The Denver residential real estate market appears to be stabilizing after a tumultuous year. Inventory has climbed 102.8% since November 2021! The 30-year mortgage rate retreated to 6.49%. This is welcome news since rates climbed over 7%. The markets were thinking the Federal Reserve may start slowing the rate of the federal funds rate increases but the recent Producer Price Index came in at 7.4% on Friday December 9th. The Producer Price Index measures the increase in the costs of producing goods and services. Let’s dive into the key market data for the Denver residential real estate market to see what is happening in supply, demand, sales prices, and months of Inventory for November 2022.

Supply

We saw only 2,998 new listings during November 2022. This is down (25.4%) from the 4,018 new listings in November 2021. It is worth mentioning that we saw 4,218 new listings during October 2022, so we saw a month over month decline of (28.9%). The Denver market does see a seasonal slowdown, but the residential market is slowing faster.

The total amount of active listings at the end of the month came in at 7,435. This is up 102.8% compared to November 2021! This does sound dramatic when looking year over year but the inventory is actually lower than the 10-year average from 2010 to 2019 of 12,264 listings.

Year to date, detached single-family home construction starts, for the Dener Metropolitan Statistical Area (MSA), are down (16.1%) compared to the same period in 2021; however, housing starts are only down (3.1%) compared to 2020.

All in all, the market is very different from what we saw in early spring, but we needed a slow down to temper the red hot market. We do have more supply than the record lows of 2021. Let’s look at demand.

Demand

Showings are a great leading indicator for market health. The average total showings for 2019, 2020, and 2021 during November is 72,014. November 2022 had a dismal 36,602 showings. This represents a (49.5%) decrease in showings compared to November 2021.

Denver had 2,669 properties go under contract in November 2022. This is a (37.6%) decrease compared to November 2021 and is a (12.9%) decrease compared to October 2022.

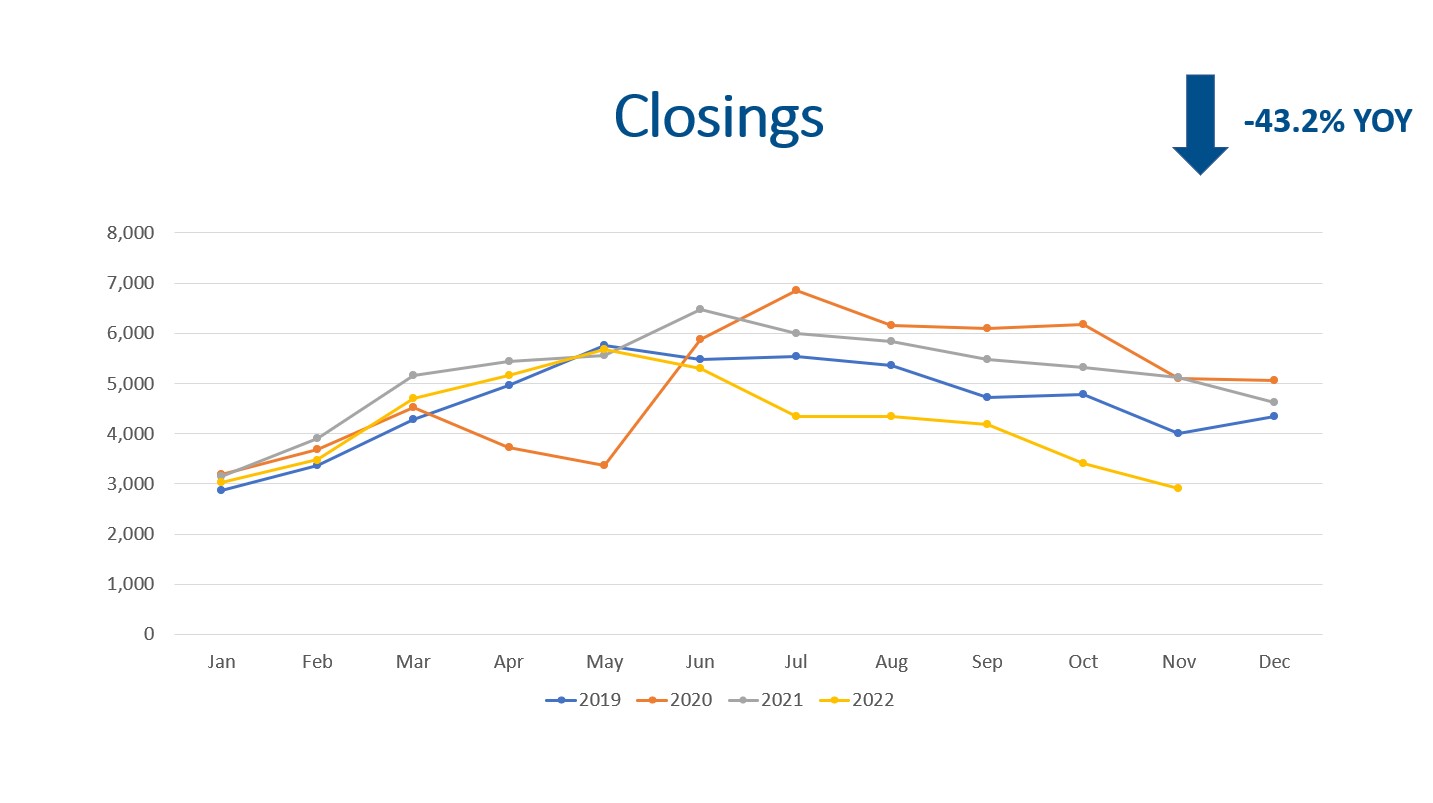

There were 2,913 closings in November 2022 compared to 3,405 in October 2022. This is a (14.4%) decrease month over month. A year ago, we had 5,128 closings in November. We expect total closings for 2022 to be (21%) lower than 2021.

The median days on market for November 2022 was 21 days. This means half of the properties listed are sold in 3 weeks, which is still pretty quick. The average marketing time has crept up to 34 days as more properties are taking longer to sell.

In summary, demand for housing is being suppressed by market uncertainty and higher interest rates. We believe pent up demand for housing is being created right now. People still want to buy and sell. As interest rates and prices come down, more buyers will jump in! Let’s look at sales prices.

Sales Prices

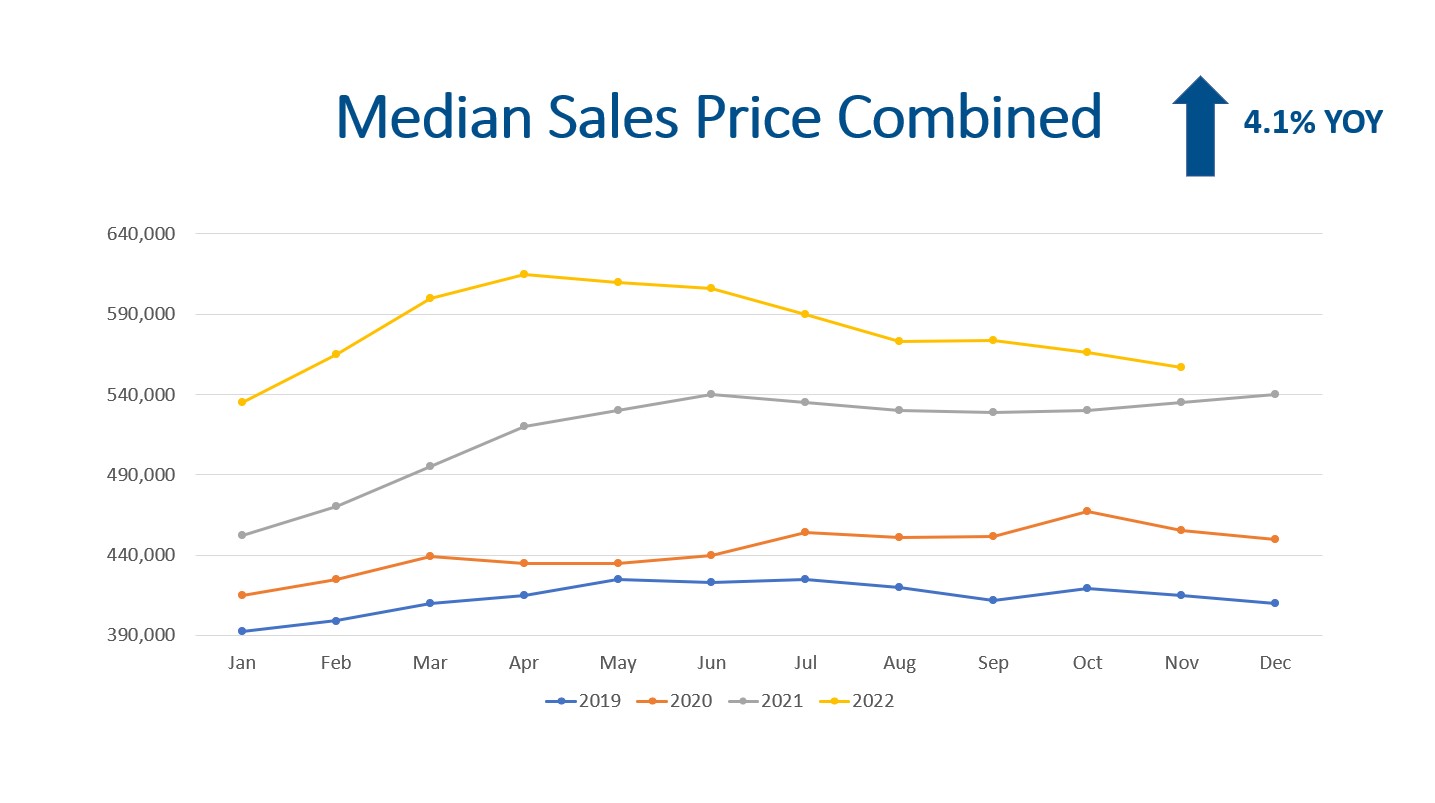

The median sales price for November was $557,000. This metric includes detached homes, condos, and town homes. This price is up 4.1% compared to November 2021 but is down (9.5%) from the peak in April 2022.

Detached homes came in at $615,000. This is down (1.6%) from last month but is 2.5% higher than November 2022.

Condos and town homes came in at $357,100. This is down (0.2%) from last month but is 3.5% higher than November 2021.

We have dipped below the long-term average appreciation rate of 6%, and we expect some downward pressure on prices during 2023 until inflation is under control and interest rates start coming down.

In summary, sales price appreciation is now below the long-term average. Let’s look at months of inventory now.

Months of Inventory

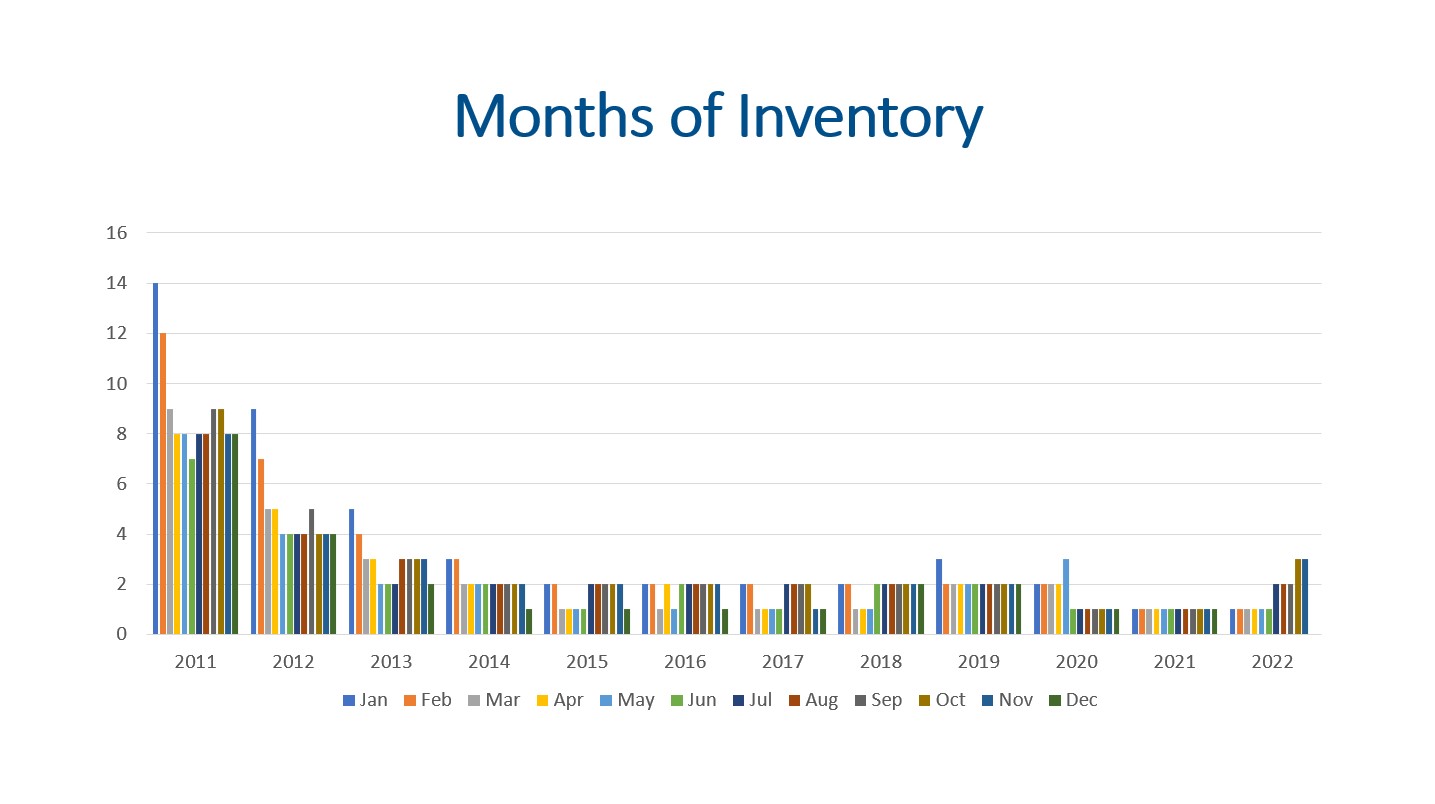

The months of inventory is a great indicator to watch for market trends. Typically, a seller’s market has 0-3 months of inventory. A balanced market has 4-6 months of inventory, and 7+ months of inventory is a buyer’s market. In a seller’s market prices go up. In a buyer’s market prices go down.

With 7,435 listings on the market and 2,913 closings, we have 3 months of inventory. More specifically, we have 10.94 weeks of inventory. This is a lot more inventory compared to the record low of 3.1 weeks of inventory in March of 2022.

All in all, months of inventory is steadily increasing but is moderating over the last few months.

Final Thoughts

In conclusion, supply, demand, sales prices, and months of inventory are great key performance indicators to watch for market trends. Supply has been trending higher all year but is still lower than pre-pandemic years. Demand is much softer than earlier in the year but properties are still selling! Higher mortgage interest rates and uncertainty in the economy is having an impact on showings, new contracts, and closings. The 30-year mortgage interest is off of a recent high but is still more than double the 3.1% rate we started 2022 with. Lastly, three months of inventory is still quite low.

Here is a link to the full presentation: