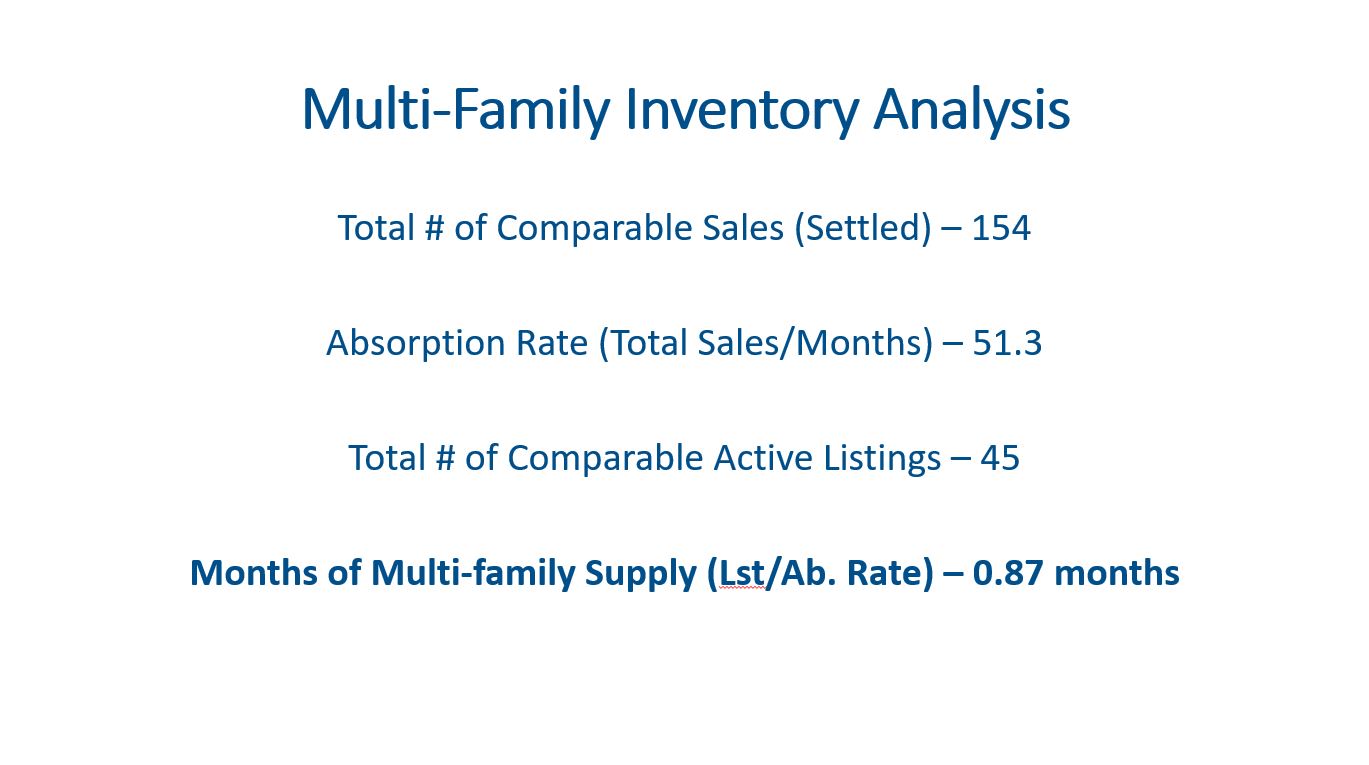

Supply

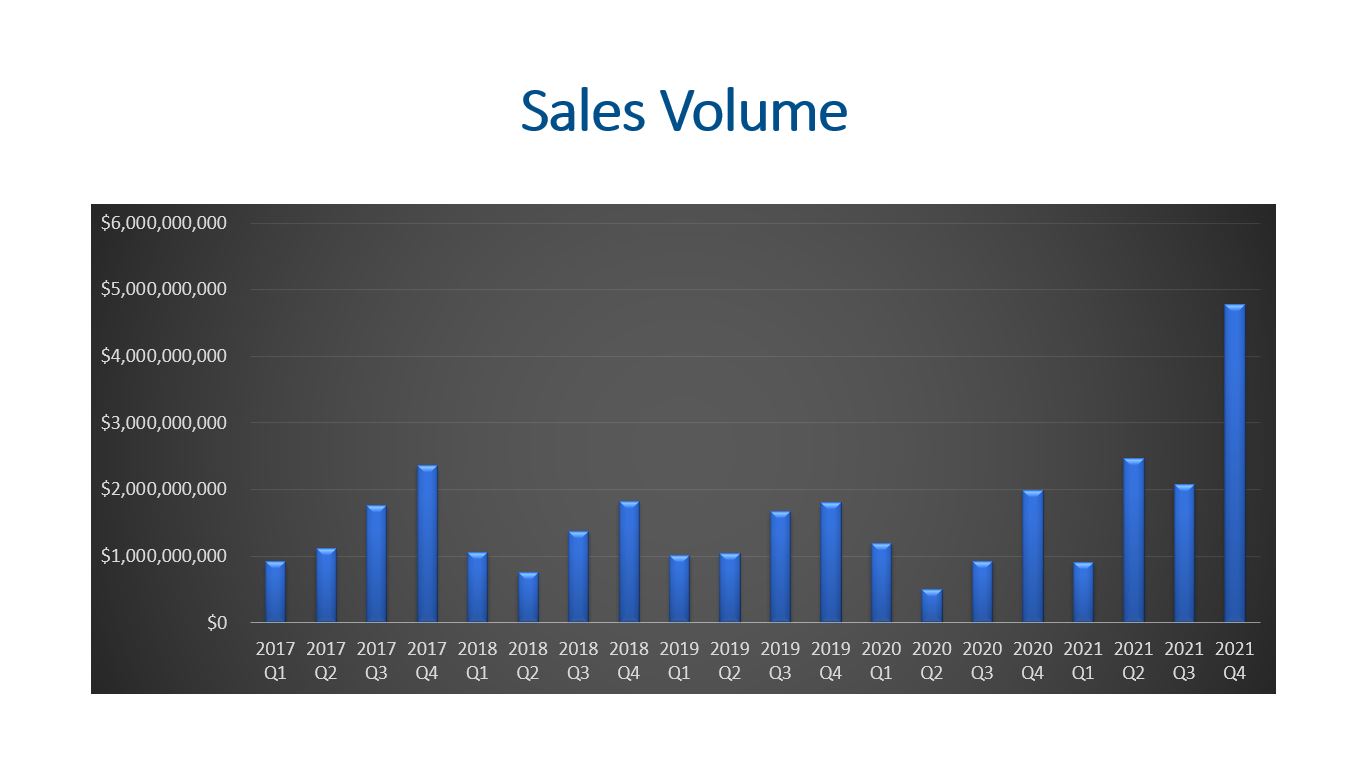

Demand

The price per unit saw a 15.6% increase YOY. Capitalization rates compressed about 15 basis points to 4.328%. The market is seeing this commercial real estate property type as being less risky compared to a year ago and less risky compared to all other commercial property types.

The YTD sales, in dollar volume, is up 122% when compared to 2020.

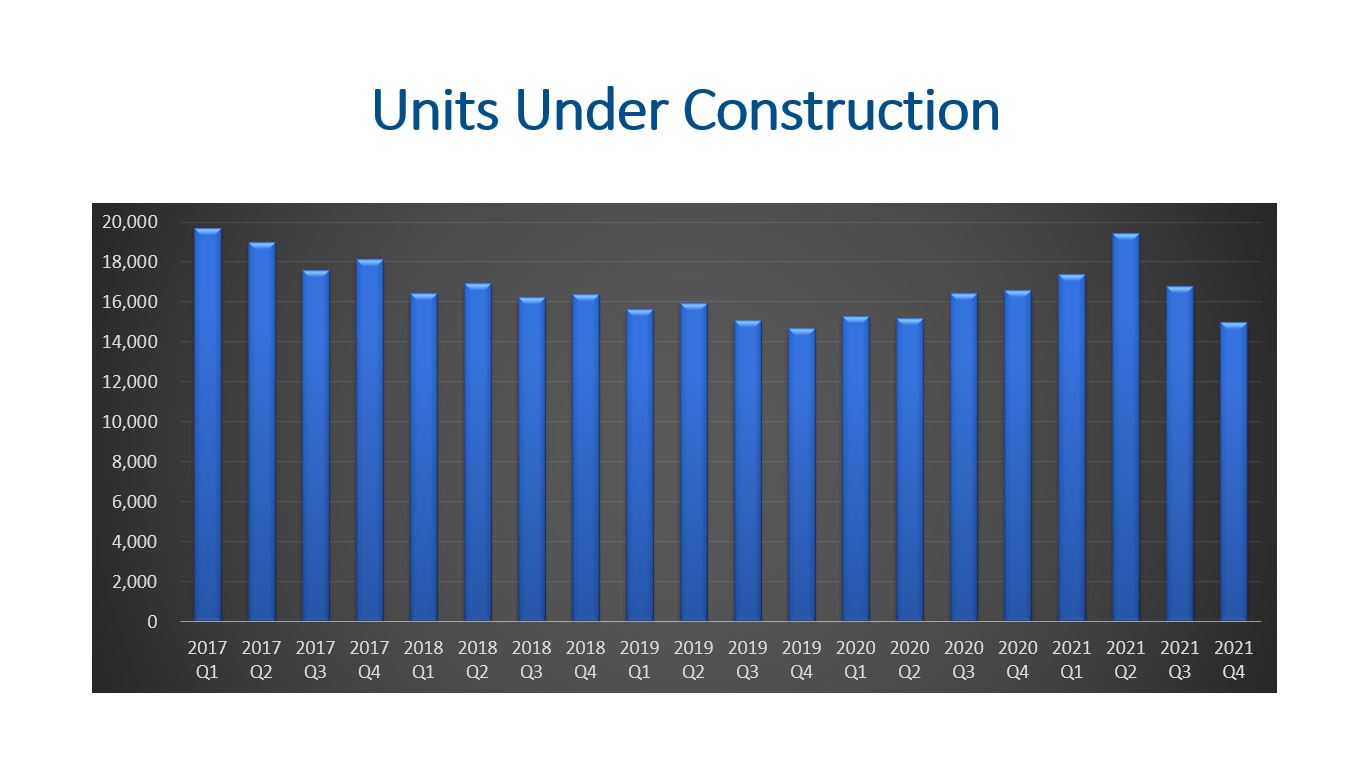

New Construction

Currently there are 14,995 units under construction. If the average unit was 800 sf, this would mean we have around 11,996,000 sf under construction. This is very close to the same amount of sf under construction for industrial.

Developers delivered 3,350 units to the market during Q4.

Vacancy Rates

Vacancy rates in Denver have been trending higher than the national average since Q2 of 2016. It is interesting to note that both Denver and the national rates declined from Q4 2020 to Q2 2021. At that point, national continued to decline while Denver increased from 5.5% in Q2 2021 to end the year at 6.3%.

Leasing

With the Consumer Price Index (CPI) for the Denver Metropolitan Statistical Area (MSA) increasing by 6.5% multi-family actually grew twice as fast as inflation.

Tenants leased 1,354 units during Q4. Overall, tenants leased 12,511 units during 2021. This represents a 66% increase in 2021 over 2020 in total units.

Final Thoughts

All in all, supply, demand, new construction, vacancy rates, and leasing all contribute to the outlook for the multi-family property type in commercial real estate. We have a very low supply of properties for sale and very strong demand leaving us with less than a month of inventory. Construction starts are down (12.2%) compared to 2020 but rent growth appears to indicate that more units can be built. Vacancy rates did move higher in Q3 and Q4 but are still low at 6.3%. Denver’s net population growth is not as strong as it has been, but we still need more for rent and for sale housing.

Here is a link to the full presentation: