Supply

New listings dipped (6.7%) compared to last year, but they are right in line with 2019. This is very typical and following the seasonal trend.

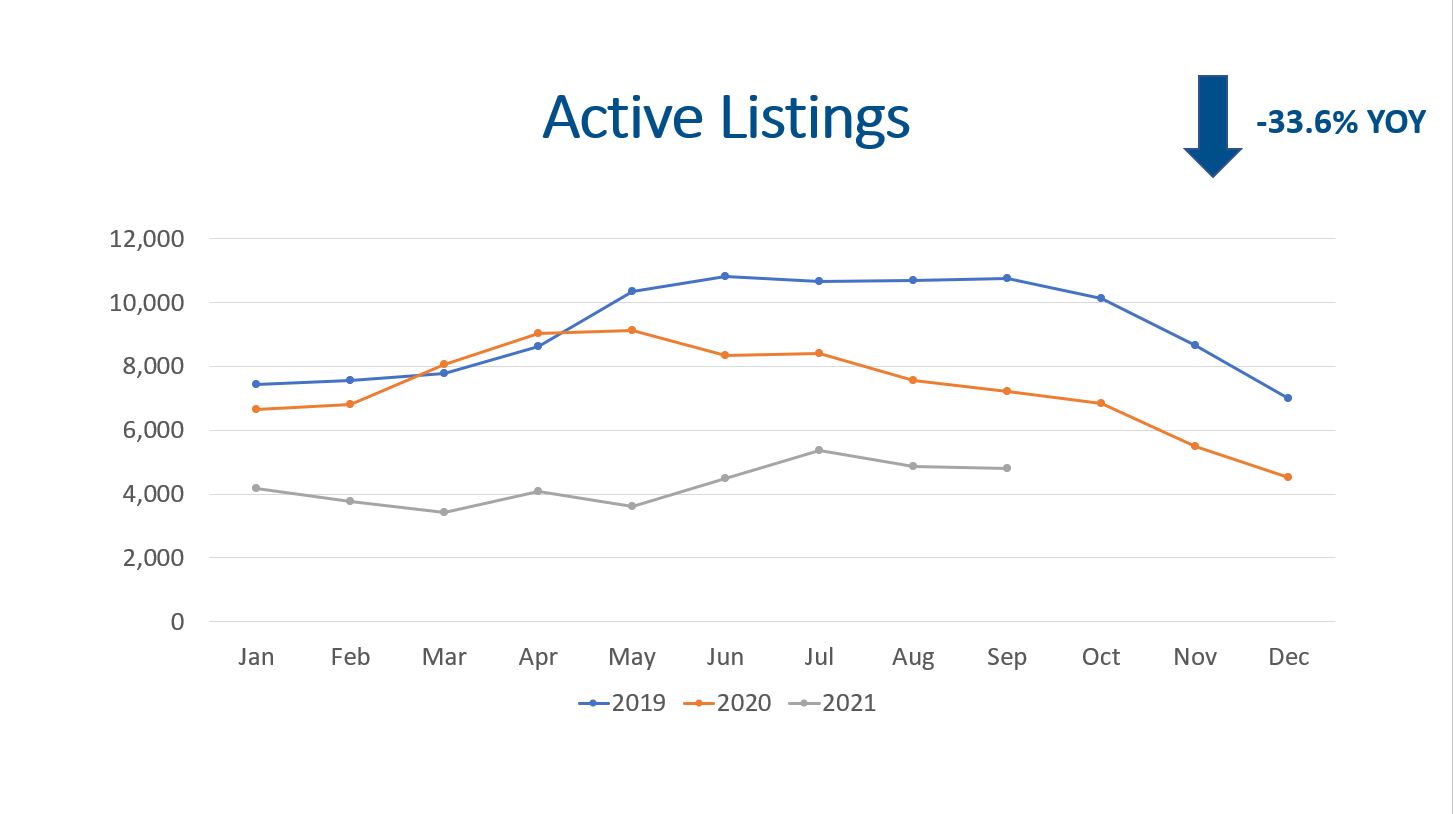

A larger issue than new listings is Active listings. The Active listings metric is a snap shot in time at the end of the month. We ended September with 4,795 homes on the market. This is (33.6%) lower than September 2020 and (55.1%) lower than September 2019!

Fun fact! Eleven years ago we had 33,903 homes on the market, so we have measly 14% of the inventory that we had then. That is astonishing because I remember that market.

Even with all the supply chain issues plaguing new construction, builders have started construction on 8,889 detached single family homes YTD. This represents a 20% increase over the same period in 2020! There is a one-month delay in reporting, so this data is through August.

I am working with two different clients right now that much more concerned with finding the replacement home than they are with selling their current home.

Simply put, we need more homes on the market in order for price appreciation to moderate. With that said, I don’t think 2022 will see the same home value appreciation as 2021.

Demand

Showings per active listing is another great metric. By this metric, 2021 is exceeding records set in 2020. The average listing is seeing 12.22 showings per month compared to 7.86 showings per listing in September 2019. Although this is a lot less than the February 2021 peak of 22.25 showings per listing it is still quite strong.

There were 5,411 properties that went under contract in September 2021. The trendline for properties going under contract in 2021 is following 2019 closely.

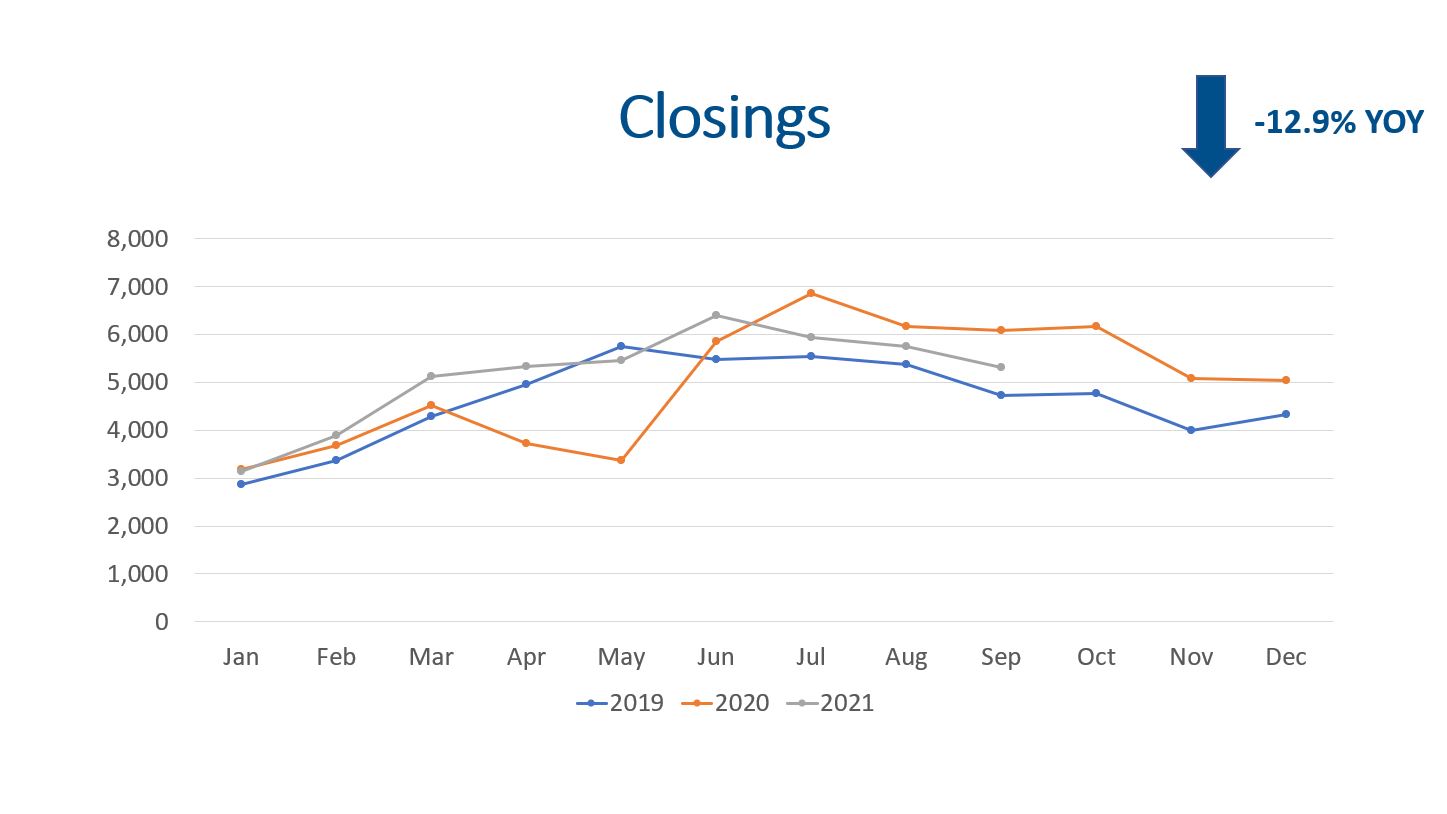

There were 5,304 closings during September. Again, this volume is lower than 2020 but is higher than 2019.

The median days on market is 5 days! This means half of the 5,304 closings sold in 5 days or less and half sold in more than 5 days.

Total transaction volume is up 6.7% YTD compared to the same period in 2020.

All in all, showings, contracts, closings, and the median days on market are suggesting we are still deep in a seller’s market!

Median Sales Price

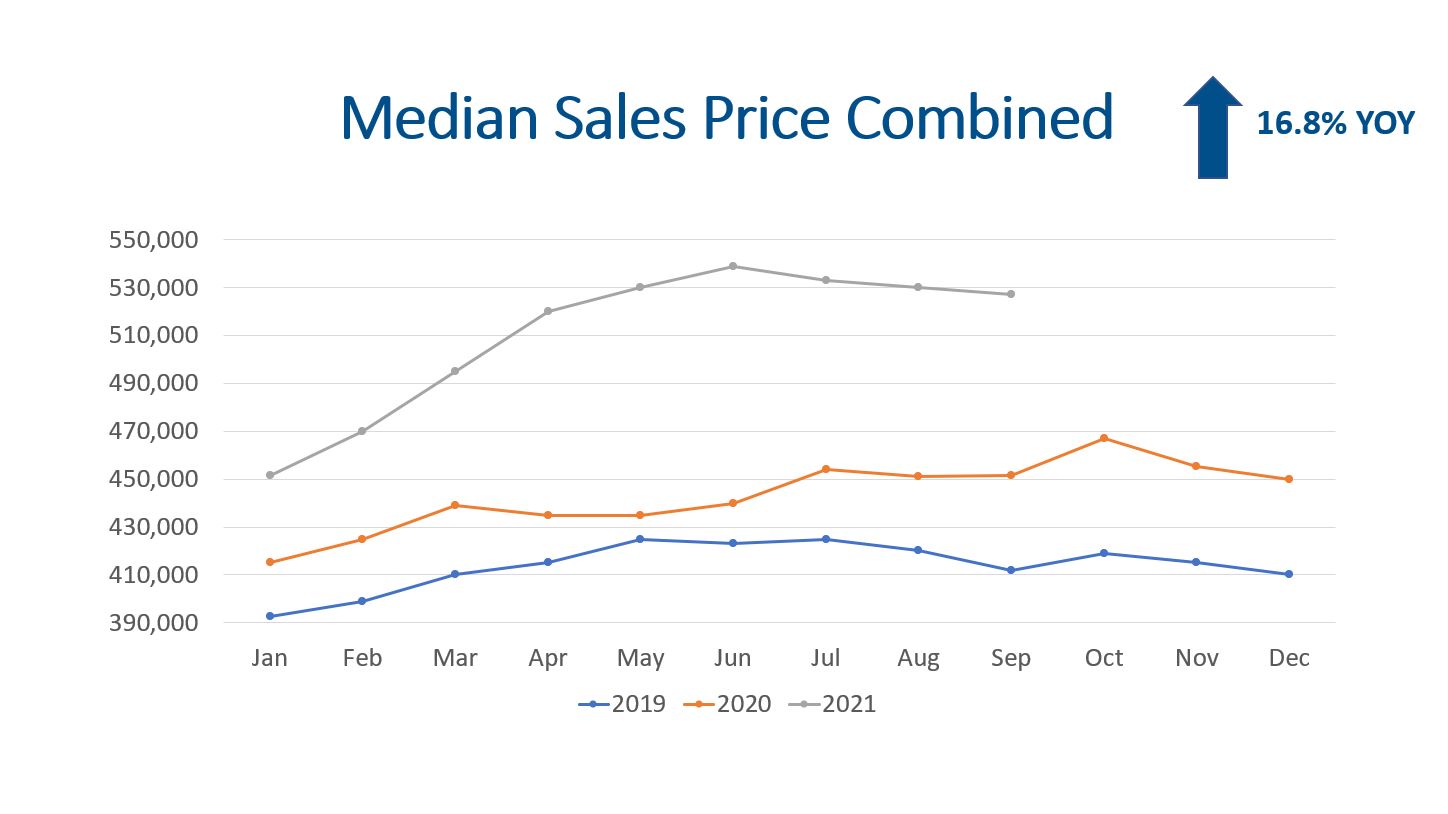

The median sales price for September was $527,000. However, the average sales price for September was $614,155. The average is quite a bit higher than the median because the amount of signature and luxury homes selling.

If we look at detached single family homes, the median sales price is $575,000! This is 14.8% higher than September of 2020 and 27.8% higher than September of 2019. Wow! A great time to have owned real estate, but a very challenging time for buyers looking to get into the market.

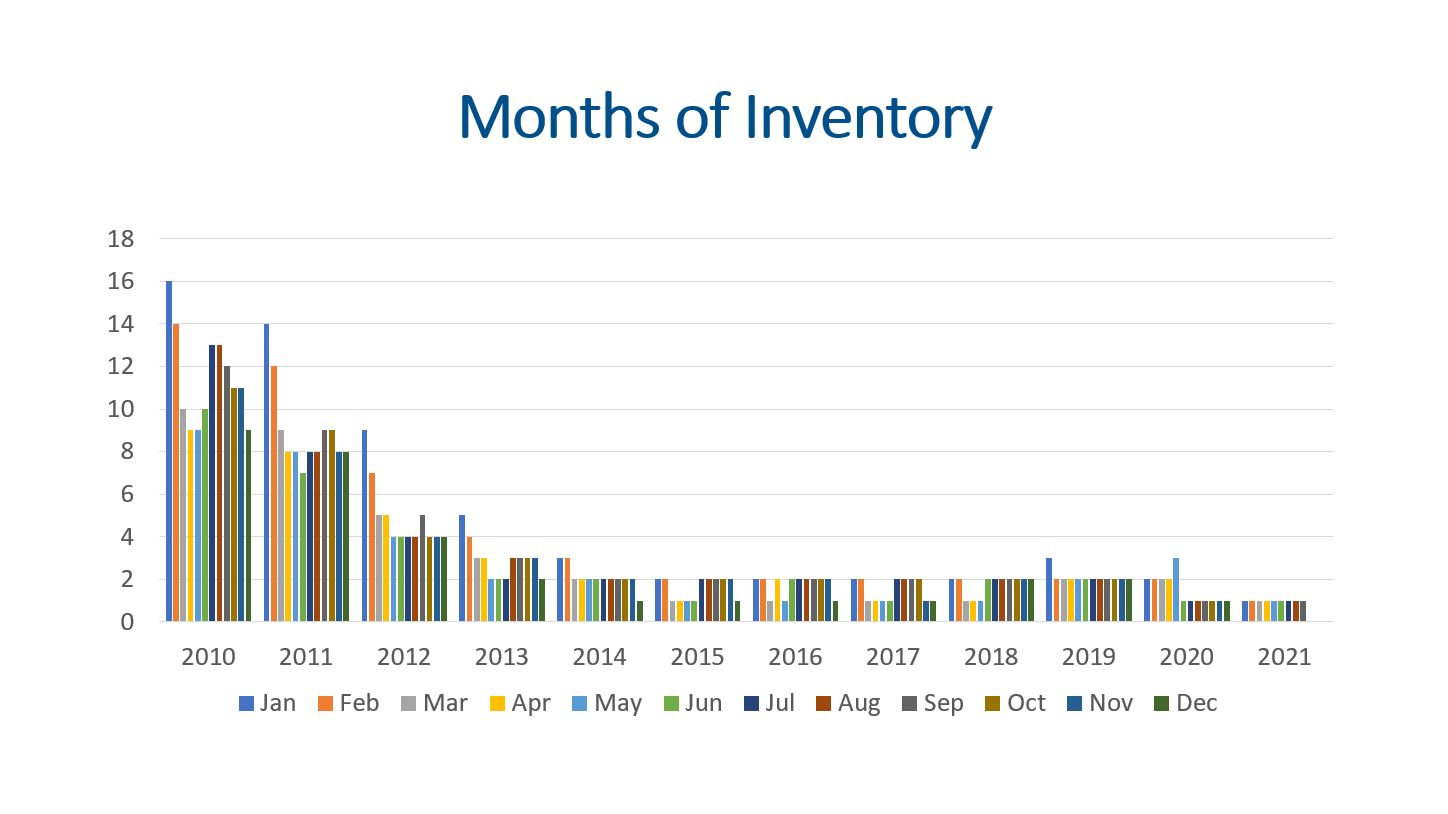

Months of Inventory

With 4,795 listings on the market and 5,304 closings, we have 3.9 weeks of inventory. This is still low inventory but it is a little less competitive than when we had 2 weeks of inventory!

Market Risks

What could change this fast-appreciating market? Here are some possibilities: 1. Incomes, 2. Oversupply, 3. Reduced Demand & lower jobs, or 4. Higher interest rates.

Incomes are on the rise, but they are not rising as fast as the cost of housing.

Oversupply isn’t very likely as builders are not building many spec houses. A spec house is where they build before having a buyer.

Reduced demand could happen as prices continue to rise because the amount of people who can afford them goes down. Six years ago our population was growing by 55-60k people a year. Now we are growing at 24k people a year. If our net population growth turned negative, that would have an impact. We lost 391,285 jobs due to the pandemic, and we have only added 194,524 jobs in the last six months. We have 196,761 jobs to go to be back where we were.

Finally, higher interest rates could really slow things down and possibly reduce values. The federal reserve has been talking about higher than expected inflation. They can slow their bond purchases and/ or increase interest rates. Think about this… The principal and interest payment on a $400,000 loan with a 30-year term at 3% is $1,686.42 (not too bad). If the interest rates jumped 5% overnight, that same loan would cost $2,147.29 ($460.87 more)! This is why the fed will probably raise rates gradually.

Final Thoughts

In summary, supply, demand, median sales price, months of inventory, and market risks are all great to be looking at. Supply has been quite low for several years now. Demand is moderately higher than previous years but growing. This is why the median sales price has continued to climb. As long as the months of inventory is below 3 months, we expect prices to increase. With that said, we believe home appreciation will moderate some over the next 12 months and be in the single digits instead of double digits. Future appreciation will be a result of how the market risks are handled going forward.

Here is a link to the full presentation: