We are still seeing headlines of retailers in trouble. Everything from store closure announcements to bankruptcies. While online retail is setting all time records. Let’s be clear… America is IN LOVE with stuff!!!! Therefore, I don’t see the end of retail coming, but I do see a continued shift in how we consume. How did retail commercial real estate fair in 2020? Let’s check it out.

Supply

There are currently 370 retail listings for sale in the Denver Metro Area. When comparing this supply to demand we have 6.0 months of inventory for supply. This is a lot better than office with 9.5 months of inventory.

Demand

Demand for buying retail commercial properties was decent with 183 sales for Q4. This breaks down to an average absorption rate of 61 sales per month.

New Construction

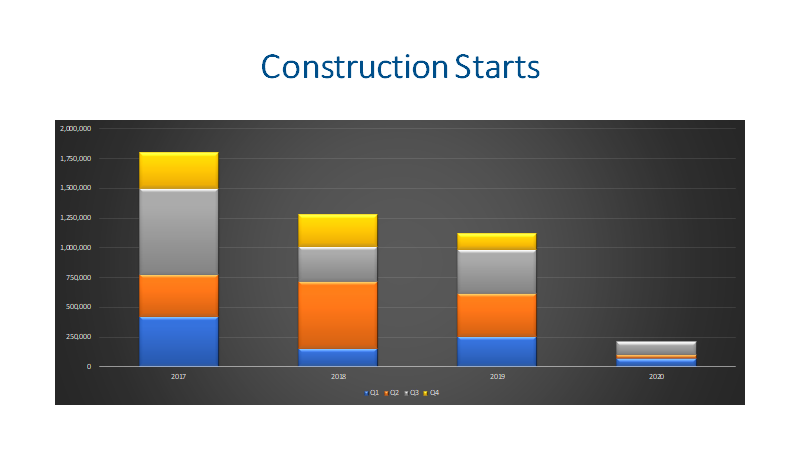

I am guessing there will be a revised number of SF of construction starts because CoStar currently reports ZERO SF was started in Q4. On average developers started construction on 1.4M SF per year during 2017, 2018, and 2019, but they only started construction on 209,673 SF during 2020. This represents a YOY decline of (81.3%). Wow!

The Denver Metro area has 11,738 buildings with a total square footage of around 158.5M SF. Developers currently have 526,229 SF under construction, so the retail market is set to expand by 0.33% (one third of one percent).

Vacancy Rates

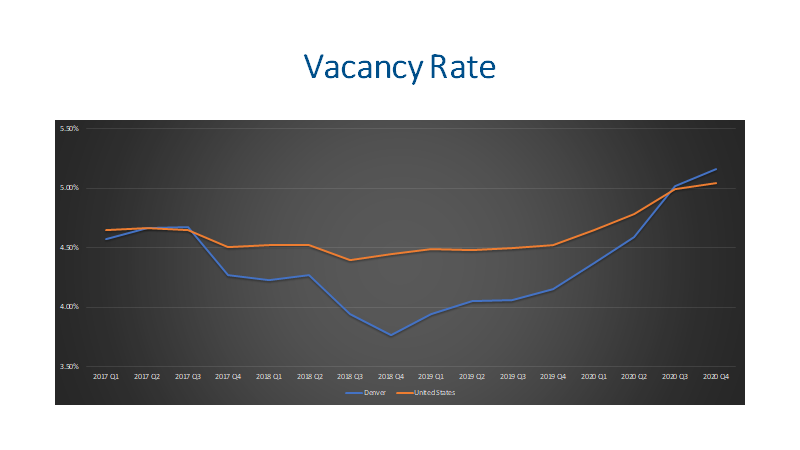

Vacancy rates have been increasing since Q4 of 2018 but are still fairly low at 5.16% on average for all the different types of retail. Power Centers are the large spaces at the back of the development and have had the highest vacancy (over 7%) since 2018. Surprisingly neighborhood centers just creeped up to 7.7%. For all of the bad press on malls, they are sitting at 3.58% vacancy. I do expect to see the vacancy rate rise.

As I drive around, I see a bunch of space that hasn’t been filled all year, and I see new vacancies created by businesses closing down. Southlands, near my house, has lost Old Chicago, Jos. A. Banks, Bar Louie during 2020, and 9 Rounds Kickboxing.

Leasing

The average gross lease for retail is at $22.90 per SF per year. This is down from $23.13 per SF in Q2 but up from the $22.83 in Q4 2019. I expect to see some downward pressure on rents.

The average gross lease for retail is at $22.90 per SF per year. This is down from $23.13 per SF in Q2 but up from the $22.83 in Q4 2019. I expect to see some downward pressure on rents.

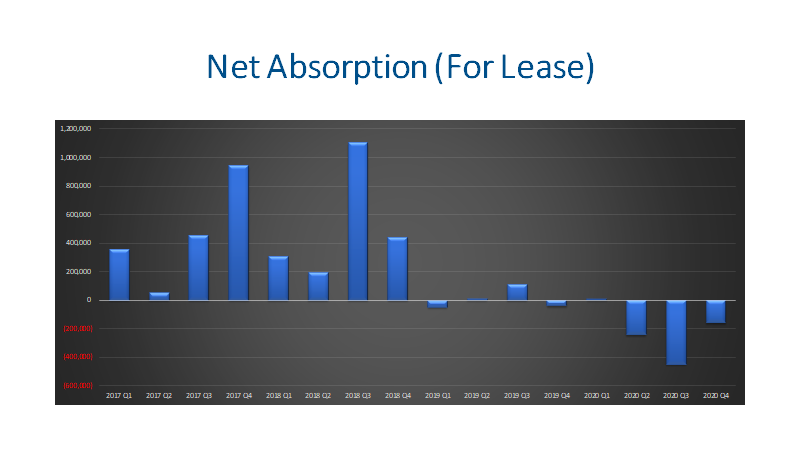

The negative net absorption isn’t much of a surprise. Altogether, retail has lost 836,405 SF of occupancy this year. This is only about 23% of what office has lost. With a full 1% increase in vacancy over the last year, I would expect that we would have lost closer to 1.6M SF of occupancy this year.

Final Thoughts

Supply and demand for retail properties is fairly balanced with 6.0 months of inventory. Developers have really slowed down on new construction starts and there is a modest amount of new development. Even though vacancy rates have increased they are still fairly low.

Here is a link to the slides for the full analysis: