-term vacancy rate in order to understand the market better.

Retail properties have a vacancy rate of 4.6% compared to a long-term rate of 6.1%. Mutli-family has a current rate of 6.6% compared to a long-term rate of 7.1%. Industrial has a current rate of 5.5% compared to a long-term rate of 6.5%. All three of these property types are performing better than the long-term average.

Office properties have a vacancy rate of 14.2% compared to a long-term vacancy of 12.1%. Therefore, office properties aren’t doing as well as they have in the past.

Data Summary

Final Thoughts

Supply, demand, new construction, and vacancy rates are all worth studying when looking at Denver Commercial Real Estate Trends. The supply of commercial properties for sale fluctuates depending on the property type. The fewest amount of available properties are in multi-family and industrial. Retail property types have the most available properties and also have the most amount of existing buildings. There is a consistent demand for purchasing commercial real estate in Denver. New construction is happening all over the city with most of the developments being multi-family and industrial. Vacancy rates are fairly similar across the property types with the exception of office. Office is consistently higher than the other property types when we look at the long-term vacancy rates.

Here is a link to the full presentation for each property type:

Commercial Real Estate Retail 2022 Q1.pdf

Commercial Real Estate Multi-Family 2021 Q1.pdf