The Denver Commercial Real Estate market is worth studying closely. The economic environment has seen a variety of changes over the past few years. We have high inflation and high job growth right now. We also have higher interest rates, and the Federal Reserve is likely to increase the rates by another 75 basis points this month. Todd Kuhlman believes we will see a decline in commercial real estate values because of the higher mortgage rates. Higher mortgage rates will increase capitalization rates which ultimately decreases values. The four major property types we are tracking are: retail, multi-family, office, and industrial. Each property type is performing differently. Let’s dive into supply, demand, new construction, and vacancy rates.

Supply

There are 860 active for sale listings across the four major property types. The 317 retail listings range from a 347 sf storefront on Downing for $249,228 to a five unit portfolio of Walgreens buildings for $39.6M. The 122 multi-family properties range from a duplex in Aurora at $460,000 to a six property portfolio with 102 units for $26M. The 247 office properties range from a 268 sf condo for $80,000 to a six story building with 267,117 sf for $30M. Lastly, the 174 industrial properties range from an 1,166 sf condo for $390,000 to a 155,916 sf warehouse for $25M.

Demand

There were 529 closed sales in Q2 2022 with a total dollar volume of $3.24B. The average transaction was $6.13M. Among the four property types: retail accounted for 198 sales, multi-family accounted for 122 sales, office accounted for 98 sales, and industrial accounted for 111 sales. The monthly absorption rate was 176.33 sales; therefore, we have 4.9 months of commercial inventory.

Another gauge for demand is net absorption. Absorption is a gauge of the space tenants need to operate their businesses. Retail gained 17,307 sf of occupancy. Multi-family gained 2.18M sf! Office lost (281,152) sf of occupancy, and industrial gained 2.83M sf! Clearly, demand for multi-family and industrial is much higher than retail and office.

Investors look at capitalization rates (cap rates) when they are investing. A cap rate is what an investor is willing to pay for the net operating income (NOI). For example, if an investor wants $5 of NOI, and they are willing to pay $100 the capitalization rate would be 5% (NOI / value = cap rate). The Denver area currently has average cap rates ranging from 4.1% to 6.9% depending on the property type. This measure is a really broad stroke of investment performance and is only one of three components of measuring an actual internal rate of return.

We agree with Todd Kuhlman, higher interest rates will translate to higher cap rates and this means the value of commercial real estate is likely to go down.

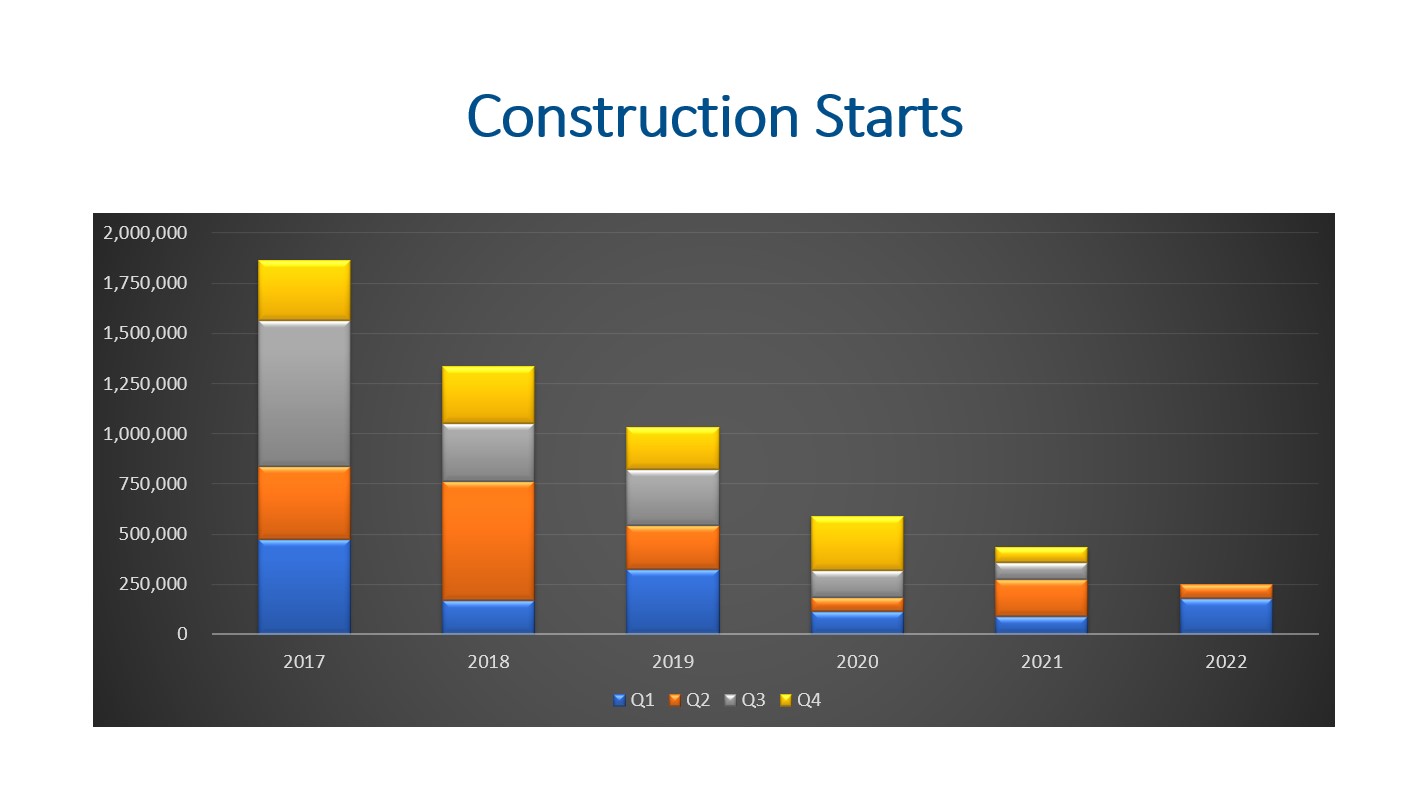

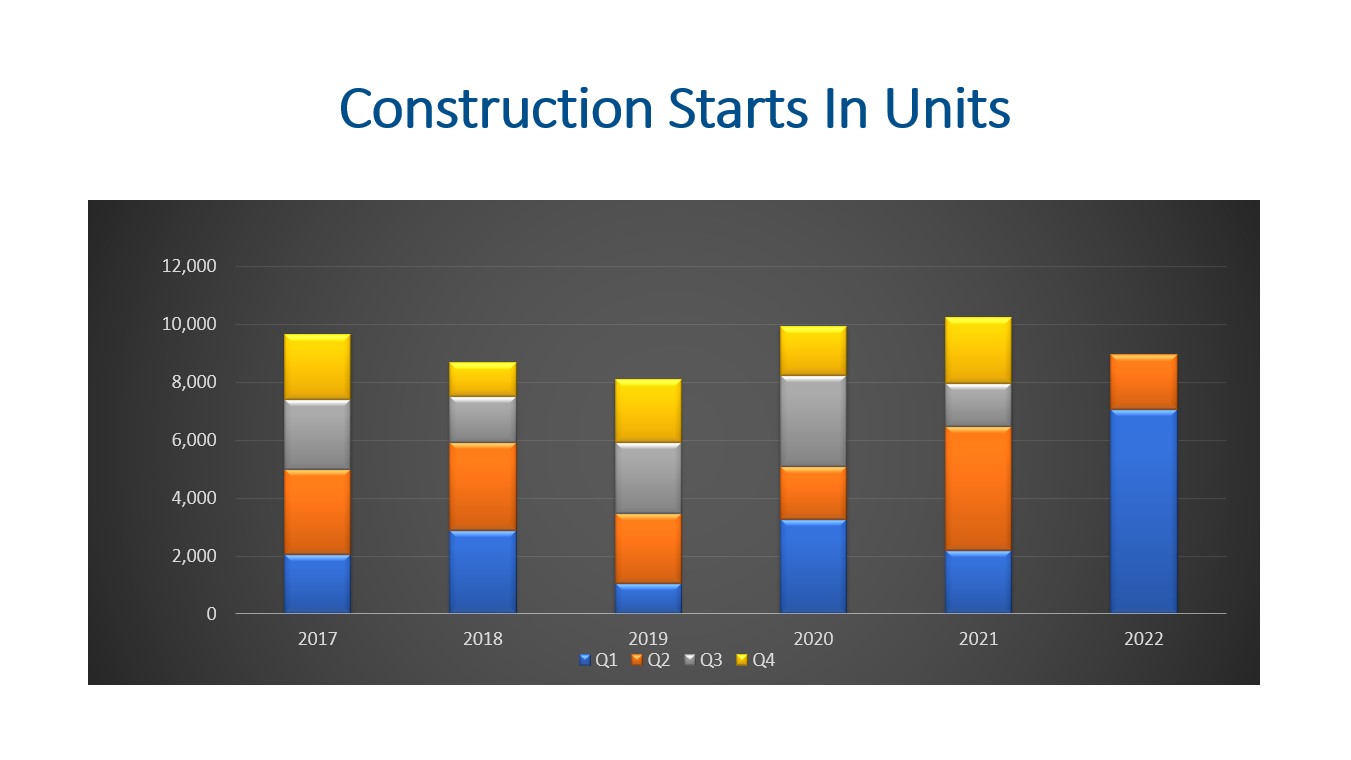

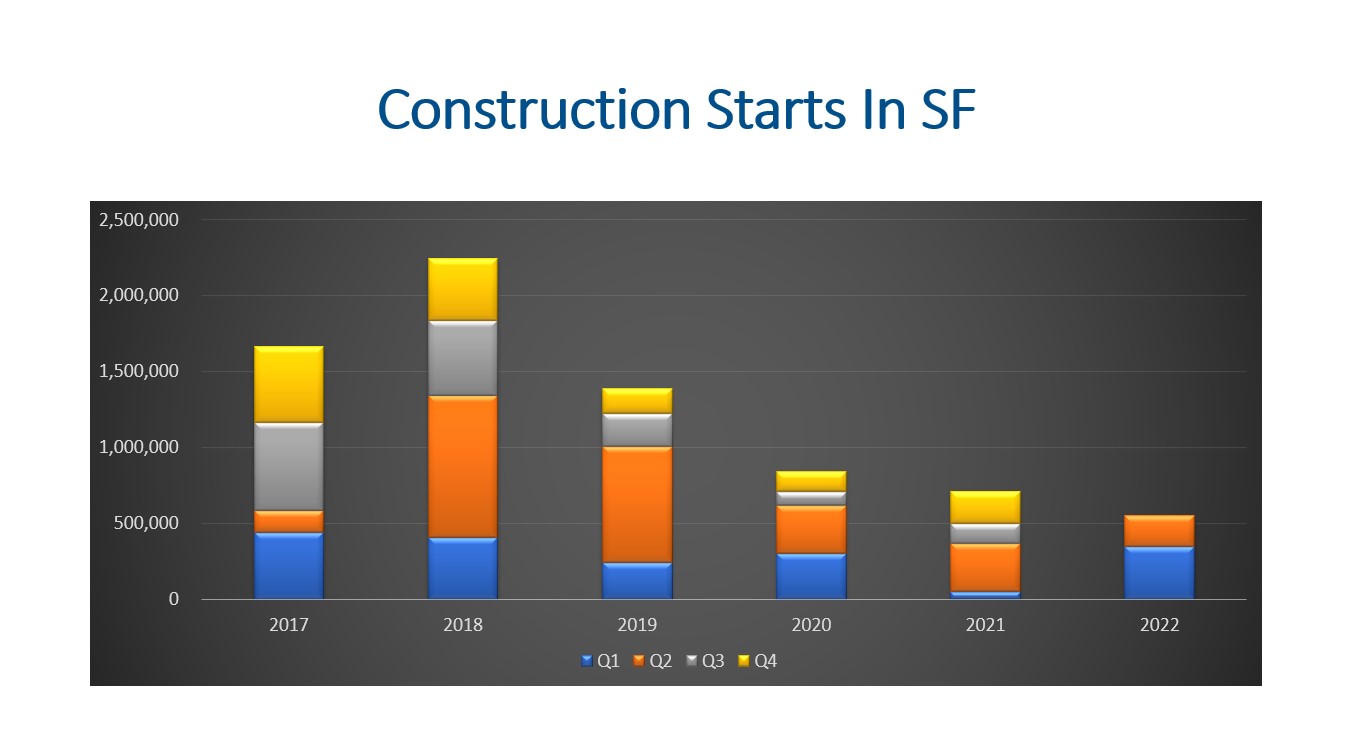

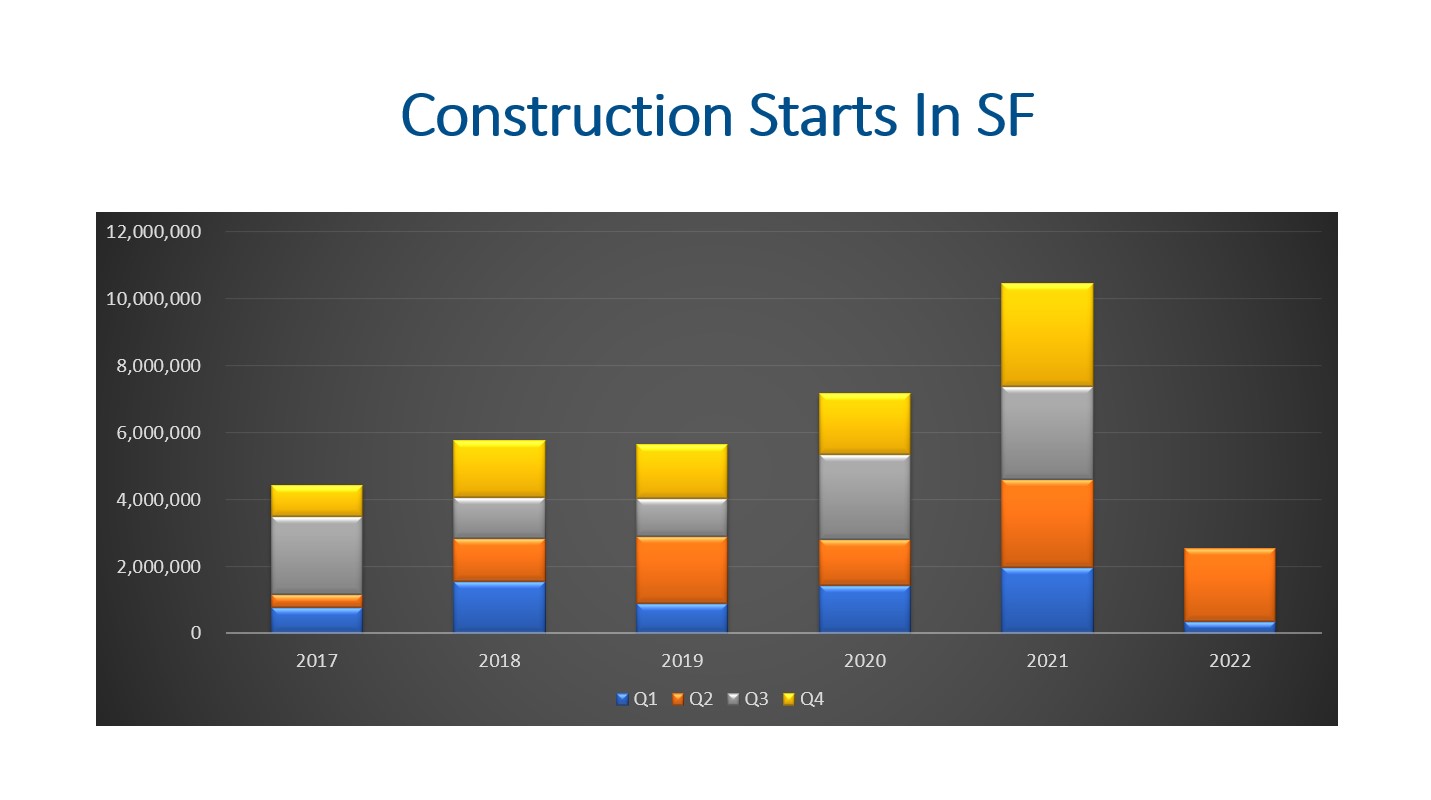

New Construction

Developers started construction on 3.98M sf during Q2. This is quite a bit lower than the 6.5M sf in Q1 2022. Retail construction starts accounted for 72,205 sf. Multi-family construction starts were 1.5M sf. Office construction starts were 205,780 sf, and industrial construction starts accounted for 2.8M sf.

Retail: Multi-family:

Multi-family:

Office:

Industrial: Another factor to consider is the total sf of space under construction. Retail has 644,781 sf under construction. Multi-family has 18.2M sf under construction. Office has 1.5M sf under construction, and industrial has 9.9M sf under construction. All together 30.25M sf of construction is under way.

Another factor to consider is the total sf of space under construction. Retail has 644,781 sf under construction. Multi-family has 18.2M sf under construction. Office has 1.5M sf under construction, and industrial has 9.9M sf under construction. All together 30.25M sf of construction is under way.

Developers delivered just over 3M sf during Q2. Retail delivered a meager 17,307 sf. Multi-family developers completed nearly 1.5M sf. Office developers delivered a net loss of (45,510 sf). This net loss came from new construction of 15,571 sf less (61,081 sf) that was demolished. Industrial developers delivered 1.5M sf.

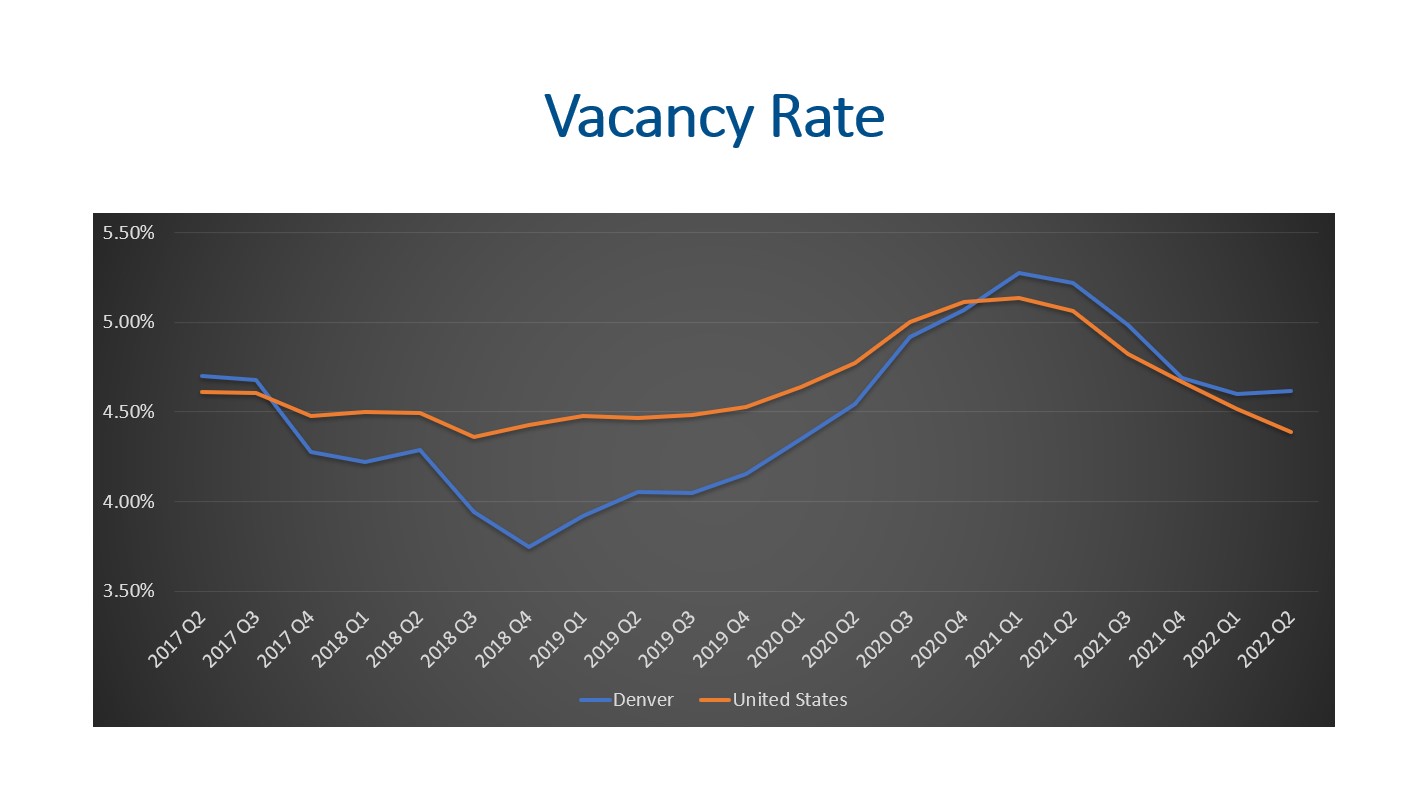

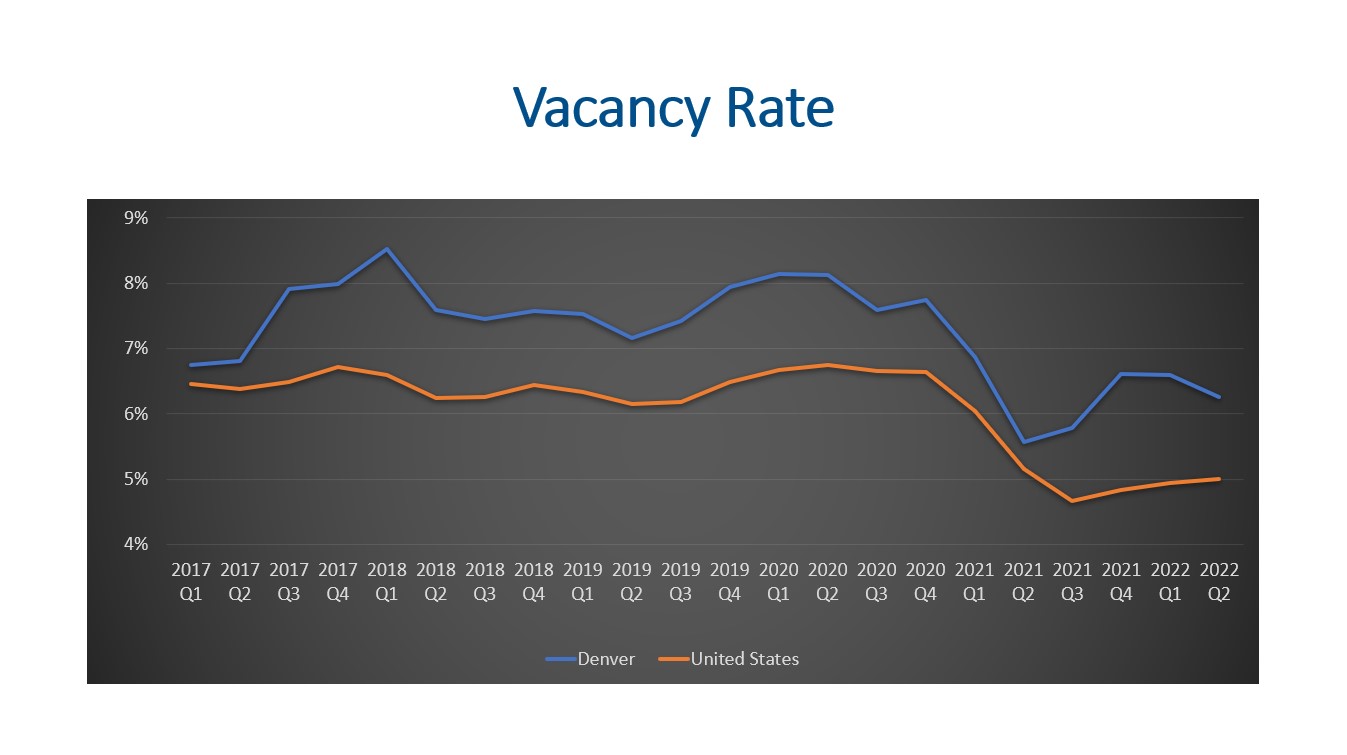

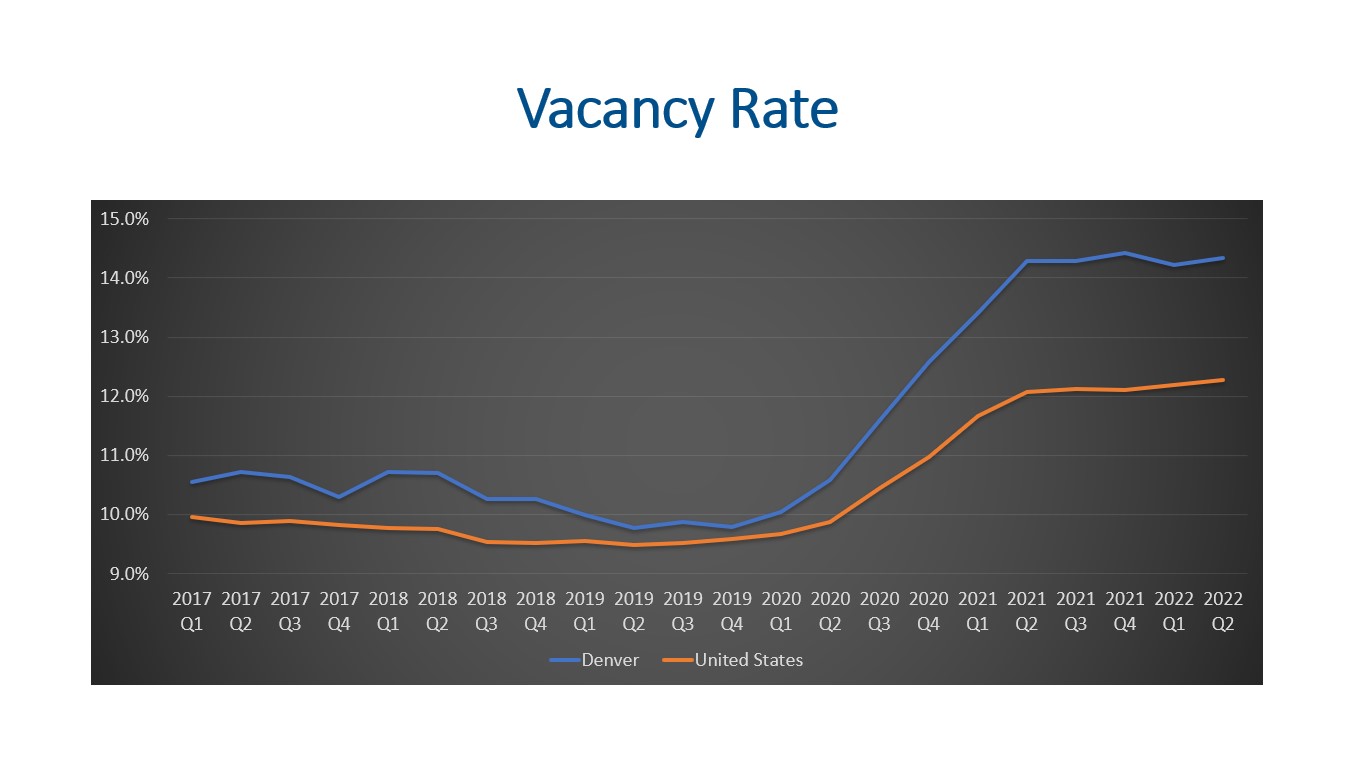

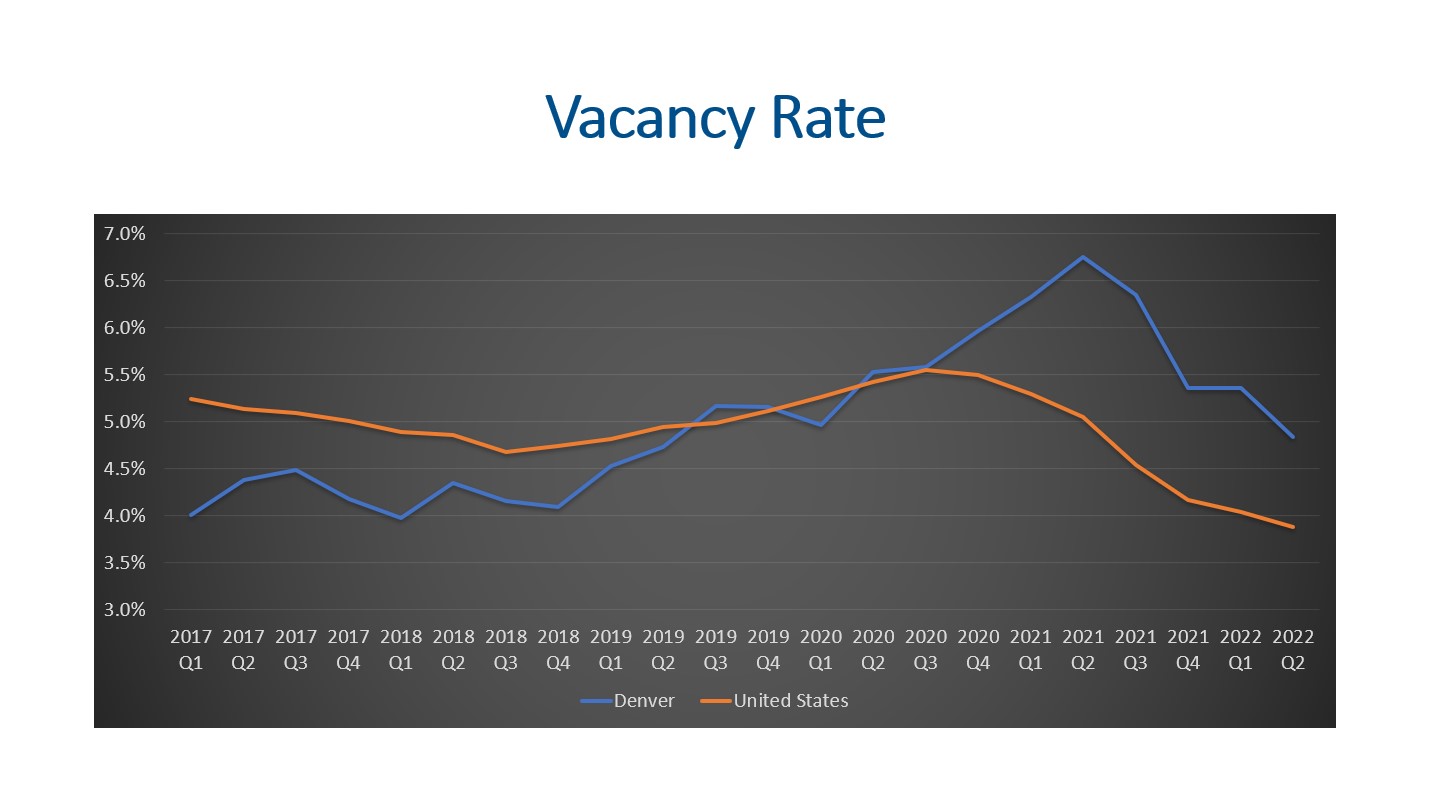

Vacancy Rates

Vacancy rates for Denver Commercial Real Estate tell an interesting story as well. A vacancy rate is a metric comparing the amount of unoccupied sf compared to the total sf of all the buildings in a market. Denver has a total of 60,868,493. Though this sounds like a lot it is worth mentioning Denver 825,438,815 sf of total space. Therefore, the vacancy rate is 7.4% (60,868,493/ 825,438,815 sf = 7.4%).

Specifically, we need to compare the current vacancy rates to the long-term vacancy rates in order to understand the market better. Retail properties have a vacancy rate of 4.6% compared to a long-term rate of 6.1%. Multi-family has a current rate of 6.2% compared to a long-term rate of 7.1%. Office properties have a vacancy rate of 14.5% compared to a long-term vacancy of 12.1%. Lastly, industrial has a current rate of 4.8% compared to a long-term rate of 6.5%.

Retail:

Multi-Family:

Office:

Industrial:

Three of the property types are performing better than the long-term average. The only property type with a vacancy rate exceeding the long-term vacancy rate is office.

Final Thoughts

Supply, demand, new construction, and vacancy rates are all good key performance indicators for the commercial real estate market in Denver. The supply of commercial properties for sale fluctuates depending on the property type and retail has the most amount of properties for sale. Demand for properties appears to be strong with only 4.9 months of inventory. Developers are hard at work starting new buildings, working on their projects, and delivering buildings to the market all over the city. Vacancy rates are fairly similar across the property types with the exception of office. Office is consistently higher than the other property types when we look at the long-term vacancy rates.

Here is a link to the full presentation for each property type: