Multi-family had a HUGE quarter! There was $2.45B in sales in Q2. Multi-family commercial real estate is the favored product type of this cycle. Residential is the easiest to lease and the easiest for most people to understand. Let’s dive into supply, demand, new construction, and leasing.

Supply

There are currently 115 multi-family listings for sale in the Denver Metro Area. These active listings range from $395k to $8.7M. The unit counts on these properties range from 3 units to 42 units. The only properties on the market with more units are portfolio sales where multiple buildings are being sold.

Demand

Demand for buying multi-family properties is still very strong. When reviewing Q2, we found 162 closed sales compared to 93 closed sales in Q1. The Q2 absorption rate, was 54 sales per month and the months of inventory are 2.1 months.

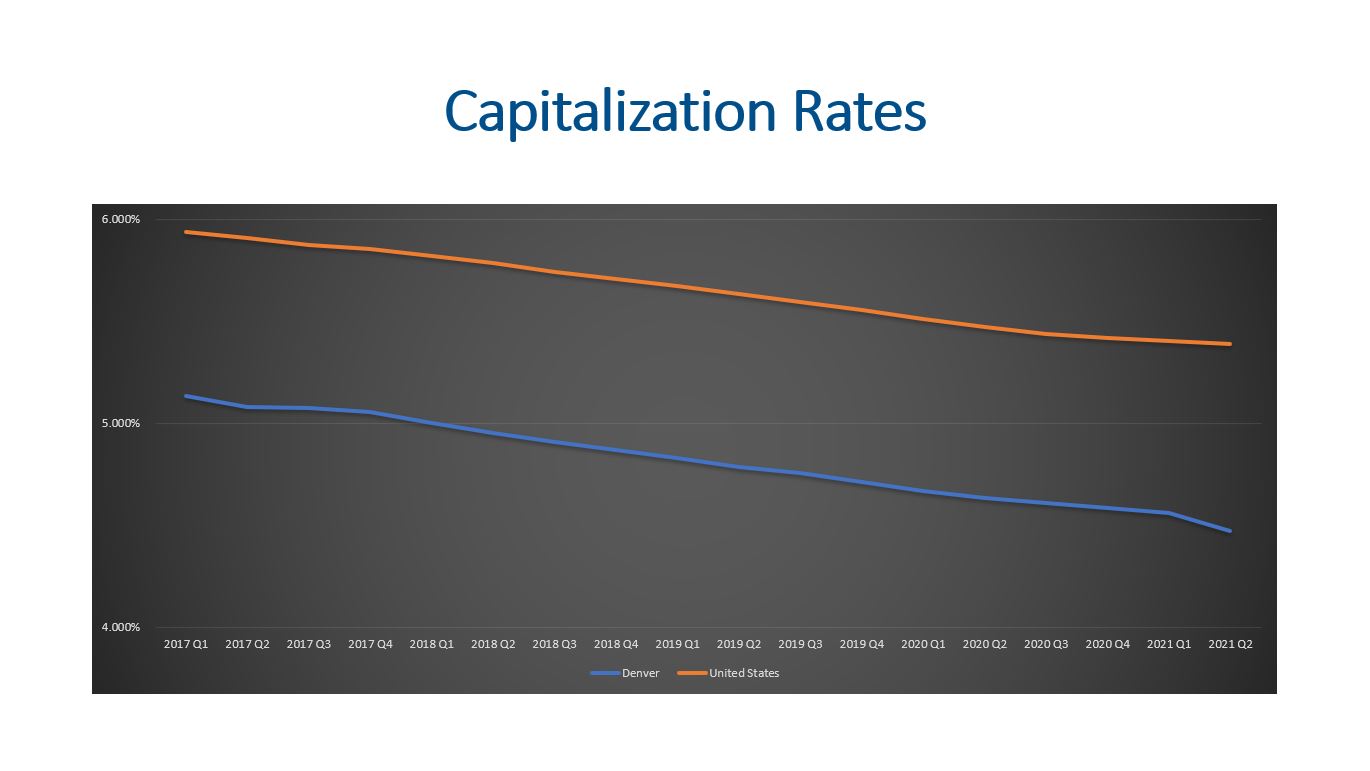

The price per unit saw a 11.6% increase YOY. Capitalization rates compressed from 4.634% to 4.476%. The market is seeing this commercial real estate product type as being less risky compared to a year ago.

The YTD sales, in dollar volume, is nearly double compared to Q1 and Q2 of 2020.

New Construction

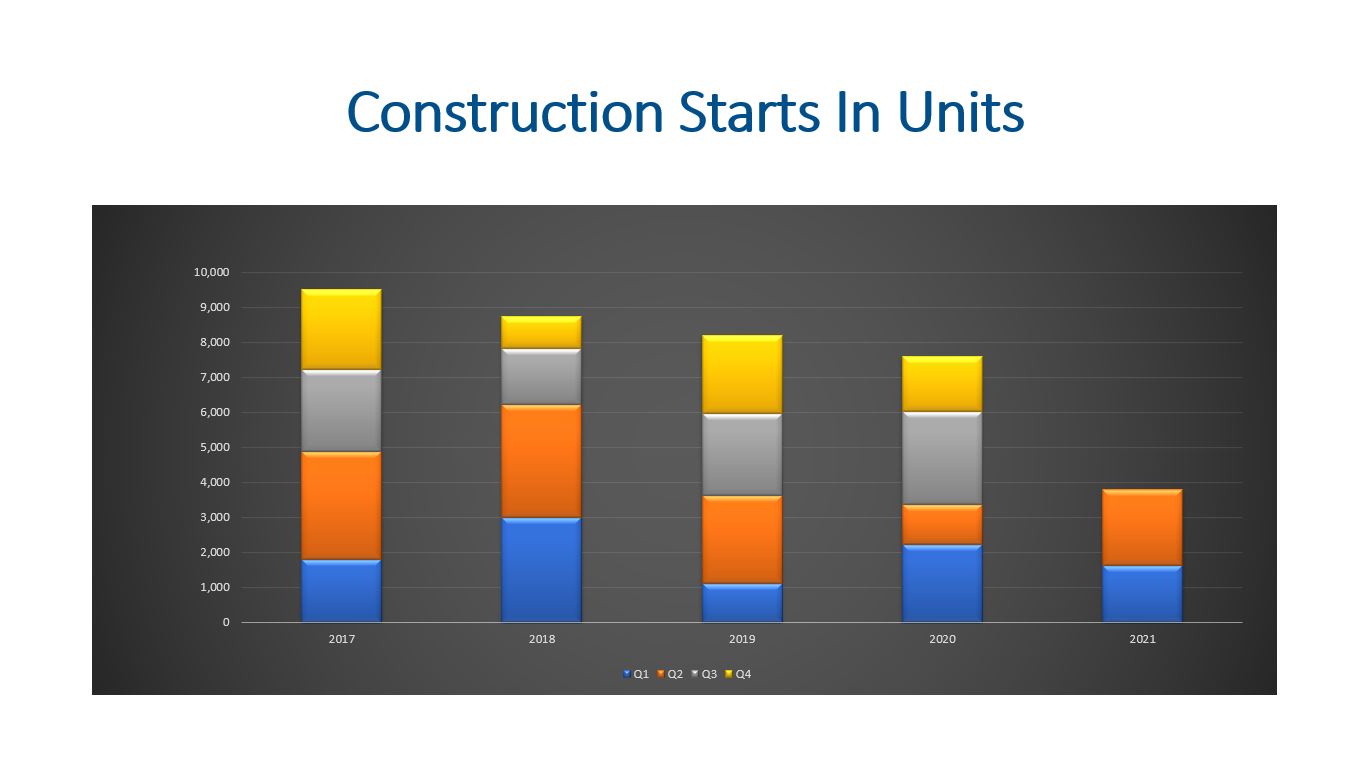

Developers started construction on 2,157 new units in Q2 2021. This is 518 more units than Q1. There are currently 15,438 units under construction. This represents 12% increase YOY.

Developers delivered only 1,515 units to the market during Q2.

Vacancy Rates

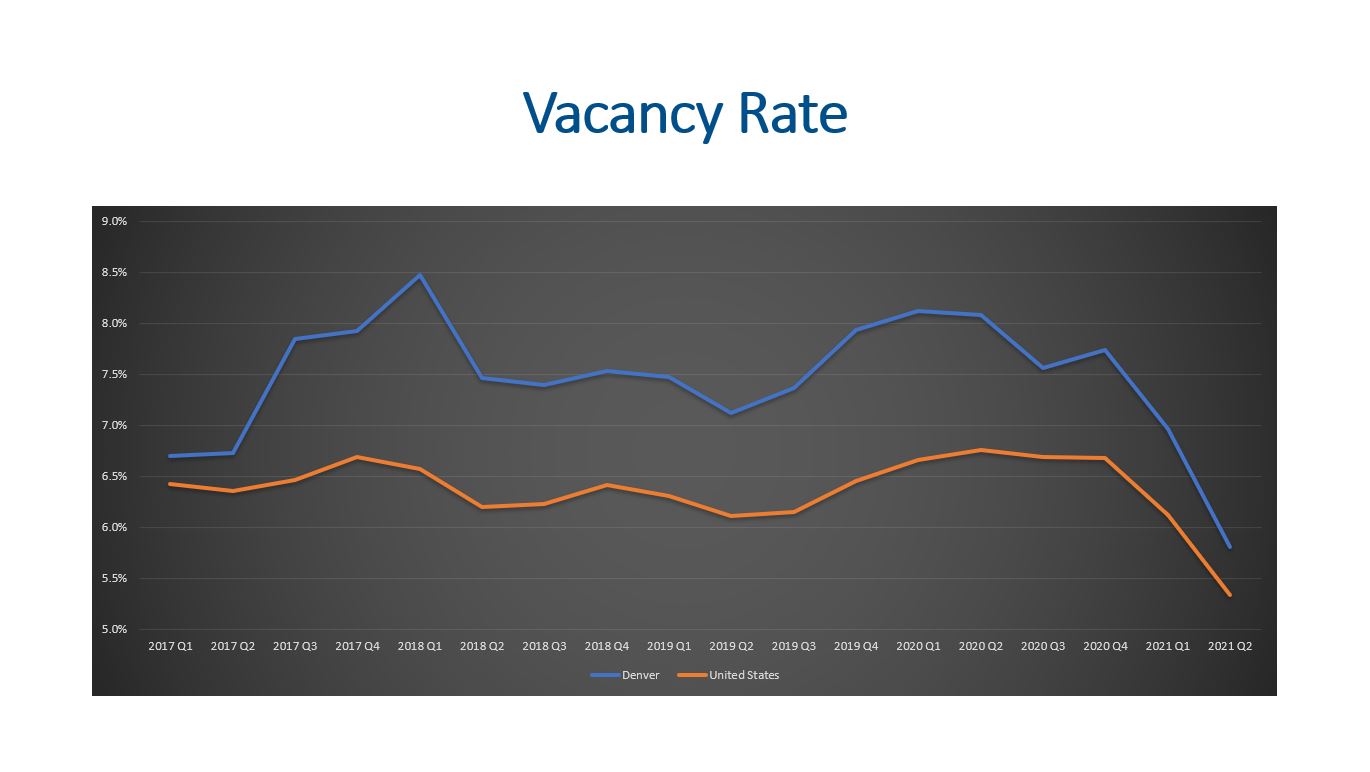

Vacancy rates in Denver have been trending higher than the national average since Q2 of 2016. However, both Denver and the national average have gone down significantly since Q4 2020. Denver ended Q2 2021 at 5.8% compared to the national average of 5.3%.

The newer 4-5 star properties have a vacancy rate of 6.8% which is amazing because 4-5 star properties had a 10.97% vacancy rate back in Q1 2020. The 3 star properties have a 4.9% vacancy rate, which is down from approximately 6% in Q1 2020.

Leasing

The average gross lease apartment rent varies by bedrooms. Studio units are renting for $1,302 per month, and one-bedroom units are leasing for $1,488 per month. Two-bedroom units are renting for $1,861 per month, and 3-bedroom units are now leasing for $2,331. Each of these unit types are higher than Q4 2020.

Studio apartments have had the smallest rent growth and two bedroom units have had the largest rent growth.

Tenants leased 4,402 units during Q2. This absorption was 140% higher than the same time last year, but last year we were dealing with the lockdowns.

Final Thoughts

All in all, supply, demand, new construction, vacancy rates, and leasing all contribute to the outlook for multi-family commercial real estate. We have a limited supply of properties for sale and very strong demand leaving us with 2.1 months of inventory. New construction starts are increasing and the total units under construction are 12% higher than last year. Vacancy rates contracted and rents are increasing. As long as we continue seeing a net growth in our population, this product type will perform well.

Here is a link to the full presentation: