The retail product type for Denver Commercial Real Estate has performed better than expected. I wonder if there is some disconnect in the data from what I see as I drive around. I see space that is still vacant from 1.5 years ago, and I see new vacancies but the data is showing the opposite. Let’s dive into supply, demand, new construction, and leasing.

Supply

There are currently 350 retail properties for sale in the Denver Metro area. These properties range from $249k with 5,130 sf to $17.1M for a 55,833 sf neighborhood retails center. Also, there are 2,522 spaces for lease in the Denver market.

Demand

Demand for buying retail commercial properties was stronger with 229 sales during Q2. This breaks down to an average absorption rate of 76.3 sales per month which is up from 52.6 sales per month in Q1.

Surprisingly market cap rates have hovered around 6.5% for the last four quarters.

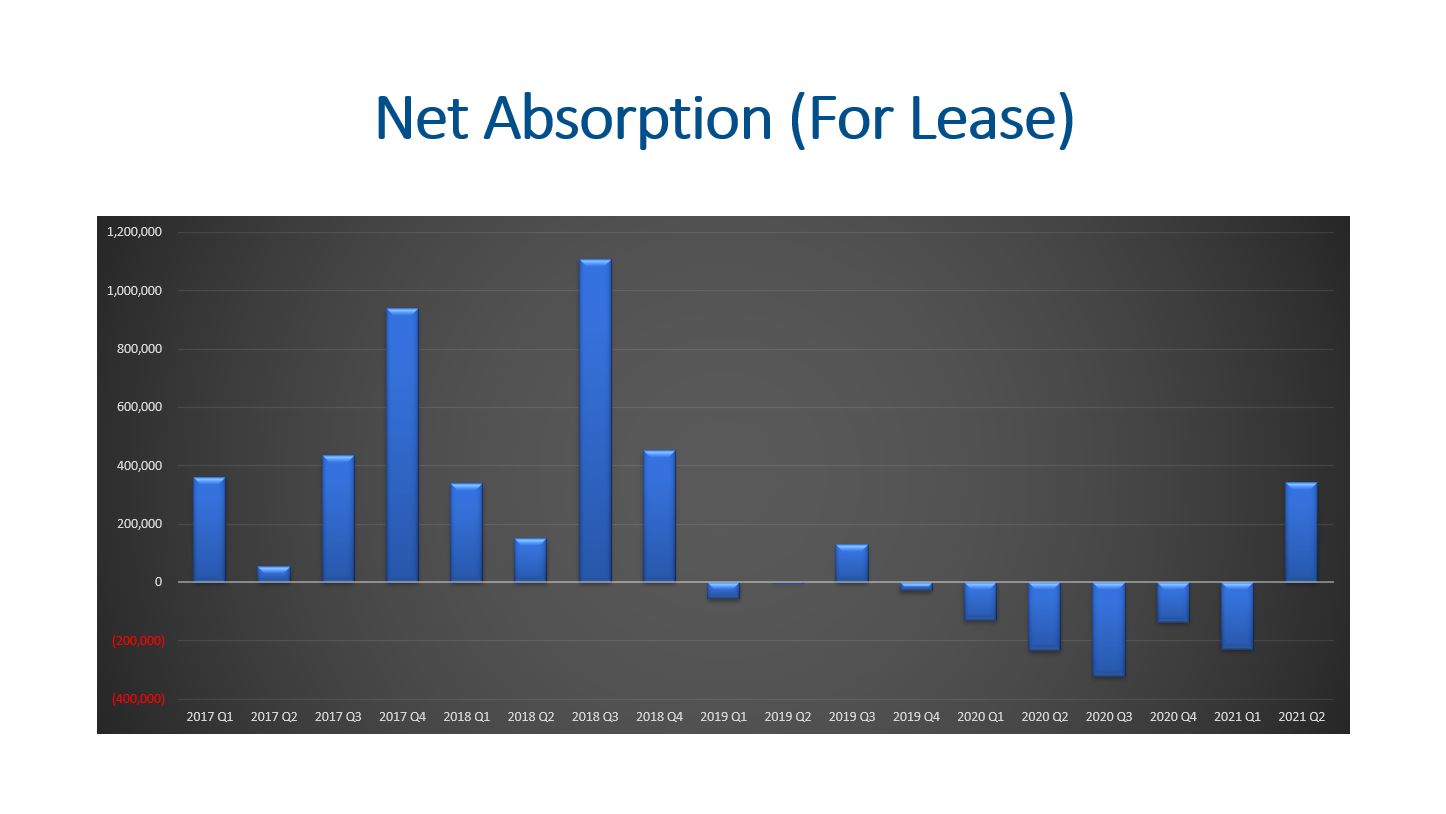

The net absorption turned positive with 341k sf! This is welcome news after six quarters of negative absorption. The market retail market lost has lost almost 1.1M sf of occupancy from Q4 2019 to Q1 2021.

New Construction

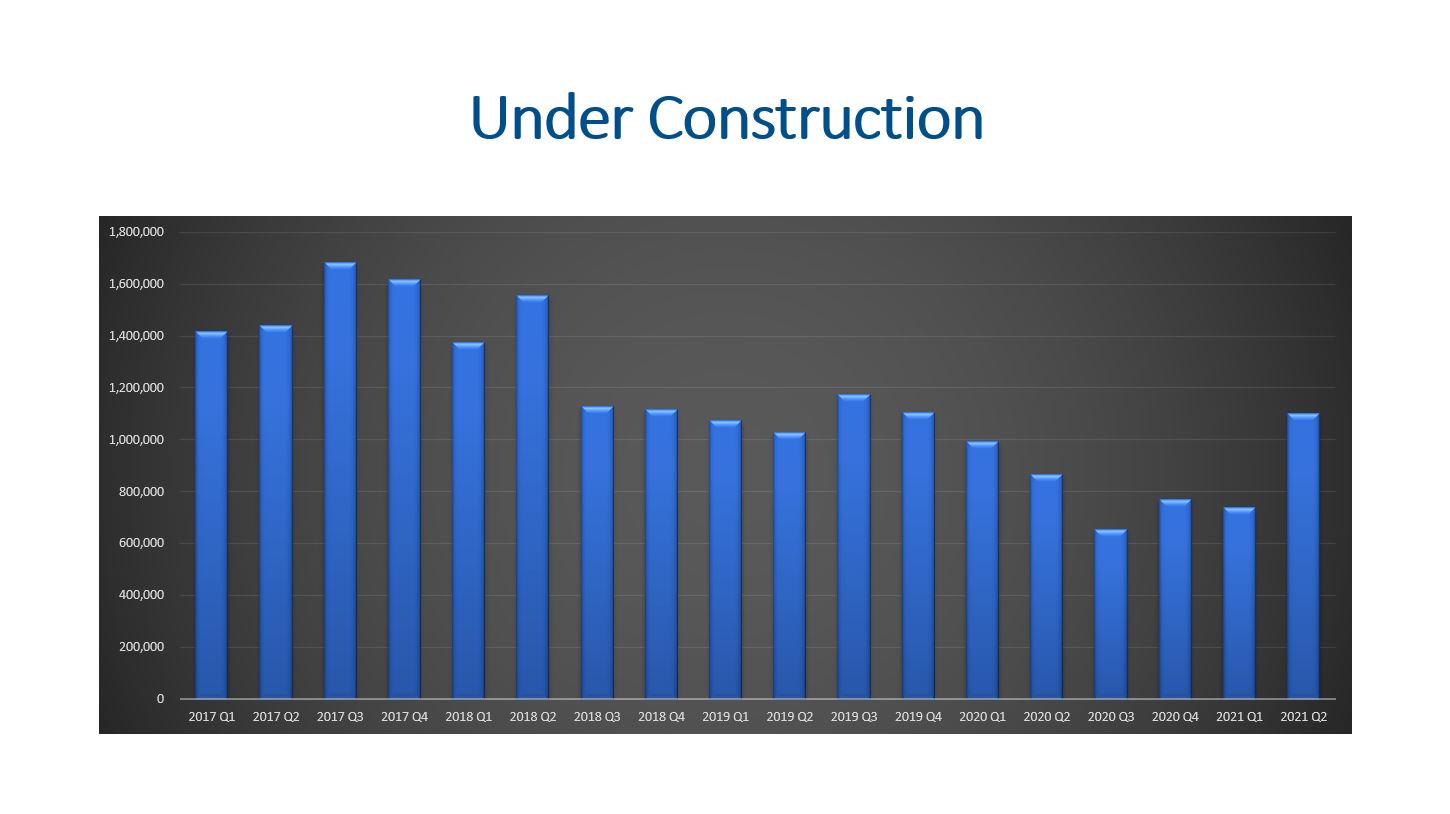

Developers started 536,505 sf of retail space in Q2 2021, which is the highest amount in the last three years. In Q1 2021, only 48k sf of retail was started. This is a little more than office but less than 25% of what was started in industrial.

The Denver Metro area has 11,786 buildings with a total space market of 160M sf. Developers currently have 1.1M sf under construction, so the retail market is set to expand by 0.68% (about two thirds of one percent).

About 173k sf was delivered to the market in Q2.

Leasing

Vacancy rates have been increasing over the last few years, but I believe they dipped some in Q2. In Q2 2021 the vacancy rate for retail was 5.11%. The availability rate is 6.49%.

The average gross lease for retail is at $23.43 per SF per year. This is up just a little from the $23.37 in Q2 2020.

The months on market has been climbing since Q1 2019 when we had a low of 9 months. Now the Denver Metro market is taking 13.2 months on average to lease retail space.

Final Thoughts

All in all, supply, demand, new construction, and leasing all offer unique insights into the health of the retail market. There seem to be a good supply of properties for sale and lease. The demand appears to be keeping up with the supply even though there do seem to be more vacancies compared to before the pandemic. New construction saw the highest level of starts but it is still a small amount of construction compared to the size of the market. Leasing rates are fairly strong with minimal changes to the rates and vacancies. It will be interesting to continue monitoring what happens in the retail product type of commercial real estate.

The full presentation can be found at: