Office properties still have a big question mark hanging over them. Most people know that a large amount of professional positions transitioned to working remote in Q2 of 2020. In the beginning, many believed most of these positions would head back to the office soon. From my perspective, many companies have been quite successful at working remote. The potential outcomes could be as small as rethinking their space needs to as large as massive long-term work from home structures. The moves by REI, Uber, Facebook, Google, Twitter and more appear to suggest the later.

Supply

There are 308 office buildings for sale in the Denver Metro Area. When comparing this supply to demand we have 9.5 months of supply. This is nearly four times as much months of inventory as multi-family properties.

Demand

Demand for buying office properties in Q3 was pretty strong and in line with Q3 2019 and Q3 2018; however, Q4 was at the lowest sales volume in the last 10 years. There were a little over 32 sales per month or 97 for the quarter with a transaction dollar volume of $327M. Overall, the sales volume for office properties was down (29.2%) when compared to 2019.

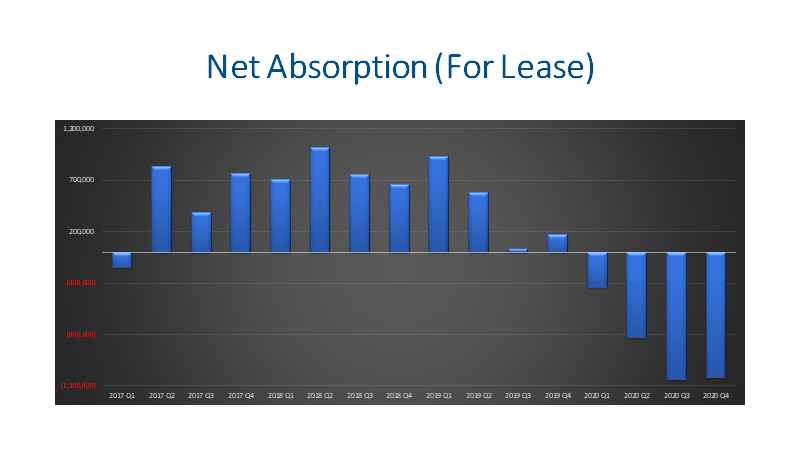

Is there anything more telling than the negative net absorption of (3.61M SF).

New Construction

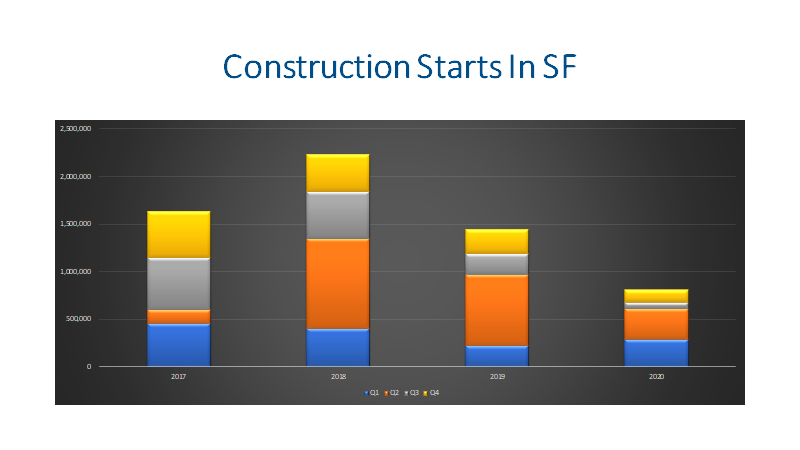

Developers started construction on 130,045 SF in Q4. This is half of the SF started in Q4 of 2019. When looking at the year, construction starts in terms of SF was down (43.9%). Altogether developers currently have 2.57M SF under construction. The office market size is around 179,919,400 SF so the market is set to expand by 1.4% at this rate.

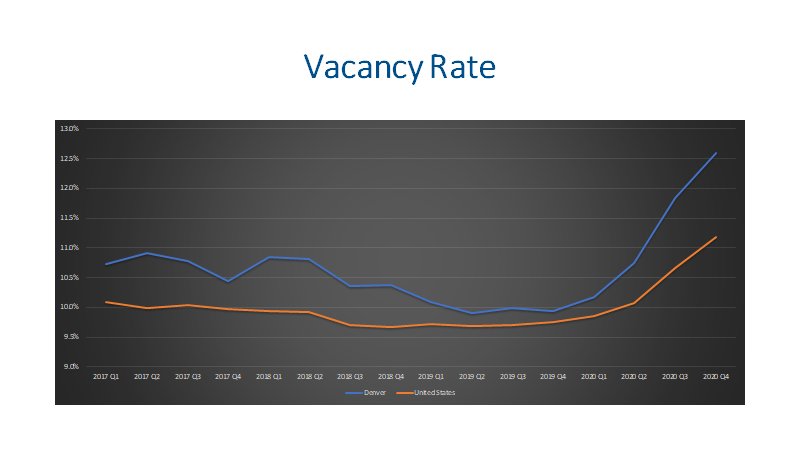

Vacancy Rates

Vacancy rates have been on the rise since the beginning of the year. Many employers are succeeding with remote employees. Vacancy for office buildings is up 27% since Q4 2019 with a current rate of 12.6%. Based on the forecasts we are looking at, the vacancy rate could peak in Q3 2021 at 14.2% or it could be worse that. The 4-5 star buildings are worse with a current vacancy rate of 15.2%. In the severe downside forecast, the vacancy rate climbs to 16.2% in Q1 2022 as a market and the 4-5 star office properties go to 18.7% in Q1 2022.

Another metric worth looking at is the availability rate. This rate includes both the vacant and occupied space offered for lease. This shows Denver is at 17.6% available and 21.8% for 4-5 star properties.

Leasing

The average Gross lease is $28.53 and this is down about (1.3%) since the beginning of the year. On average it is taking 11.5 months to find a new office tenant. With negative net absorption expected for 2021, we expect to see downward pressure on rents. The base case forecast shows a loss of another (1M SF) in 2021, but the severe downside scenario forecasts a loss of another (4.48M SF). Ouch!!! Time will tell…

Final Thoughts

Supply and demand for buying and selling office properties are in a worse position than most of the other commercial real estate product types. Developers are building some new office but not much. If I had to guess, most of it is medical office which is certainly the bright spot. We expect vacancy rates to continue to rise and sales to be dampened.

Here is a link to the slides from the full analysis: