Multi-family commercial real estate ended 2020 in a strong position! This product type saw $900M in transaction volume during Q3 and $1.97B in Q4. That is right, an additional $1,000,000,000 in sales closed in Q4 compared to Q3. Overall, the sales volume was up 90% compared to Q3 but still ended down (18.9%) for the year compared to 2019.

Multi-family commercial real estate ended 2020 in a strong position! This product type saw $900M in transaction volume during Q3 and $1.97B in Q4. That is right, an additional $1,000,000,000 in sales closed in Q4 compared to Q3. Overall, the sales volume was up 90% compared to Q3 but still ended down (18.9%) for the year compared to 2019.

Supply

There are currently 109 multi-family listings for sale in the Denver Metro Area. When comparing this supply to demand we have 2.7 months of supply. This the lowest of any commercial property type.

Demand

Demand for buying multi-family properties is strong. There were 122 closings in Q4 of 2020 with the absorption rate of 40.7 per month. Another indicator of demand is the lower capitalization rate of 4.748%.

New Construction

Developers started construction on 1,089 new units in Q4 for a total of 6,057 new units for the year. This represents a (27.5%) decline compared to 2019.

Developers delivered 1,909 units to market during Q4. Although, this is about 100 units more than the average Q4 for the last few years the total units delivered in 2020 was 7,744 which is down (19.5%) compared to 2019.

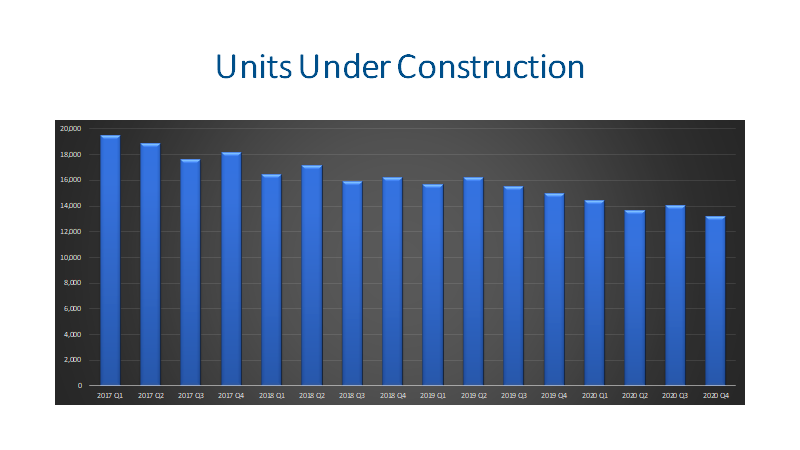

As for the units currently under construction, there are 13,223 units being built right now. Although this may seem like a lot, this is significantly lower than the 19,512 units that were under construction in Q1 of 2017.

Vacancy Rates

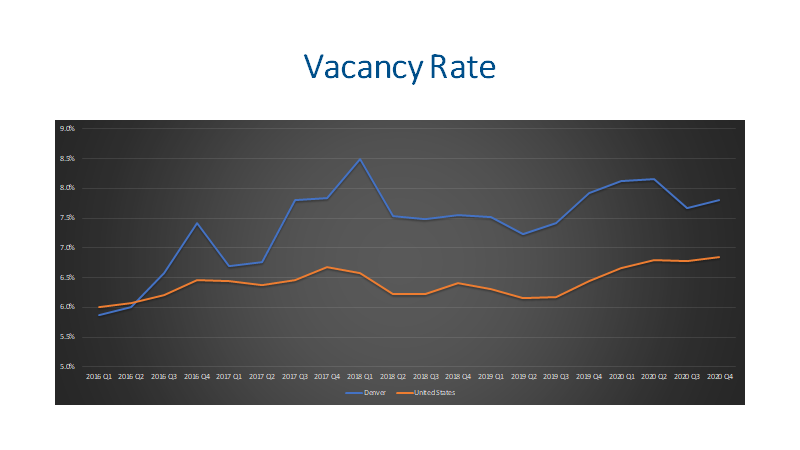

Vacancy rates in Denver have been trending higher than the national average. Denver ended 2020 at 7.8% compared to the national average of 6.8%. Denver’s higher vacancy rate is mostly coming from newer 4-5 star properties. These properties have an average vacancy rate of 9.4% compared to the 3 star properties which have a 6.4% vacancy. The forecasts we are watching are predicting the vacancy rates will rise in 2021.

Leasing

The average gross lease apartment rent varies by bedrooms. Studio units are renting for $1,201 per month, and one-bedroom units are leasing for $1,329 per month. Two-bedroom units are renting for $1,655 per month, and 3-bedroom units are leasing for $2,134. All of these are down slightly from the Q3 rates but there is a seasonal adjustment in Q4 each year.

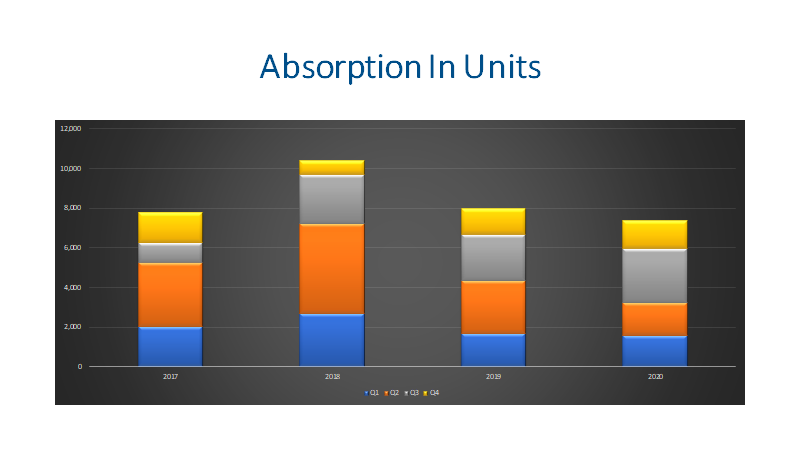

Tenants leased 1,406 units during Q4. This absorption was 9.2% higher when compared to Q4 of 2019; however, the year of year totals were down (7.7%).

Final Thoughts

Supply and demand for buying and selling multi-family properties is in a great position with only 2.7 months of inventory. Developers are building a fair number of new units, but they are building fewer units than they were just a few years ago. The forecasts appear to show an increase in the vacancy rate so this will likely put downward pressure on rents.

Here is a link to all of the slides from the analysis: