The Denver residential real estate market is still picking up steam! Even though interest rates are high (near 7%), low inventory is helping to push prices higher. The 10-year average for new listings is 7,248 for the month of June, but we only saw 5,882 new listings last month. With low inventory and properties going under contract quickly, the months of inventory remained at 2 months. Mortgage interest rates with a 30-year term ended June at 6.71%. Let’s dive into the key market data for the Denver residential real estate market to see what is happening with supply, demand, sales prices, and months of Inventory for June 2023.

Supply

In June we had 5,882 new listings hit the market! This is up from May by 6.9%. Unfortunately, this is down (24.7%) compared to June 2022. This limits buyers options.

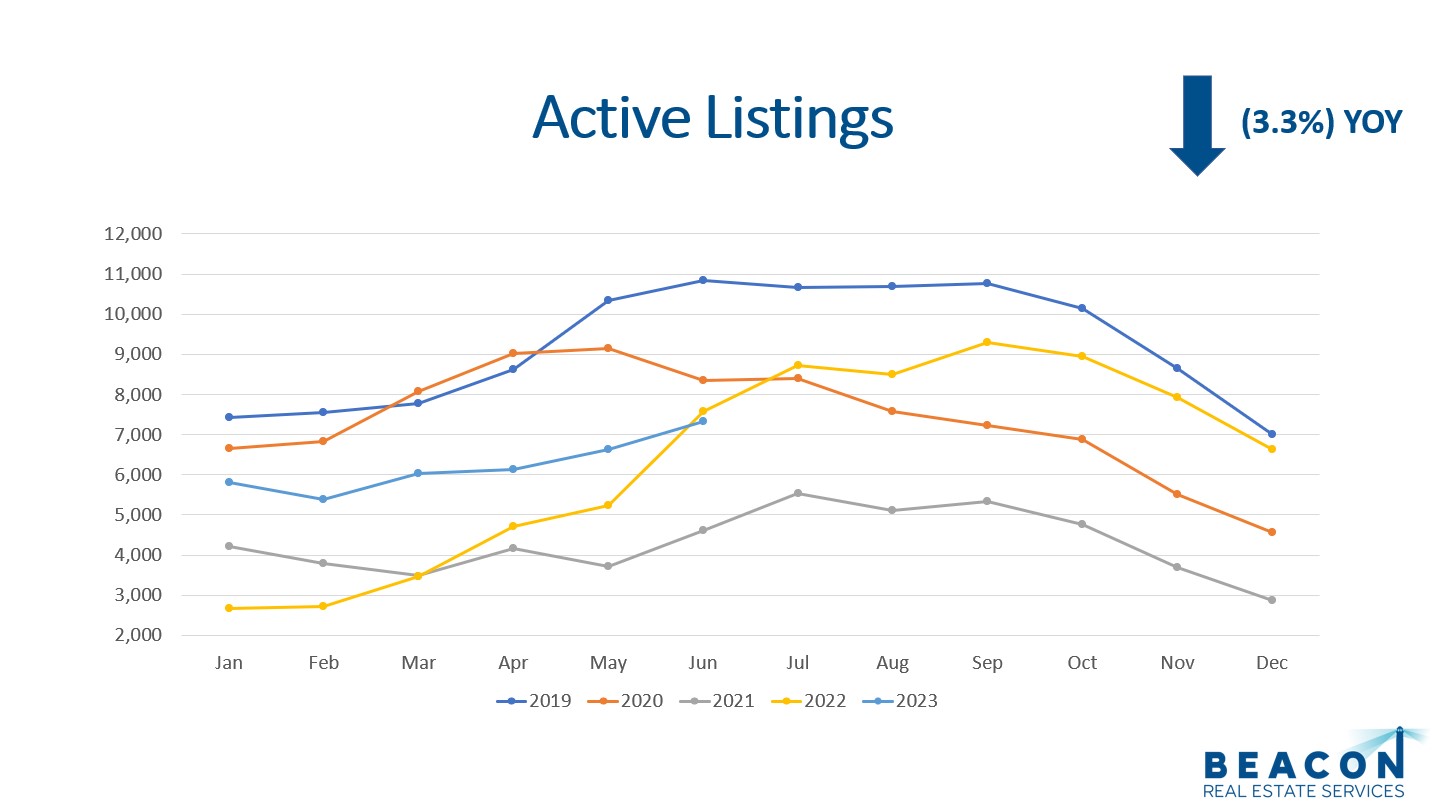

The total amount of active listings at the end of the month was 7,328. This is up 10.7% from May 2023. The 10-year May average from 2013 to 2022 is 8,055 listings, so we are below our long-term average.

The most recent report for detached home construction starts is May 2023. The Denver Metropolitan Statistical Area (MSA) pulled permits on 822 homes. This is lower than the three year average of 944 for May. Year to date construction starts for 2023 compared to the same period in 2022 shows a (40.6%) decline.

All in all, the supply is in a better position compared to 2021 and 2022 but is still lower than 2019 and 2020.

Demand

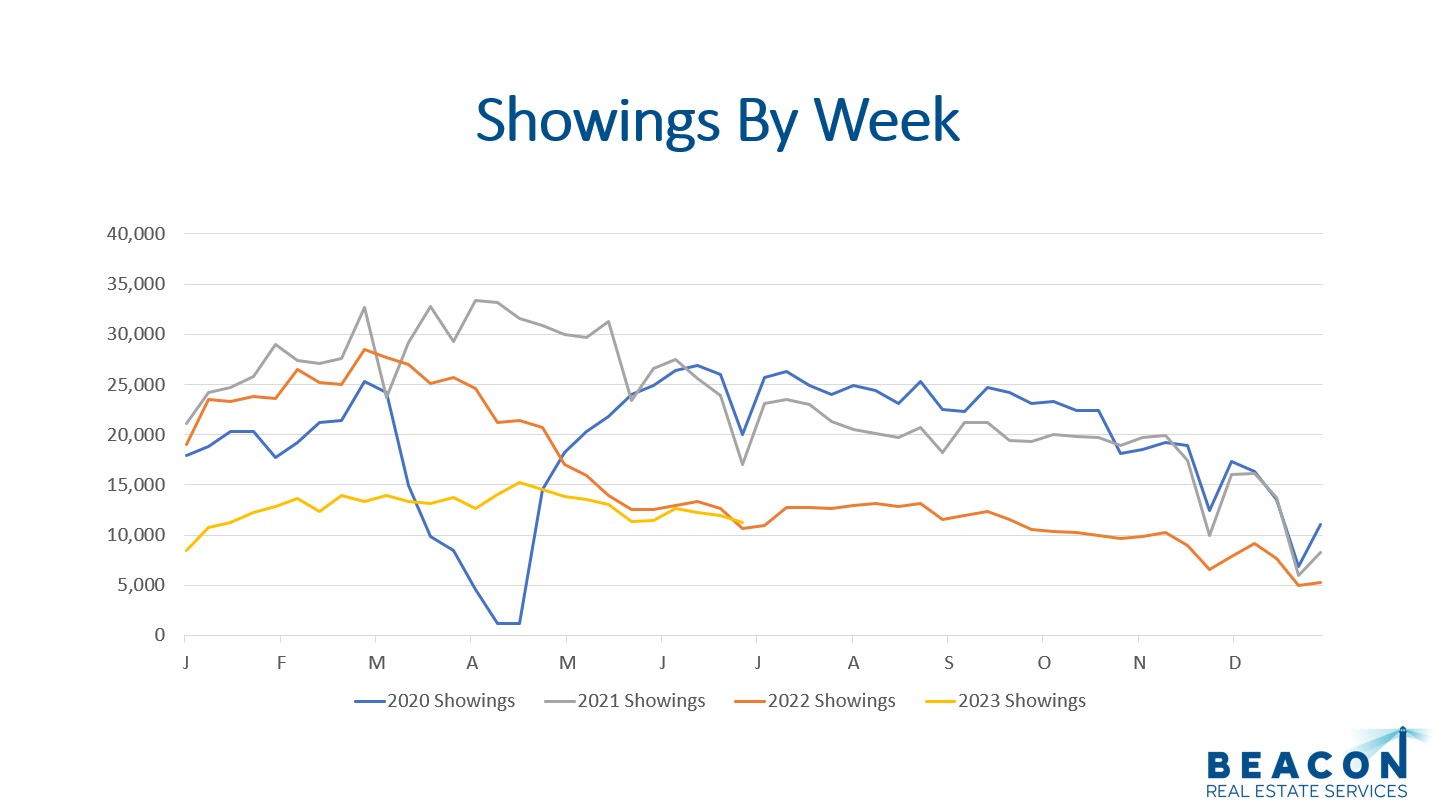

Showings are a great leading indicator for demand in the residential real estate market. There were 53,124 showings booked through the largest showing service in the Denver metro area during June.

This is down (6.8%) when compared to June 2022. The average amount of showings for June, over the last four years, is 92,875. Therefore, we have a lot few showing requests than previous years.

Denver had 4,061 properties go under contract in June 2023. This is up 2% compared to May 2023 but is down (8.4%) compared to May 2022.

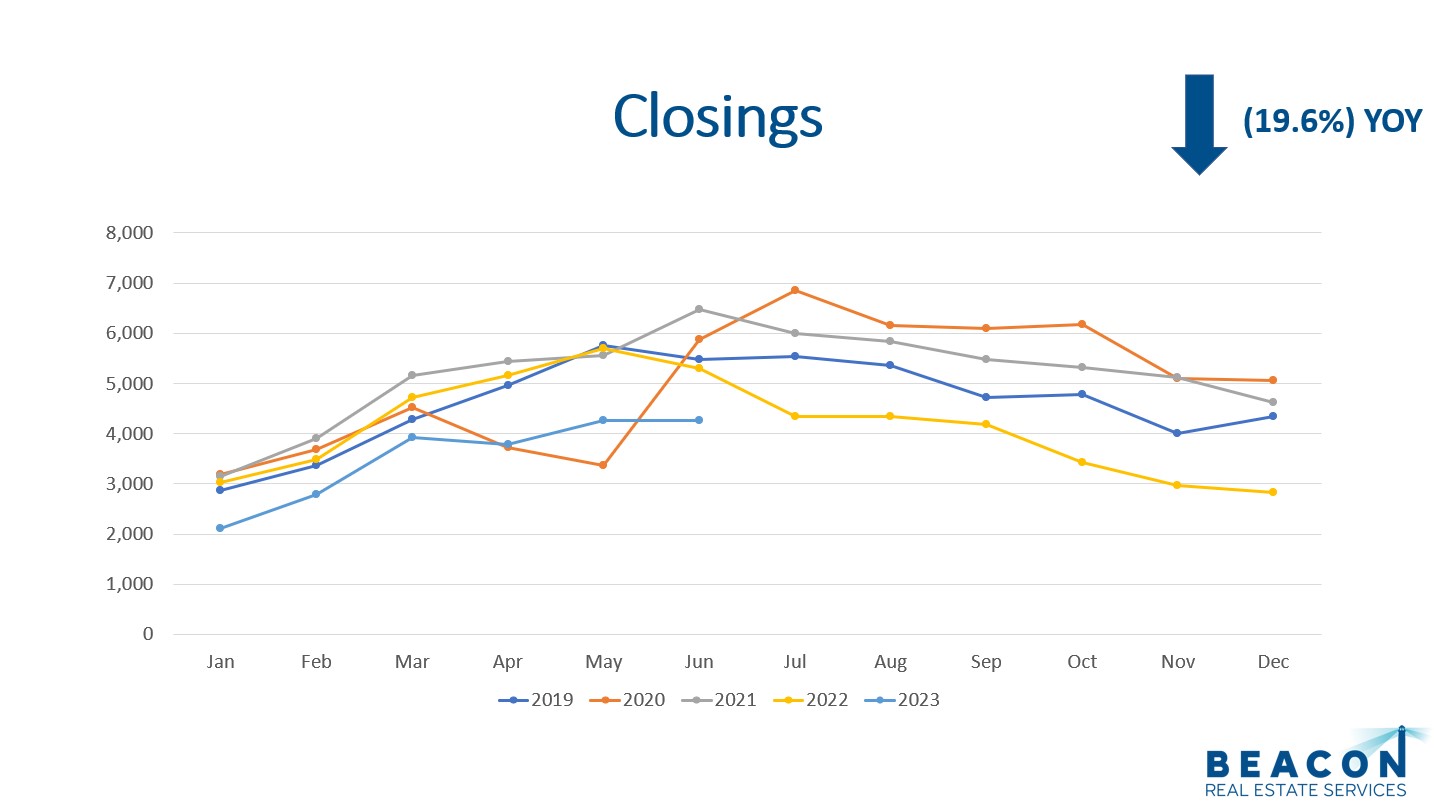

There were 4,256 closings in June 2023 compared to 4,272 in May 2023. This is a (0.4%) decrease from May 2023. A year ago, we had 5,292 closings in May 2022 so the volume of closings is down (19.6%) YOY.

The median days on market for June 2023 was 7 days. This means half of the properties listed are under contract in 7 days or less.

The list price to close price ratio held steady at 100%, so sellers are generally getting what they are asking. With that said, I have seen homes that are overpriced sit on the market for a long time.

All in all, demand for housing is softer when we look at showings but decent when we look at closings. Let’s look at the median sales price.

Sales Prices

The median sales price has increased every month this year! In June the median sales price rose to $594,970 from $585,000. This metric includes detached and attached properties. The median price increased 1.7% over May and is now only down (1.8%) from June 2022.

The long-term average appreciation for residential real estate is 6%. Higher prices and higher interest rates will continue to temper appreciation in the short run. Tight inventory is helping to prop up the market.

Although prices are down slightly from last year, we are encouraged to see the median price increasing as we roll through the summer selling season.

Let’s look at months of inventory now.

Months of Inventory

The months of inventory is a great indicator to watch for market trends. Typically, a seller’s market has 0-3 months of inventory. A balanced market has 4-6 months of inventory, and 7+ months of inventory is a buyer’s market. In a seller’s market prices go up. In a buyer’s market prices go down.

With 7,328 listings on the market and 4,256 closings in June, the months of inventory is at 1.7 months or 7.4 weeks of inventory. Therefore, the inventory is still low when compared to the demand. We expect the months of inventory to continue to be low this year.

All in all, months of inventory is a great metric to watch.

Final Thoughts

In conclusion, supply, demand, median sales price, and months of inventory are ideal key performance indicators to watch for market trends. Supply is higher than the record lows of 2021 and 2022 but is still lower than the long-term average. Overall demand is there even with higher prices and higher interest rates. We believe there is a tremendous amount of pent up demand happening right now and as soon as rates come down, more buyers will enter the market. Lastly, 1.7 months of inventory still quite low.

Here is a link to the full presentation: