We are seeing an increase in showing traffic off our historic lows, but the residential real estate market is still adjusting to higher interest rates. New listings were down (13.6%) compared to January 2022 and 30-year mortgage interest rates are close to 6%. This is welcome news since rates climbed over 7% back in November. Let’s dive into the key market data for the Denver residential real estate market to see what is happening with supply, demand, sales prices, and months of Inventory for January 2023.

Supply

In January we had 3,219 new listings hit the market. This is down (13.6%) from January 2022 but is up 52.3% from December 2022. This indicates more sellers are willing to list as they recognize they cannot hold off selling forever.

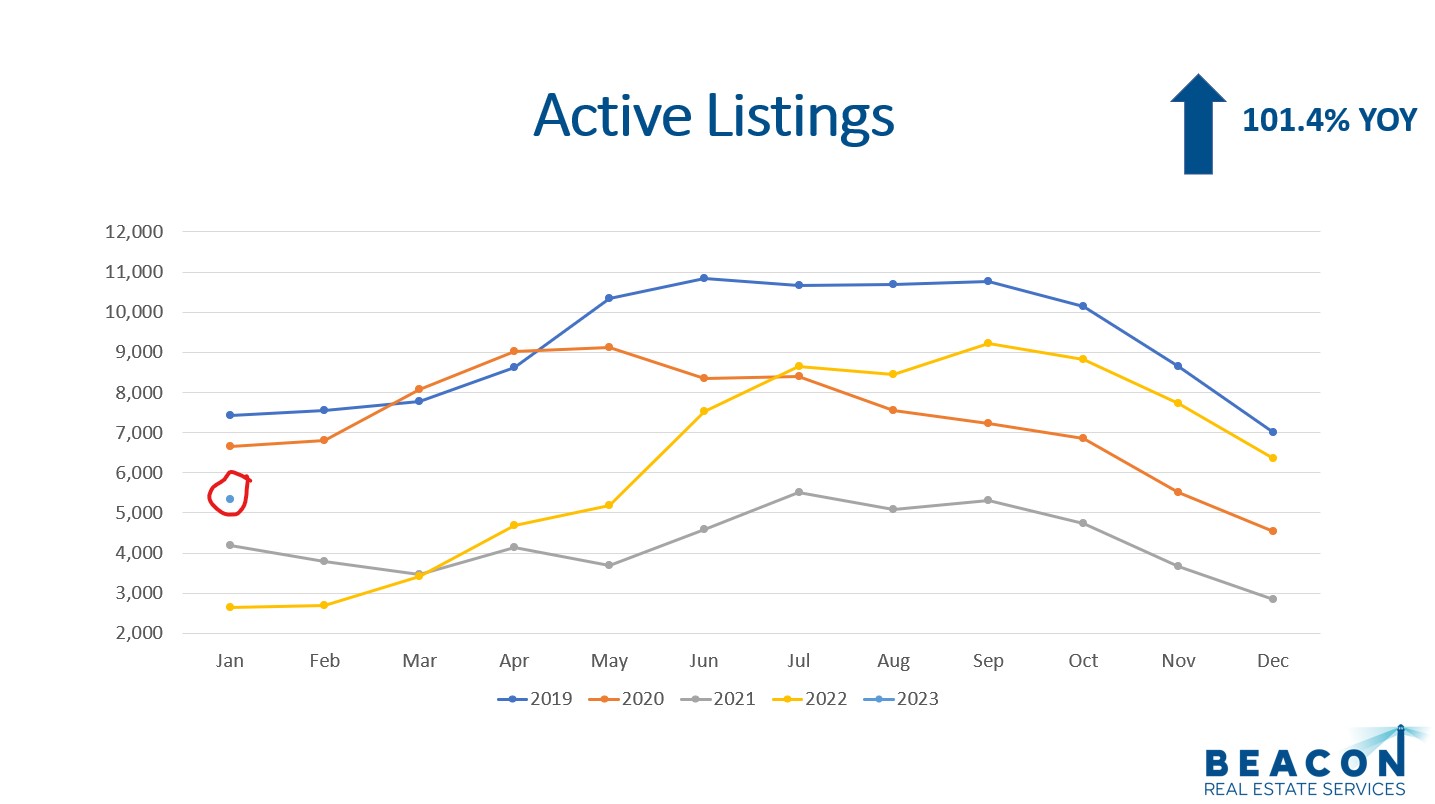

The total amount of active listings at the end of the month came in at 5,342. This is up 101.4% from January 2022 but is down (16.1%) from December 2022. The 10-year January average from 2013 to 2022 is 6,403 listings, so we are below our long-term average.

The total amount of active listings at the end of the month came in at 5,342. This is up 101.4% from January 2022 but is down (16.1%) from December 2022. The 10-year January average from 2013 to 2022 is 6,403 listings, so we are below our long-term average.

The most recent report for detached home construction starts is December 2022 with only 475 new permits for the Dener Metropolitan Statistical Area (MSA). This is about half of the new homes compared to December 2020 and December 2021. The cost of construction needs to come down and so do interest rates for buyers to return to new construction.

All in all, the supply is up from the same time last year but is still quite low. Let’s look at demand.

Demand

Showings are a great leading indicator for where the market is headed, so we are excited to see an increase. January 2023 saw 46,796 showings scheduled in the Denver metro area. This is about half of what we have seen compared to the average for January 2019, 2020, 2021, and 2022 but is up nearly 50% from the 30,429 in December 2022.

Denver had 3,141 properties go under contract in January 2023. This is a 45.8% increase compared to December 2022 but is a (12%) decrease compared to January 2022. It is early in the year to call this a spring thaw, but we did have a nice run of warmer weather to melt some snow that had been on the ground since before Christmas.

Denver had 3,141 properties go under contract in January 2023. This is a 45.8% increase compared to December 2022 but is a (12%) decrease compared to January 2022. It is early in the year to call this a spring thaw, but we did have a nice run of warmer weather to melt some snow that had been on the ground since before Christmas.

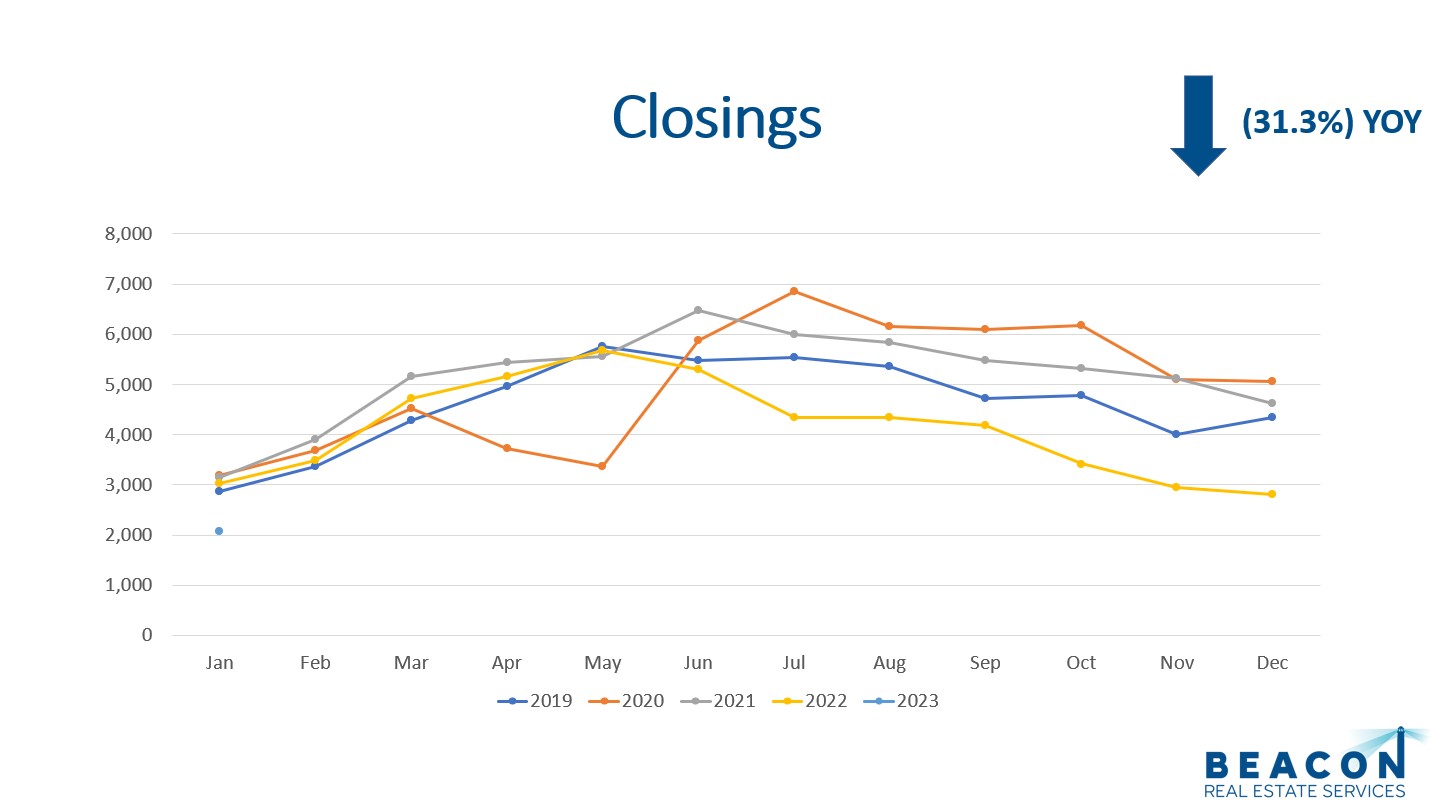

There were 2,080 closings in January 2023 compared to 2,817 in December 2022. This is a (26.2%) decrease month over month. A year ago, we had 3,028 closings in January so this represents a (31.3%) decrease.

The median days on market for January 2023 was 34 days. This means half of the properties listed are sold in a month or less and half took longer. The average marketing time is now 47 days as more properties take longer to sell.

All in all, demand for housing is still out there but the market conditions are different from a year ago. We believe higher interest rates is keeping some buyers on the sidelines which is creating pent up demand. Although the Federal Reserve is likely to raise rates one to two more times before the middle of the year, the 30-year mortgage rate is likely to be 1.5% to 1.7% higher than the fed funds rate compared to the higher spread we saw back in November. Let’s look at sales prices.

Sales Prices

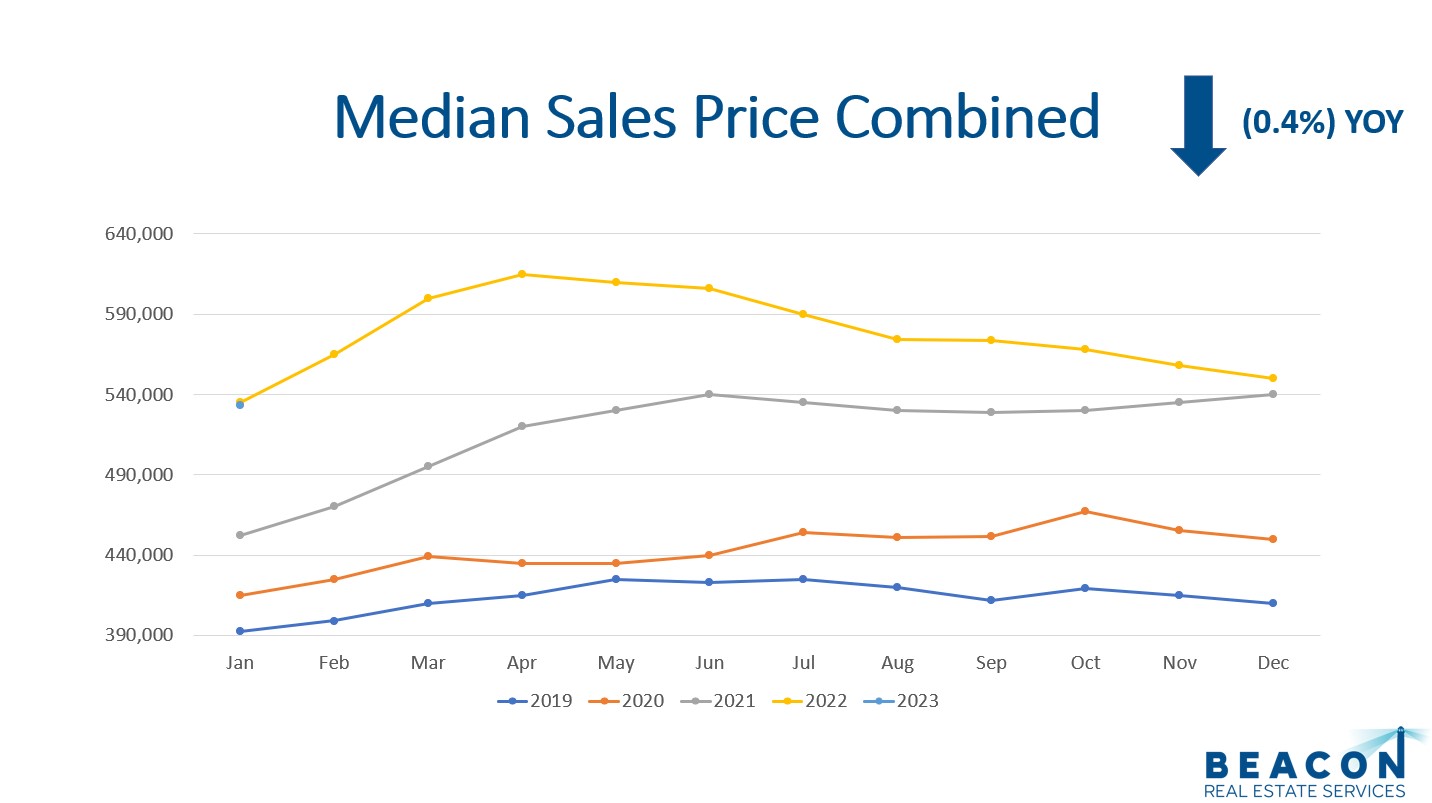

The median sales price for January was $533,000. This metric includes detached homes, condos, and town homes. This price is down (0.4%) compared to January 2022 but is down (3.1%) from December 2022. The medial sales price is down (13.3%) compared to April 2022.

The median detached home sold for $590,000. This is down (1.7%) compared to December 2022.

The median detached home sold for $590,000. This is down (1.7%) compared to December 2022.

The long-term average appreciation for residential real estate is 6%. On the heels of major increases in 2021 and 2022, we expect some downward pressure on prices during 2023.

In summary, prices are coming down some, and we expect to see some more of this in the first half of this year. Let’s remember though that real estate is a long-term investment and timing any market is next to impossible. The best we can do is look at the data! Let’s look at months of inventory now.

Months of Inventory

The months of inventory is a great indicator to watch for market trends. Typically, a seller’s market has 0-3 months of inventory. A balanced market has 4-6 months of inventory, and 7+ months of inventory is a buyer’s market. In a seller’s market prices go up. In a buyer’s market prices go down.

With 5,342 listings on the market and 2,080 closings, we have 2.6 months of inventory or 11.01 weeks of inventory. This is up from the 2.3 months of inventory in December as more sellers decided to list before more buyers jump in to put properties under contract.

All in all, months of inventory is still very low compared the great recession.

Final Thoughts

In summary, supply, demand, sales prices, and months of inventory are great key performance indicators to watch for market trends. Supply is higher than it was in 2021 and 2022 but is still lower than the long-term average. Even with a strong jobs report demand is being suppressed right now. The 30-year mortgage interest rates have come down but not enough to have a material impact on the market. Lastly, 2.6 months of inventory is still quite low.

Here is a link to the full presentation: