Let’s take a look at the latest market trends for the residential real estate market in Denver as by examining: Supply, Demand, Sales Prices, and Months of Inventory for February 2022.

Supply

New listings dropped to a new low compared to the last three years. February saw just 4,312. To put this into perspective, February 2021 had 4,789 and February 2020 had 5,322. This represents a (10 %) decline.

New listings dropped to a new low compared to the last three years. February saw just 4,312. To put this into perspective, February 2021 had 4,789 and February 2020 had 5,322. This represents a (10 %) decline.

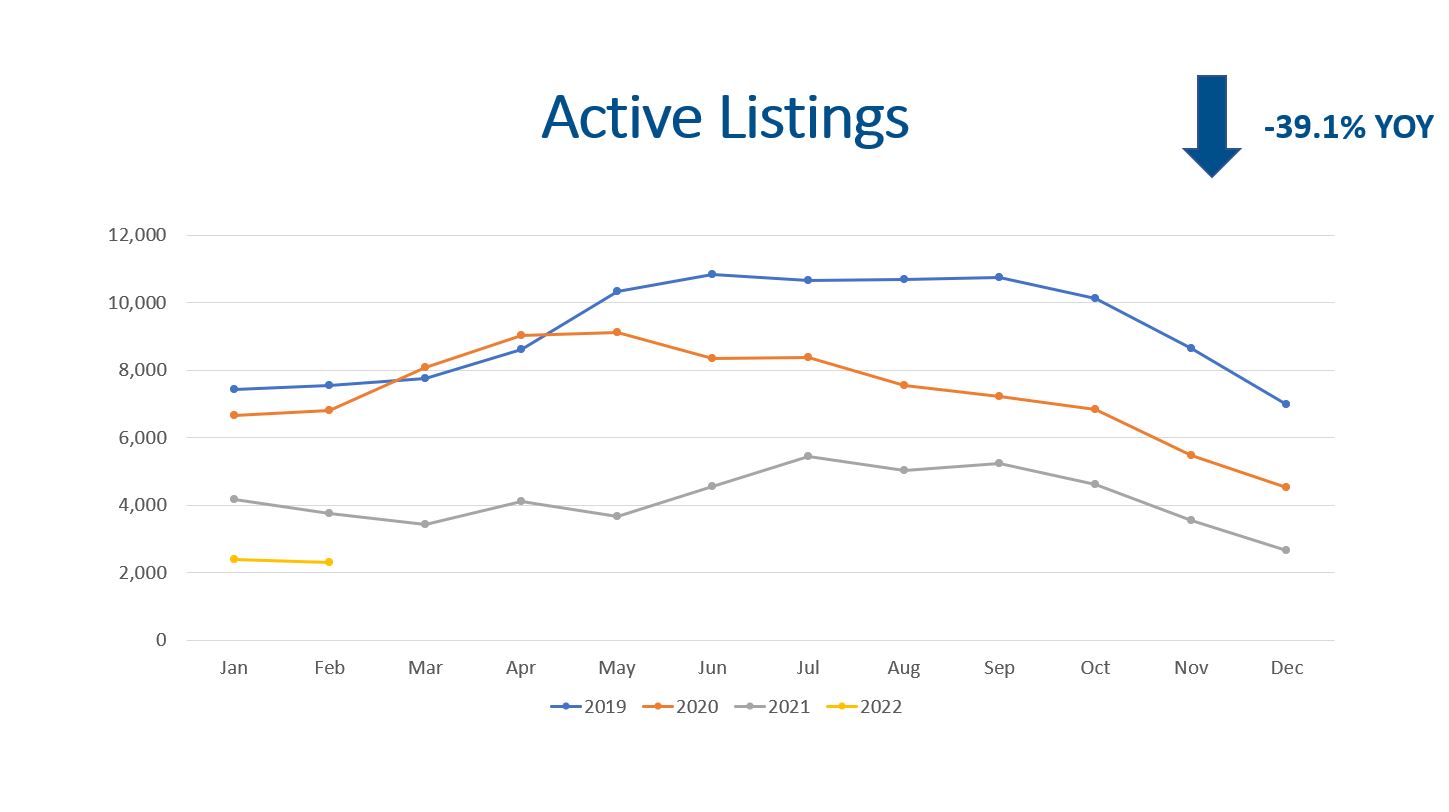

The Denver Metro market ended February 2022 with just 2,296 homes on the market! This is (39.1%) decrease YOY. Many were asking, can the inventory problem get any worse? The answer is yes! Ultimately, buyers have had fewer and fewer options for a long period of time leading buyers to pay higher and higher amounts for homes.

Detached single family construction starts are up 15.5% YOY. (The data lags by 1 month.)

All in all, supply for residential homes for sale is reaching even lower levels. Since it takes 3-4 years to go from raw dirt to a finished home in a subdivision, we aren’t able to build our way out of this problem. More sellers need to enter the market.

Demand

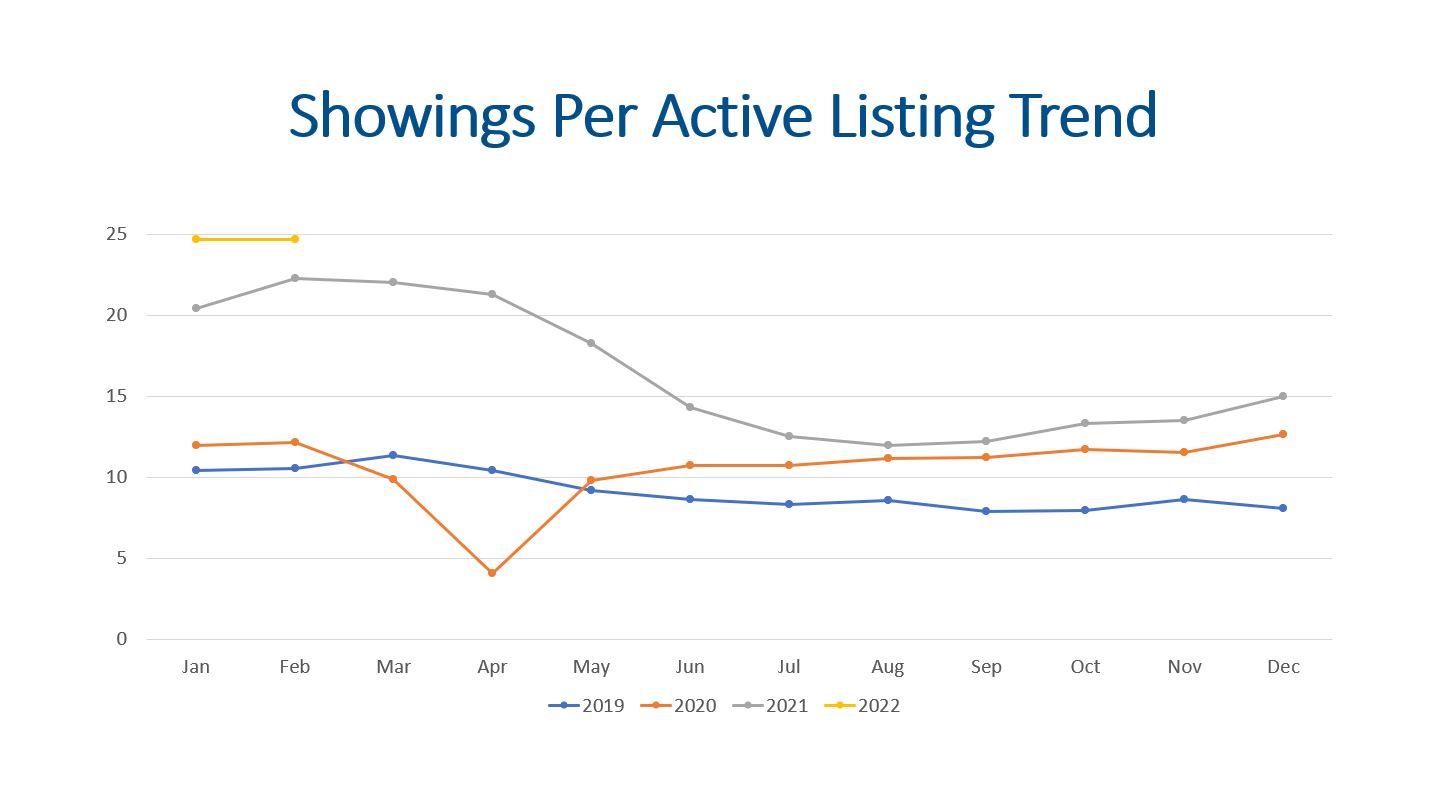

Total showings for February were lower than 2021 but that might be because of a new showing service competing with ShowingTime. The number of showings per active listing reached a new high of 24.66! This is the strongest end to winter that we have seen yet.

We saw 4,092 properties go under contract in February 2022. This does represent a (9.3%) decline YOY, but I think this is because of the inventory problem not that demand is slowing.

The median days on market has dropped to 4 days. This means half of the homes that are listed sell within 4 days.

Increasing interest rates are likely to have an impact on demand because this has a direct impact on the monthly mortgage payments.

All in all, showings, contracts, closings, and the median days on market all indicate we are firmly in a seller’s market.

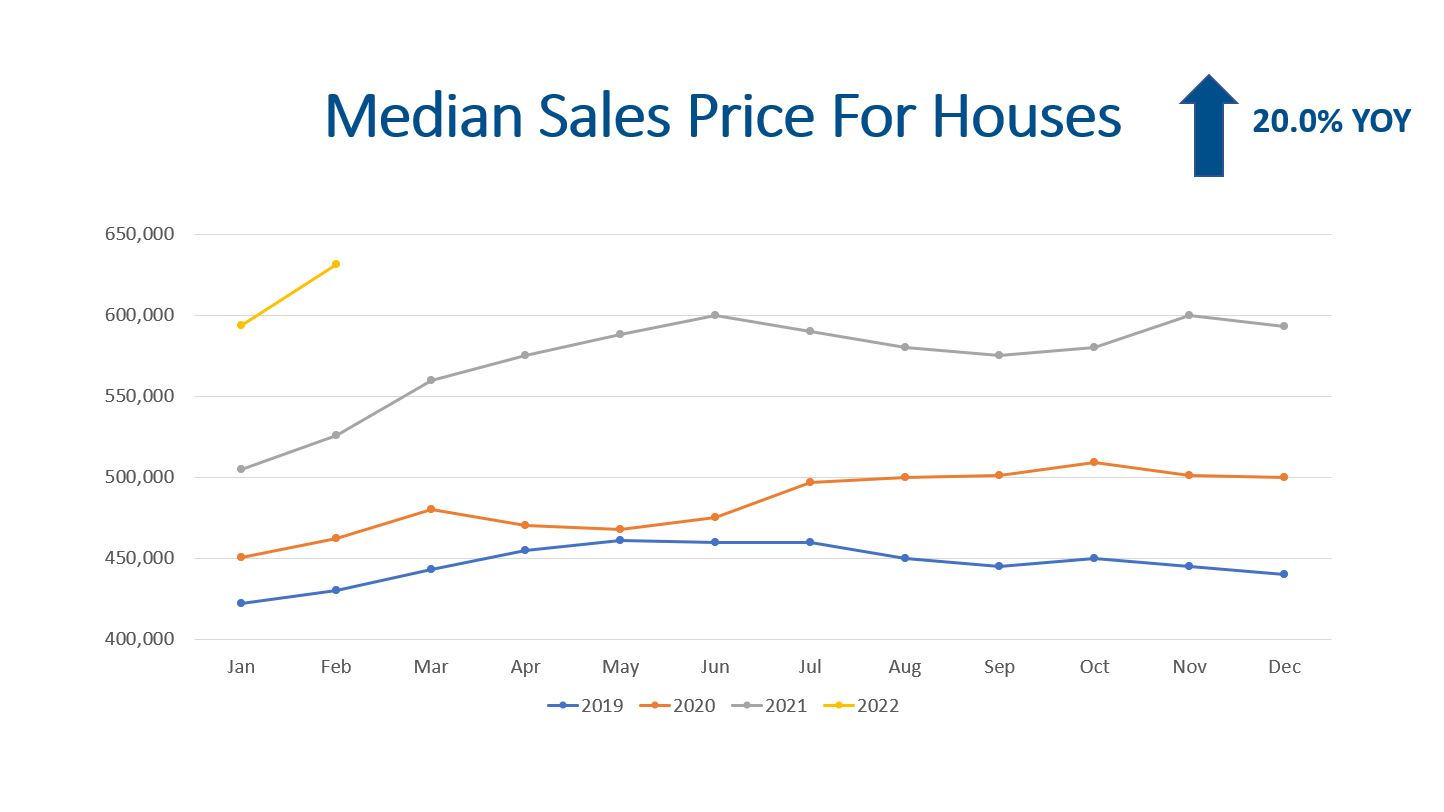

Sales Price

The average sales price for the market during February was $636,180. This is higher than the median due to high sales in the luxury market segment. When we focus on detached homes, the average is $734,194.

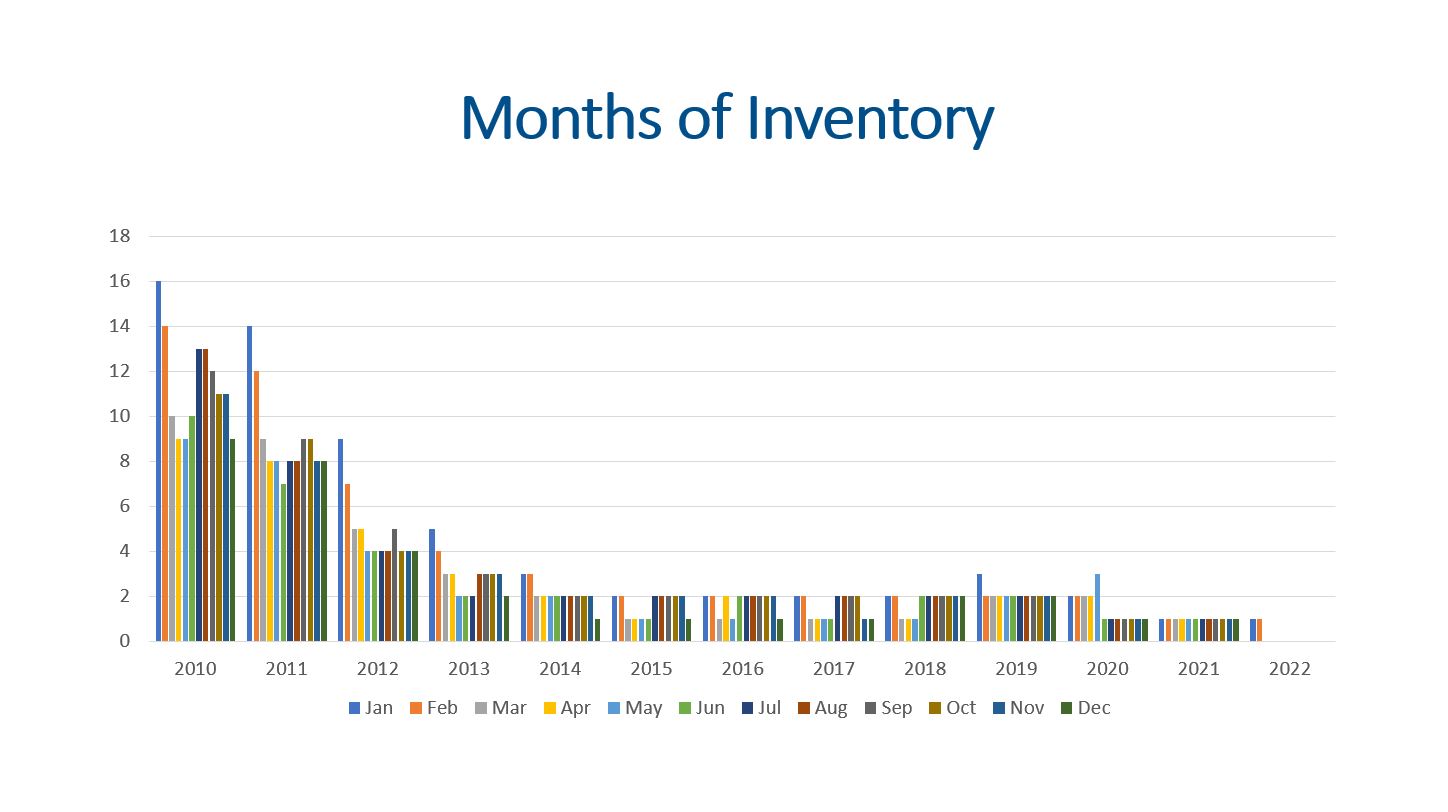

Months of Inventory

With 2,296 listings on the market and 3,316 closings, we have 2.9 weeks of inventory. Therefore, we are still in a seller’s market!

Final Thoughts

In summary, supply, demand, sales prices, and months of inventory are all worth tracking. Supply is still a problem for Denver Residential Real Estate, and we anticipate supply will continue to be low. Demand is strong as we look at showings, contracts, and closings, and we are closely monitoring interest rates. Lastly, with 2.9 weeks of inventory, home appreciation is likely to continue in 2022.

Here is a link to the full presentation: