The Denver Commercial Real Estate market is a very interesting study! The economic environment has been changing over the past few years. We still have high inflation, and we have job growth. We also have much higher interest rates. The Federal Reserve is likely to increase the rates by another 75 basis points in November and December 2022. The four major property types we are tracking are: retail, multi-family, office, and industrial. Each property type is performing differently. Let’s dive into the local economy, supply, demand, new construction, and vacancy rates for Denver Commercial Real Estate.

Local Economy

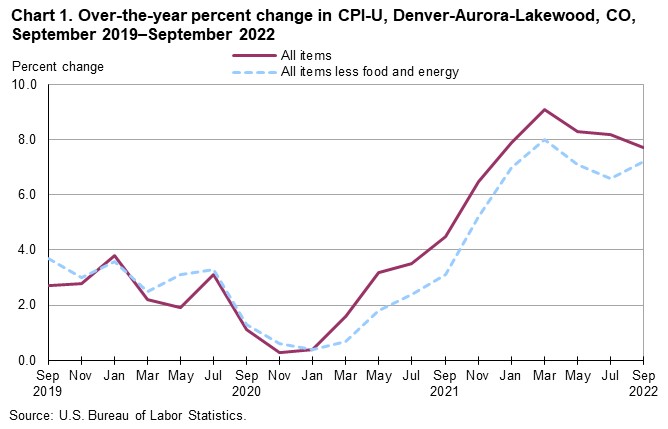

As reported by the Bureau of Labor Statistics, the Denver Metropolitan Statistical Area (MSA) had inflation of 7.7% year over year for all items in September. This is a little better than the 8.2% inflation rate for the US.

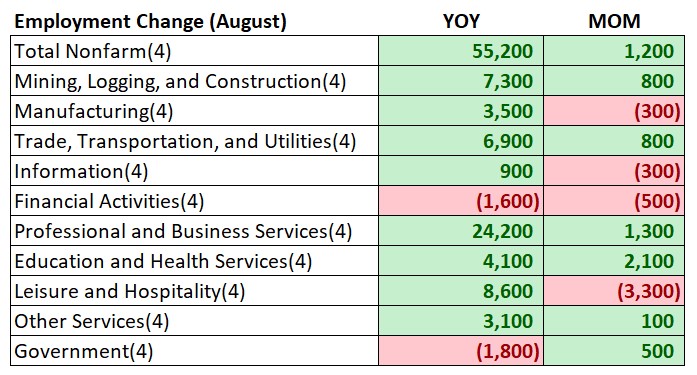

When comparing Denver to the National jobs, Denver is behind the US in: manufacturing, trade, transportation, utilities, education & health services, and government jobs. However, Denver has more jobs in: mining, logging, construction, information, financial activities, professional & business services, and other services.

The total employment base is 1,586,300 as of August 2022. This is up 55,200 jobs from a year ago and up 1,200 from July 2022. It is interesting to see which areas of the economy are expanding and contracting.

Let’s look at the supply of Commercial Real Estate.

Supply

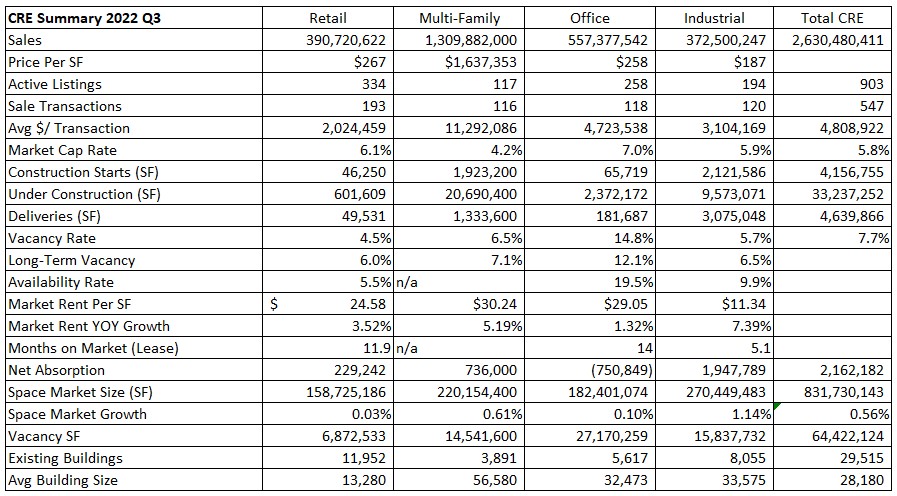

There are 903 active listings across the four major property types. The 334 retail listings range from a 387 sf storefront on Downing for $249,228 to a 7.39 acre Auto Dealership on Federal for $19,900,000. The 117 multi-family properties range from a 7-unit mobile home park in Bennett for $450,000 to a 68-unit apartment building for $17,000,000 in Aurora. The 258 office properties range from a 891 sf condo for $215,000 in Littleton to a 267,117 sf building on 12 acres in Thornton for $30,000,000. Lastly, the 194 industrial properties range from a 1,098 sf condo for $315,000 to a $43,000,000 industrial portfolio in Denver.

Below is a table of the key performance indicators we are monitoring.

Demand for commercial space is created by investors and businesses using the space.

Demand

There were 547 closed sales in Q3 2022 with a total dollar volume of $2.63B. The average transaction was $4.8M. Among the four property types: retail accounted for 193 sales, multi-family accounted for 116 sales, office accounted for 118 sales, and industrial accounted for 120 sales. The monthly absorption rate was 182.3 sales; therefore, we have 4.95 months of commercial inventory.

Another gauge for demand is net absorption. Absorption is a gauge of the space tenants need to operate their businesses. Retail gained 229,242 sf of occupancy. Multi-family gained 736,000 sf of occupancy. Office lost (750,849) sf of occupancy, and industrial gained 1,947,789 sf! Clearly, demand for multi-family and industrial is much higher than retail and office. Office recovered some as the pandemic ended but has since trended down again as companies reassess their real estate needs.

Investors look at capitalization rates (cap rates) when they are investing. A cap rate is what an investor is willing to pay for the net operating income (NOI) of a building. For example, if an investor wants $5 of NOI, and they are willing to pay $100 the capitalization rate would be 5% (NOI / value = cap rate). The Denver area currently has average cap rates ranging from 4.2% to 7.0% depending on the property type. This measure is a really broad stroke of investment performance. With commercial mortgage rates in the 6% to 7% range some of these assets would be producing negative leverage (where the cost to borrow money is higher than the return). Sellers of commercial real estate will not be able to sell now for as much as they would have been able to earlier this year.

We agree with Todd Kuhlman, higher interest rates will translate to higher cap rates and this means the value of commercial real estate is likely to go down.

Let's take a look at new construction in the various property types.

New Construction

Developers started construction on 4.1M sf during Q3. This is quite a bit lower than the 7.56M sf in Q1 2022. Retail construction starts accounted for 46,250 sf. Multi-family construction starts were 1.9M sf. Office construction starts were 65,719 sf, and industrial construction starts accounted for 2.1M sf.

Another factor to consider is the total sf of space under construction. Retail has 601,609 sf under construction. Multi-family has 20,690,400 sf (25,863 units) under construction. Office has 2.3M sf under construction, and industrial has 9.57M sf under construction. All together 33.24M sf of Commercial Real Estate under construction in Denver.

Developers delivered just over 4.6M sf during Q3. Retail delivered 49,531 sf. Multi-family developers completed nearly 1.3M sf. Office developers delivered 181,687 sf. Industrial developers delivered 3.075M sf.

Next, vacancy rates tell us how much space is not occupied.

Vacancy Rates

Vacancy rates for Denver Commercial Real Estate tell an interesting story as well. A vacancy rate is a metric comparing the amount of unoccupied sf compared to the total sf of all the buildings in a market. There is 64,422,124 vacant sf for Denver commercial real estate. Though this sounds like a lot, it is worth mentioning that Denver has 831,730,143 sf of total commercial space. Therefore, the vacancy rate is 7.7% (64,422,124/ 831,730,143 sf = 7.7%).

If we are to understand commercial, we need to compare the current vacancy rates to the long-term vacancy rates. Retail properties have a vacancy rate of 4.5% compared to a long-term rate of 6.0%. Multi-family has a current rate of 6.5% compared to a long-term rate of 7.1%. Office properties have a vacancy rate of 14.8% compared to a long-term vacancy of 12.1%. Lastly, industrial has a current rate of 5.7% compared to a long-term rate of 6.5%.

Three of the property types are performing better than the long-term average. The only property type with a vacancy rate exceeding the long-term vacancy rate is office.

Final Thoughts

In Summary, the economy, supply, demand, new construction, and vacancy rates are all good key performance indicators for the commercial real estate market in Denver. The supply of commercial properties for sale fluctuates depending on the property type. Generally, we have plenty of each property type. Total demand for properties appears to be strong with only 4.95 months of inventory. Developers are hard at work building all over the city. Vacancy rates are fairly similar across the property types with the exception of office. Office is consistently higher than the other property types when we look at the long-term vacancy rates.

Here is a link to the full presentation for each property type: