Industrial commercial real estate in Denver is flashing some interesting signals. Construction starts are up YTD compared to the same time last year. As we drive around the city, we can see a lot of new space being built along I-70. Let’s dive in and review some of the metrics.

Supply

There are 187 active listings for industrial properties. These properties range from a $170k industrial condo with 1,050 sf to a massive $69M 630,812 sf distribution center. There is 11M sf for sale with a total listing value of $490M.

Demand

There were 131 sales in Q2 2021. This averages out to a market absorption rate of 43.7 sales per month. The dollar volume for closed listings in Q2 was $299M for the Denver Metro market. This is a (16.8%) decrease compared to Q2 2020.

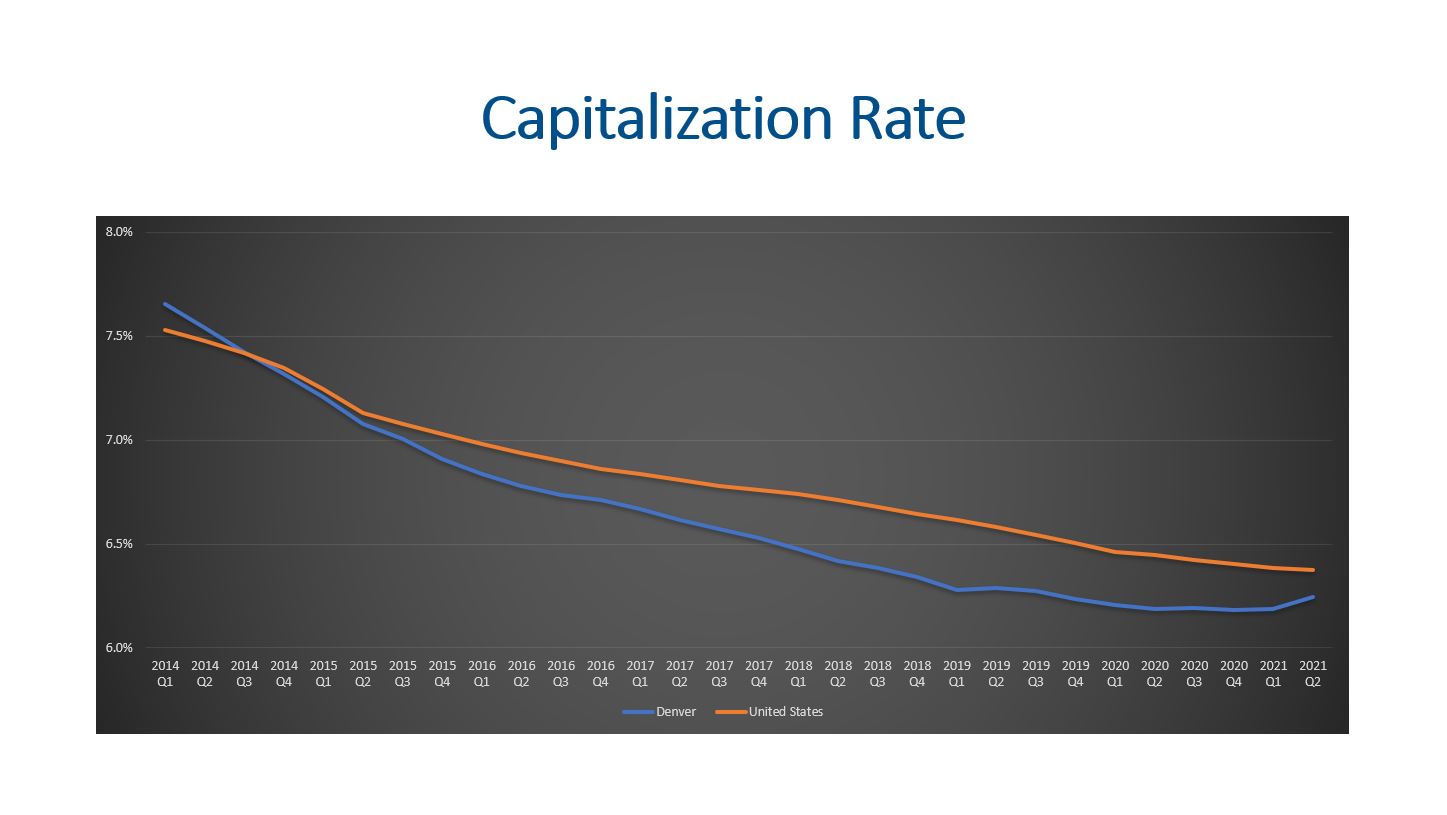

When we compare this supply against the absorption rate, the inventory is at 4.3 months. Capitalization rates increase slightly to 6.2%. The gap between the Denver and National capitalization rates has been narrowing over the last 5 quarters.

New Construction

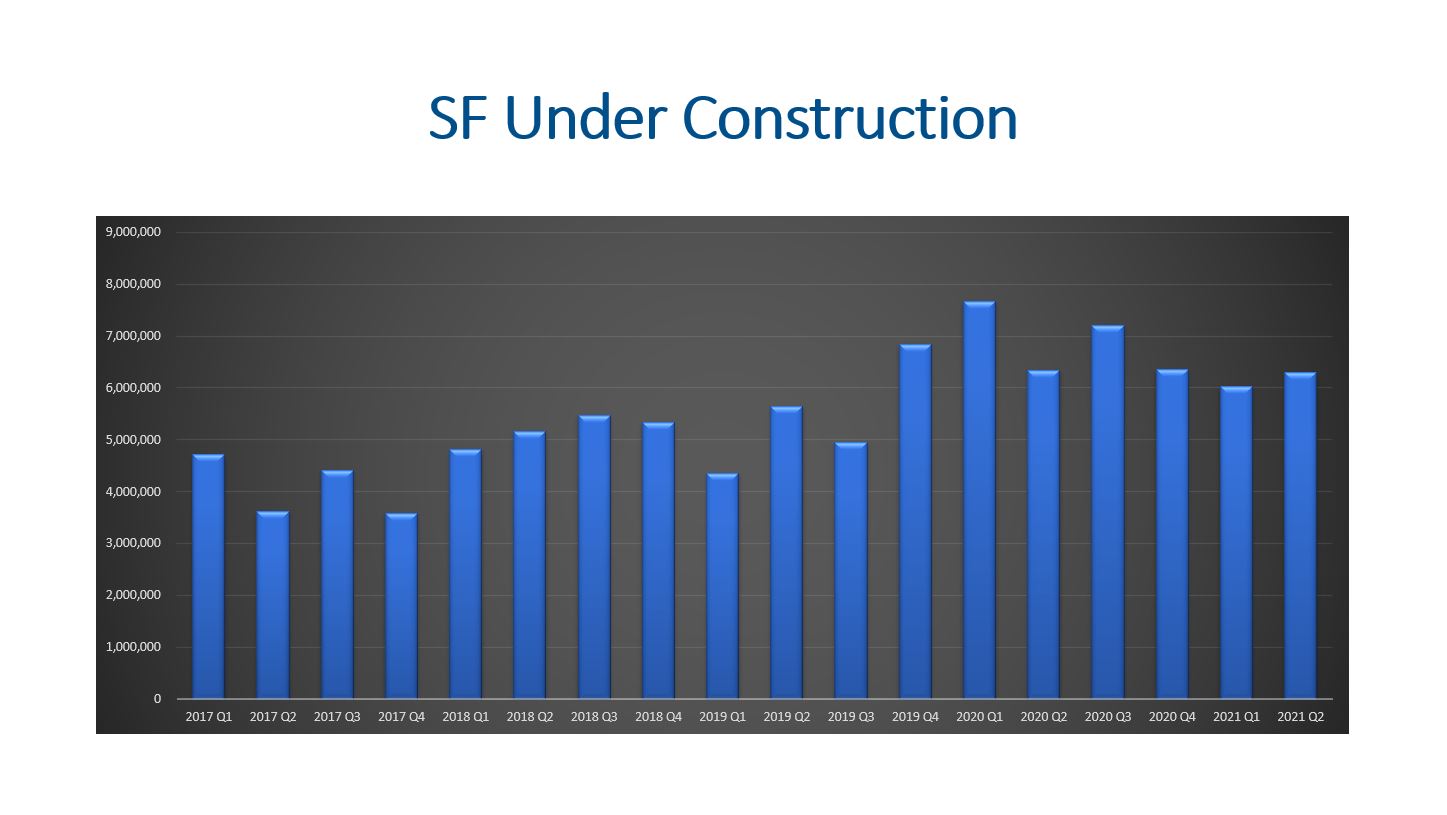

Developers started construction on nearly 2.2M sf in Q2. This is almost twice as much sf compared to Q1 2021. All together there is nearly 6.3M sf under construction right now. Given the space market for industrial is nearly 258M sf, we are set to grow by 2.4%. The net deliveries placed into the space market during Q2 was nearly 1.9M sf.

Vacancy Rates

Vacancy rates have been rising in Denver since Q2 2020 and the national vacancy rate has been declining since Q3 2020. This divergence is quite interesting and suggests that the growth rate may be too aggressive.

Leasing

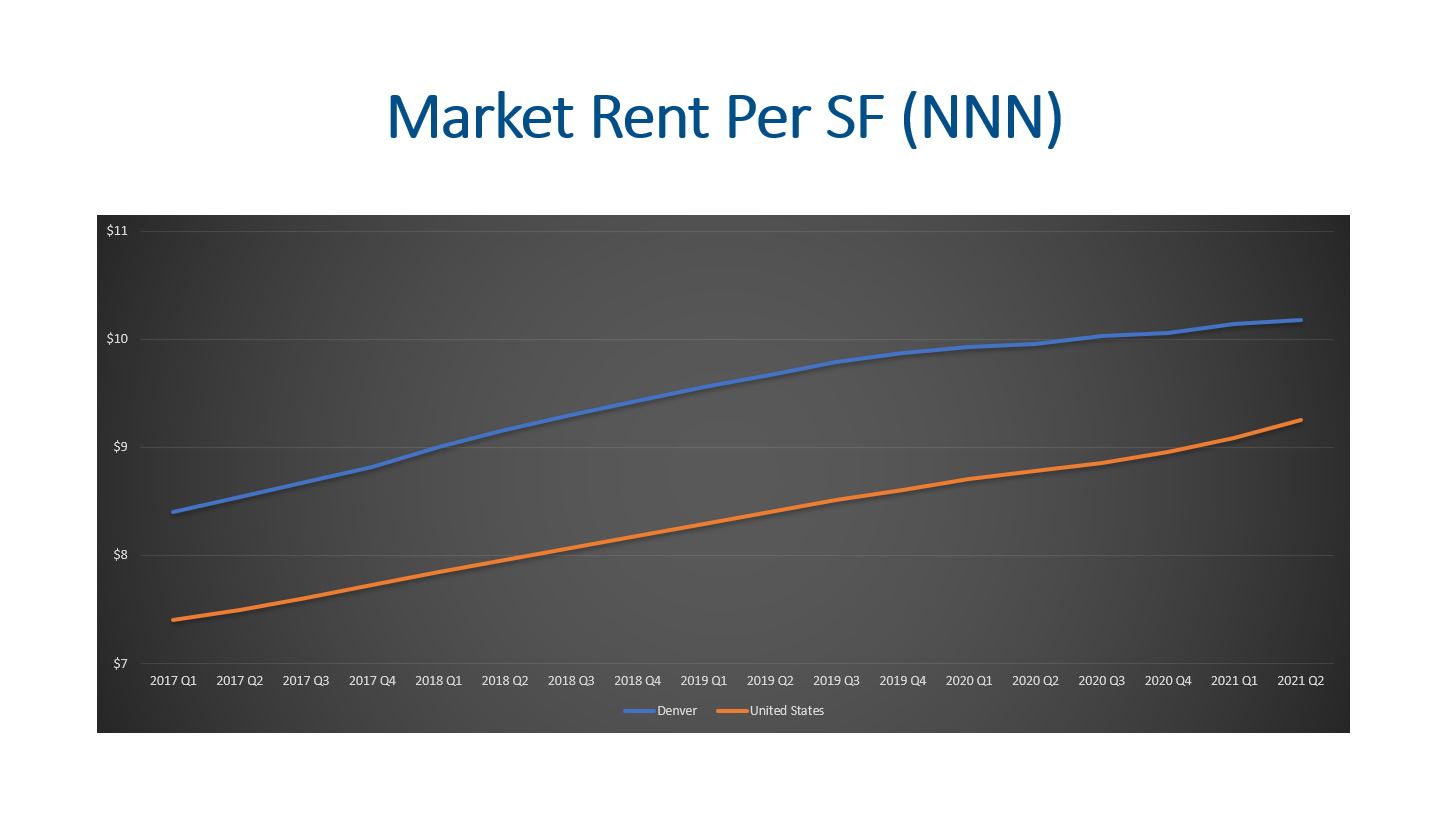

The average NNN lease is now $10.18 per SF per year for industrial space. This represents a 2.2% increase YOY. It is interesting to see some rent growth while vacancies are increasing and the time on market to lease increased to 7 months. This is an increase from 6.1 months on market a year ago.

Q1 2021 net absorption was revised down from 69,010 sf to losing nearly 120k sf of occupancy. Q2 net absorption was much better with absorbing nearly 674k sf.

Final Thoughts

Supply and demand for industrial properties seem to be fairly balanced. Although construction starts are up and the total sf under construction is nearly flat, a space market growth rate of 2.4% seems to be reasonable. We need to keep an eye on vacancies since they have been increasing for the last 6 quarters and have diverged from the national vacancy rate. Rental rates have increased over the last year, but our marketing time increased by nearly a month. It will be interesting to continue monitoring the industrial market.

The full presentation can be found at: